Mirae Asset Global Investments Co. Ltd. increased its stake in shares of Snap Inc. (NYSE:SNAP - Free Report) by 42.1% in the fourth quarter, according to the company in its most recent Form 13F filing with the SEC. The fund owned 82,750 shares of the company's stock after acquiring an additional 24,533 shares during the quarter. Mirae Asset Global Investments Co. Ltd.'s holdings in Snap were worth $909,000 at the end of the most recent quarter.

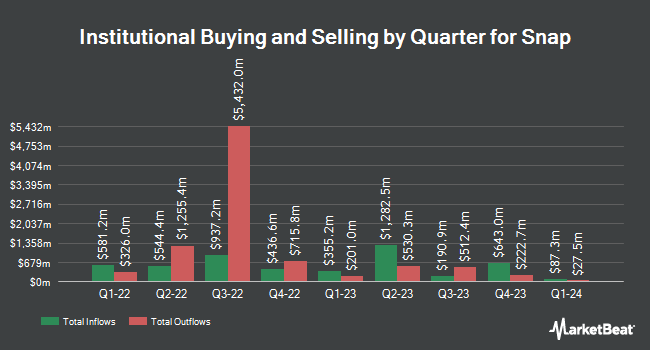

A number of other hedge funds and other institutional investors have also recently modified their holdings of SNAP. Cetera Investment Advisers boosted its position in shares of Snap by 23.7% during the second quarter. Cetera Investment Advisers now owns 104,470 shares of the company's stock worth $1,735,000 after acquiring an additional 20,038 shares during the last quarter. CWM LLC boosted its position in shares of Snap by 17.4% during the third quarter. CWM LLC now owns 114,689 shares of the company's stock worth $1,227,000 after acquiring an additional 16,968 shares during the last quarter. Livforsakringsbolaget Skandia Omsesidigt boosted its position in shares of Snap by 515.4% during the third quarter. Livforsakringsbolaget Skandia Omsesidigt now owns 8,000 shares of the company's stock worth $86,000 after acquiring an additional 6,700 shares during the last quarter. Paladin Wealth LLC bought a new position in shares of Snap during the third quarter worth $30,000. Finally, Vontobel Holding Ltd. boosted its position in shares of Snap by 17.0% during the third quarter. Vontobel Holding Ltd. now owns 327,705 shares of the company's stock worth $3,506,000 after acquiring an additional 47,717 shares during the last quarter. Institutional investors own 47.52% of the company's stock.

Insider Buying and Selling at Snap

In other news, CAO Rebecca Morrow sold 32,000 shares of the firm's stock in a transaction dated Tuesday, December 10th. The shares were sold at an average price of $12.42, for a total value of $397,440.00. Following the sale, the chief accounting officer now directly owns 433,064 shares in the company, valued at approximately $5,378,654.88. This trade represents a 6.88 % decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Also, CFO Derek Andersen sold 17,789 shares of the firm's stock in a transaction dated Wednesday, December 18th. The shares were sold at an average price of $12.00, for a total transaction of $213,468.00. Following the completion of the sale, the chief financial officer now owns 2,176,017 shares in the company, valued at $26,112,204. This represents a 0.81 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last quarter, insiders have sold 443,518 shares of company stock valued at $4,947,981. Company insiders own 22.68% of the company's stock.

Analyst Upgrades and Downgrades

SNAP has been the subject of a number of research reports. Barclays restated an "overweight" rating on shares of Snap in a research report on Wednesday, February 5th. Wells Fargo & Company lowered shares of Snap from an "overweight" rating to an "equal weight" rating and lowered their price objective for the company from $15.00 to $11.00 in a research report on Wednesday, February 5th. Benchmark reiterated a "hold" rating on shares of Snap in a research report on Friday, October 25th. Loop Capital increased their price objective on shares of Snap from $14.00 to $16.00 and gave the company a "buy" rating in a research report on Tuesday, November 5th. Finally, Evercore ISI increased their price objective on shares of Snap from $12.00 to $15.00 and gave the company an "in-line" rating in a research report on Wednesday, October 30th. One research analyst has rated the stock with a sell rating, twenty-five have issued a hold rating and seven have issued a buy rating to the stock. According to MarketBeat.com, Snap presently has a consensus rating of "Hold" and an average price target of $36.87.

Get Our Latest Stock Report on Snap

Snap Stock Down 3.7 %

NYSE SNAP traded down $0.42 during trading on Friday, reaching $10.84. 19,206,127 shares of the company's stock traded hands, compared to its average volume of 35,096,188. The company has a debt-to-equity ratio of 1.47, a current ratio of 3.95 and a quick ratio of 4.04. The firm has a market cap of $18.17 billion, a price-to-earnings ratio of -25.80 and a beta of 0.99. The company's 50 day simple moving average is $11.31 and its two-hundred day simple moving average is $10.75. Snap Inc. has a 12-month low of $8.29 and a 12-month high of $17.33.

Snap (NYSE:SNAP - Get Free Report) last posted its earnings results on Tuesday, February 4th. The company reported $0.01 EPS for the quarter, missing analysts' consensus estimates of $0.14 by ($0.13). Snap had a negative net margin of 13.02% and a negative return on equity of 25.67%. As a group, sell-side analysts forecast that Snap Inc. will post -0.26 EPS for the current fiscal year.

About Snap

(

Free Report)

Snap Inc operates as a technology company in North America, Europe, and internationally. The company offers Snapchat, a visual messaging application with various tabs, such as camera, visual messaging, snap map, stories, and spotlight that enable people to communicate visually through short videos and images.

Recommended Stories

Before you consider Snap, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Snap wasn't on the list.

While Snap currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.