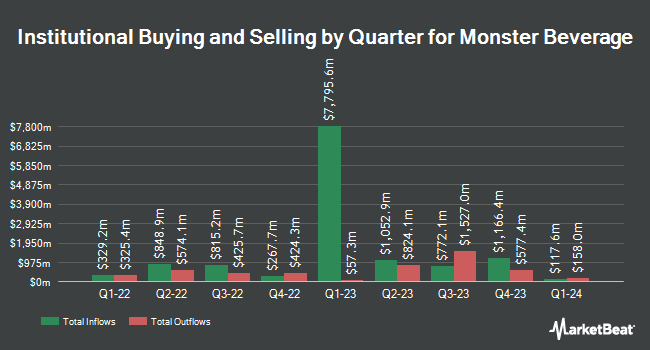

Mirae Asset Global Investments Co. Ltd. increased its holdings in Monster Beverage Co. (NASDAQ:MNST - Free Report) by 36.2% in the 4th quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The institutional investor owned 701,318 shares of the company's stock after acquiring an additional 186,568 shares during the quarter. Mirae Asset Global Investments Co. Ltd. owned about 0.07% of Monster Beverage worth $36,845,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

Other large investors also recently bought and sold shares of the company. State Street Corp increased its position in Monster Beverage by 6.9% during the 3rd quarter. State Street Corp now owns 33,742,390 shares of the company's stock valued at $1,760,341,000 after buying an additional 2,168,379 shares in the last quarter. Loomis Sayles & Co. L P lifted its stake in Monster Beverage by 4.7% during the 3rd quarter. Loomis Sayles & Co. L P now owns 27,142,970 shares of the company's stock valued at $1,416,048,000 after acquiring an additional 1,229,789 shares during the period. Janus Henderson Group PLC grew its stake in shares of Monster Beverage by 109.3% in the third quarter. Janus Henderson Group PLC now owns 22,559,092 shares of the company's stock worth $1,176,913,000 after acquiring an additional 11,779,162 shares during the period. Geode Capital Management LLC raised its holdings in shares of Monster Beverage by 3.1% during the third quarter. Geode Capital Management LLC now owns 15,728,086 shares of the company's stock valued at $817,490,000 after purchasing an additional 473,418 shares during the last quarter. Finally, Wellington Management Group LLP raised its holdings in shares of Monster Beverage by 18.1% during the third quarter. Wellington Management Group LLP now owns 3,898,127 shares of the company's stock valued at $203,365,000 after purchasing an additional 596,078 shares during the last quarter. 72.36% of the stock is owned by hedge funds and other institutional investors.

Insider Buying and Selling

In related news, CFO Thomas J. Kelly sold 10,000 shares of the company's stock in a transaction on Friday, December 13th. The shares were sold at an average price of $52.65, for a total transaction of $526,500.00. Following the sale, the chief financial officer now owns 74,924 shares of the company's stock, valued at $3,944,748.60. This represents a 11.78 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through this link. 7.80% of the stock is owned by company insiders.

Monster Beverage Price Performance

Shares of MNST stock traded up $0.27 during mid-day trading on Friday, hitting $46.57. The company had a trading volume of 4,634,368 shares, compared to its average volume of 6,898,053. The company has a debt-to-equity ratio of 0.13, a current ratio of 3.13 and a quick ratio of 2.51. The company has a market capitalization of $45.29 billion, a P/E ratio of 29.85, a P/E/G ratio of 1.96 and a beta of 0.74. The stock's 50 day moving average price is $50.85 and its 200-day moving average price is $51.04. Monster Beverage Co. has a 52-week low of $43.32 and a 52-week high of $61.22.

Wall Street Analysts Forecast Growth

MNST has been the subject of a number of research analyst reports. Bank of America lifted their target price on shares of Monster Beverage from $56.00 to $57.00 and gave the stock a "buy" rating in a research report on Tuesday, October 15th. Argus upped their price objective on Monster Beverage from $55.00 to $65.00 and gave the company a "buy" rating in a research report on Tuesday, November 12th. UBS Group lowered their target price on Monster Beverage from $57.00 to $53.00 and set a "neutral" rating on the stock in a report on Thursday, January 16th. Deutsche Bank Aktiengesellschaft reduced their price target on shares of Monster Beverage from $61.00 to $59.00 and set a "buy" rating for the company in a research report on Friday, November 8th. Finally, Stifel Nicolaus boosted their target price on shares of Monster Beverage from $57.00 to $59.00 and gave the company a "buy" rating in a research report on Friday, November 8th. Two research analysts have rated the stock with a sell rating, seven have given a hold rating and twelve have given a buy rating to the company's stock. Based on data from MarketBeat.com, Monster Beverage presently has a consensus rating of "Hold" and a consensus target price of $55.42.

Check Out Our Latest Stock Analysis on MNST

About Monster Beverage

(

Free Report)

Monster Beverage Corporation, through its subsidiaries, engages in development, marketing, sale, and distribution of energy drink beverages and concentrates in the United States and internationally. The company operates through three segments: Monster Energy Drinks, Strategic Brands, Alcohol Brands, and Other.

See Also

Before you consider Monster Beverage, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Monster Beverage wasn't on the list.

While Monster Beverage currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.