Mirae Asset Global Investments Co. Ltd. trimmed its position in Qifu Technology, Inc. (NASDAQ:QFIN - Free Report) by 55.4% during the fourth quarter, according to its most recent 13F filing with the SEC. The fund owned 18,716 shares of the company's stock after selling 23,258 shares during the period. Mirae Asset Global Investments Co. Ltd.'s holdings in Qifu Technology were worth $716,000 as of its most recent filing with the SEC.

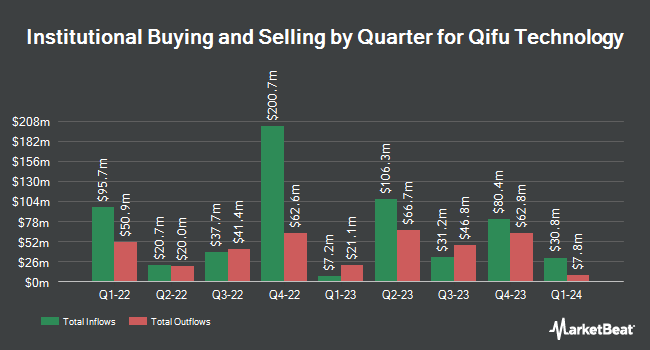

Other hedge funds have also recently bought and sold shares of the company. Robeco Institutional Asset Management B.V. boosted its position in shares of Qifu Technology by 66.9% in the 3rd quarter. Robeco Institutional Asset Management B.V. now owns 1,369,278 shares of the company's stock worth $40,818,000 after purchasing an additional 548,678 shares during the last quarter. Connor Clark & Lunn Investment Management Ltd. boosted its position in shares of Qifu Technology by 148.2% in the 3rd quarter. Connor Clark & Lunn Investment Management Ltd. now owns 820,343 shares of the company's stock worth $24,454,000 after purchasing an additional 489,865 shares during the last quarter. Swedbank AB boosted its position in shares of Qifu Technology by 156.0% in the 3rd quarter. Swedbank AB now owns 754,300 shares of the company's stock worth $22,486,000 after purchasing an additional 459,700 shares during the last quarter. Point72 Hong Kong Ltd boosted its position in shares of Qifu Technology by 443.0% in the 3rd quarter. Point72 Hong Kong Ltd now owns 535,498 shares of the company's stock worth $15,963,000 after purchasing an additional 436,882 shares during the last quarter. Finally, Artemis Investment Management LLP bought a new position in shares of Qifu Technology in the 4th quarter worth $12,493,000. 74.81% of the stock is currently owned by institutional investors.

Qifu Technology Trading Up 0.6 %

Shares of NASDAQ:QFIN traded up $0.25 during midday trading on Friday, hitting $44.26. The company had a trading volume of 1,933,799 shares, compared to its average volume of 1,009,129. Qifu Technology, Inc. has a 12 month low of $14.88 and a 12 month high of $46.25. The stock has a market cap of $6.98 billion, a price-to-earnings ratio of 8.96, a PEG ratio of 0.32 and a beta of 0.63. The firm has a fifty day simple moving average of $39.16 and a 200 day simple moving average of $32.75.

Analysts Set New Price Targets

Separately, Citigroup raised their price target on Qifu Technology from $31.44 to $37.50 and gave the stock a "buy" rating in a research report on Thursday, November 21st.

Get Our Latest Research Report on QFIN

Qifu Technology Company Profile

(

Free Report)

Qifu Technology, Inc, through its subsidiaries, operates credit-tech platform under the 360 Jietiao brand in the People's Republic of China. It provides credit-driven services that matches borrowers with financial institutions to conduct customer acquisition, initial and credit screening, advanced risk assessment, credit assessment, fund matching, and other post-facilitation services; and platform services, including loan facilitation and post-facilitation services to financial institution partners under intelligence credit engine, referral services, and risk management software-as-a-service.

See Also

Before you consider Qifu Technology, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Qifu Technology wasn't on the list.

While Qifu Technology currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.