Mirabella Financial Services LLP purchased a new stake in Kingsway Financial Services Inc. (NYSE:KFS - Free Report) TSE: KFS in the fourth quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm purchased 1,600,000 shares of the insurance provider's stock, valued at approximately $13,392,000. Kingsway Financial Services makes up 1.2% of Mirabella Financial Services LLP's holdings, making the stock its 17th biggest position. Mirabella Financial Services LLP owned 5.80% of Kingsway Financial Services at the end of the most recent quarter.

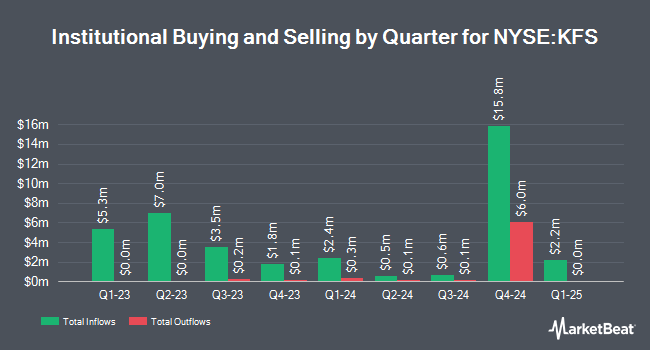

Other hedge funds and other institutional investors have also made changes to their positions in the company. Greenhaven Road Investment Management L.P. boosted its stake in shares of Kingsway Financial Services by 0.3% during the 4th quarter. Greenhaven Road Investment Management L.P. now owns 511,060 shares of the insurance provider's stock worth $4,278,000 after purchasing an additional 1,769 shares during the last quarter. Geode Capital Management LLC grew its stake in Kingsway Financial Services by 2.0% in the 3rd quarter. Geode Capital Management LLC now owns 347,235 shares of the insurance provider's stock worth $2,875,000 after acquiring an additional 6,941 shares during the period. Bard Associates Inc. grew its stake in Kingsway Financial Services by 2.8% in the 4th quarter. Bard Associates Inc. now owns 296,059 shares of the insurance provider's stock worth $2,478,000 after acquiring an additional 7,946 shares during the period. State Street Corp raised its holdings in Kingsway Financial Services by 4.8% in the 3rd quarter. State Street Corp now owns 151,477 shares of the insurance provider's stock valued at $1,254,000 after acquiring an additional 6,877 shares during the last quarter. Finally, Dimensional Fund Advisors LP grew its position in shares of Kingsway Financial Services by 14.5% in the fourth quarter. Dimensional Fund Advisors LP now owns 89,411 shares of the insurance provider's stock valued at $748,000 after purchasing an additional 11,315 shares during the period. Institutional investors and hedge funds own 72.38% of the company's stock.

Kingsway Financial Services Price Performance

NYSE:KFS traded down $0.12 during trading hours on Wednesday, reaching $8.12. 31,172 shares of the company were exchanged, compared to its average volume of 54,139. The company has a debt-to-equity ratio of 1.20, a quick ratio of 0.41 and a current ratio of 0.41. The stock has a 50 day simple moving average of $7.81 and a 200 day simple moving average of $8.29. Kingsway Financial Services Inc. has a 52-week low of $7.06 and a 52-week high of $9.58.

Insider Transactions at Kingsway Financial Services

In other Kingsway Financial Services news, Director Joseph Stilwell sold 1,000,000 shares of Kingsway Financial Services stock in a transaction that occurred on Wednesday, March 26th. The shares were sold at an average price of $8.00, for a total transaction of $8,000,000.00. Following the transaction, the director now directly owns 498,937 shares of the company's stock, valued at $3,991,496. The trade was a 66.71 % decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which is accessible through this hyperlink. Insiders have bought a total of 945 shares of company stock worth $7,499 in the last three months. 54.75% of the stock is currently owned by company insiders.

Analyst Upgrades and Downgrades

Separately, StockNews.com upgraded Kingsway Financial Services from a "sell" rating to a "hold" rating in a research report on Thursday, March 20th.

Check Out Our Latest Analysis on Kingsway Financial Services

Kingsway Financial Services Profile

(

Free Report)

Kingsway Financial Services Inc, through its subsidiaries, engages in the extended warranty and business services in the United States. The company operates through two segments, Extended Warranty and Kingsway Search Xcelerator. The Extended Warranty segment markets, sells, and administers vehicle service agreements and related products for new and used automobiles, motorcycles, and ATVs.

Further Reading

Before you consider Kingsway Financial Services, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Kingsway Financial Services wasn't on the list.

While Kingsway Financial Services currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.