Miracle Mile Advisors LLC purchased a new position in Madison Square Garden Sports Corp. (NYSE:MSGS - Free Report) in the 4th quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund purchased 18,402 shares of the company's stock, valued at approximately $4,153,000. Miracle Mile Advisors LLC owned about 0.08% of Madison Square Garden Sports at the end of the most recent reporting period.

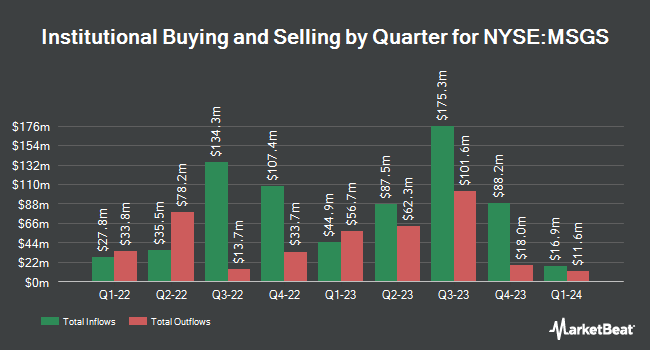

A number of other hedge funds and other institutional investors have also recently modified their holdings of MSGS. Venturi Wealth Management LLC raised its stake in Madison Square Garden Sports by 31.2% during the 3rd quarter. Venturi Wealth Management LLC now owns 223 shares of the company's stock valued at $46,000 after buying an additional 53 shares during the last quarter. Versant Capital Management Inc grew its holdings in shares of Madison Square Garden Sports by 35.3% in the fourth quarter. Versant Capital Management Inc now owns 234 shares of the company's stock worth $53,000 after acquiring an additional 61 shares during the period. Blue Trust Inc. increased its position in Madison Square Garden Sports by 326.5% during the third quarter. Blue Trust Inc. now owns 418 shares of the company's stock valued at $87,000 after acquiring an additional 320 shares during the last quarter. DekaBank Deutsche Girozentrale bought a new position in Madison Square Garden Sports in the third quarter valued at about $119,000. Finally, Quent Capital LLC boosted its position in Madison Square Garden Sports by 271.3% in the third quarter. Quent Capital LLC now owns 609 shares of the company's stock worth $127,000 after purchasing an additional 445 shares during the last quarter. 68.94% of the stock is owned by institutional investors.

Wall Street Analyst Weigh In

Separately, Macquarie upped their price target on shares of Madison Square Garden Sports from $235.00 to $240.00 and gave the company an "outperform" rating in a research report on Tuesday, November 5th.

Get Our Latest Stock Report on Madison Square Garden Sports

Madison Square Garden Sports Stock Down 0.2 %

MSGS traded down $0.45 during trading on Tuesday, hitting $213.51. The company's stock had a trading volume of 80,107 shares, compared to its average volume of 91,913. The business's 50 day simple moving average is $225.17 and its 200-day simple moving average is $212.58. The firm has a market cap of $5.11 billion, a PE ratio of 73.37 and a beta of 0.91. Madison Square Garden Sports Corp. has a one year low of $176.27 and a one year high of $237.99.

Madison Square Garden Sports (NYSE:MSGS - Get Free Report) last announced its earnings results on Friday, November 1st. The company reported ($0.31) EPS for the quarter, topping analysts' consensus estimates of ($0.86) by $0.55. Madison Square Garden Sports had a negative return on equity of 23.81% and a net margin of 6.75%. The company had revenue of $53.31 million for the quarter, compared to analysts' expectations of $43.71 million. During the same period last year, the firm earned ($0.79) EPS. Madison Square Garden Sports's revenue for the quarter was up 23.8% compared to the same quarter last year. Equities research analysts expect that Madison Square Garden Sports Corp. will post 0.81 EPS for the current fiscal year.

Madison Square Garden Sports Profile

(

Free Report)

Madison Square Garden Sports Corp. operates as a professional sports company in the United States. The company owns and operates a portfolio of assets that consists of the New York Knickerbockers of the National Basketball Association (NBA) and the New York Rangers of the National Hockey League. Its other professional franchises include development league teams, the Hartford Wolf Pack of the American Hockey League and the Westchester Knicks of the NBA G League.

Featured Stories

Before you consider Madison Square Garden Sports, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Madison Square Garden Sports wasn't on the list.

While Madison Square Garden Sports currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.