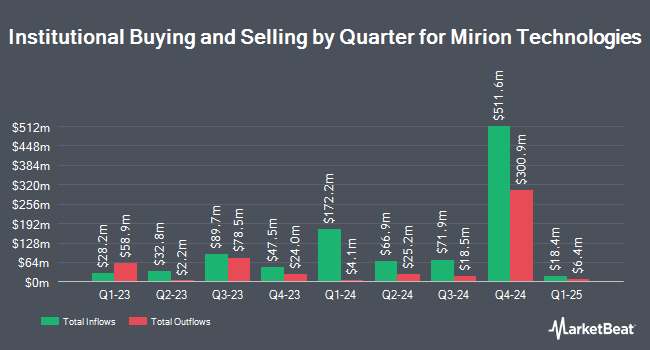

Eagle Asset Management Inc. boosted its holdings in Mirion Technologies, Inc. (NYSE:MIR - Free Report) by 60.6% during the 3rd quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The firm owned 505,247 shares of the company's stock after buying an additional 190,654 shares during the period. Eagle Asset Management Inc. owned approximately 0.22% of Mirion Technologies worth $5,593,000 as of its most recent SEC filing.

Several other institutional investors also recently added to or reduced their stakes in the business. Essex Investment Management Co. LLC increased its position in Mirion Technologies by 0.3% during the third quarter. Essex Investment Management Co. LLC now owns 351,478 shares of the company's stock worth $3,891,000 after acquiring an additional 980 shares during the period. Arizona State Retirement System increased its holdings in shares of Mirion Technologies by 2.2% during the 2nd quarter. Arizona State Retirement System now owns 48,968 shares of the company's stock worth $526,000 after purchasing an additional 1,045 shares during the period. Rhumbline Advisers raised its position in shares of Mirion Technologies by 0.4% during the second quarter. Rhumbline Advisers now owns 325,569 shares of the company's stock valued at $3,497,000 after buying an additional 1,340 shares during the last quarter. Oppenheimer & Co. Inc. lifted its stake in shares of Mirion Technologies by 4.7% in the third quarter. Oppenheimer & Co. Inc. now owns 58,260 shares of the company's stock valued at $645,000 after buying an additional 2,595 shares during the period. Finally, Innealta Capital LLC acquired a new stake in Mirion Technologies during the second quarter worth about $39,000. 78.51% of the stock is owned by institutional investors.

Analysts Set New Price Targets

A number of brokerages have commented on MIR. The Goldman Sachs Group raised their price objective on Mirion Technologies from $13.00 to $16.00 and gave the stock a "buy" rating in a research report on Thursday, October 31st. Citigroup lifted their price target on shares of Mirion Technologies from $17.00 to $18.00 and gave the stock a "buy" rating in a research note on Thursday, October 31st. Finally, B. Riley initiated coverage on shares of Mirion Technologies in a research note on Thursday, September 26th. They issued a "buy" rating and a $14.00 price objective for the company.

Check Out Our Latest Research Report on MIR

Insider Activity

In other Mirion Technologies news, insider Emmanuelle Lee sold 3,405 shares of the firm's stock in a transaction dated Thursday, October 31st. The shares were sold at an average price of $14.27, for a total value of $48,589.35. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Also, CEO Thomas D. Logan sold 7,500 shares of the company's stock in a transaction that occurred on Thursday, October 24th. The stock was sold at an average price of $14.11, for a total transaction of $105,825.00. Following the transaction, the chief executive officer now owns 1,544,017 shares in the company, valued at $21,786,079.87. The trade was a 0.48 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last 90 days, insiders sold 23,405 shares of company stock worth $285,939. Insiders own 2.20% of the company's stock.

Mirion Technologies Price Performance

Shares of Mirion Technologies stock traded down $0.20 during midday trading on Monday, hitting $16.58. 2,224,319 shares of the company were exchanged, compared to its average volume of 1,366,819. The firm has a 50 day simple moving average of $13.39 and a 200-day simple moving average of $11.54. The company has a debt-to-equity ratio of 0.43, a current ratio of 2.16 and a quick ratio of 1.55. The firm has a market cap of $3.85 billion, a P/E ratio of -49.35 and a beta of 0.73. Mirion Technologies, Inc. has a 52 week low of $8.65 and a 52 week high of $17.03.

Mirion Technologies (NYSE:MIR - Get Free Report) last issued its quarterly earnings data on Tuesday, October 29th. The company reported $0.08 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.10 by ($0.02). The company had revenue of $206.80 million for the quarter, compared to the consensus estimate of $203.67 million. Mirion Technologies had a negative net margin of 7.84% and a positive return on equity of 4.33%. The firm's revenue was up 8.2% compared to the same quarter last year. During the same period in the previous year, the business posted $0.03 earnings per share. Research analysts forecast that Mirion Technologies, Inc. will post 0.36 earnings per share for the current year.

Mirion Technologies Company Profile

(

Free Report)

Mirion Technologies, Inc provides radiation detection, measurement, analysis, and monitoring products and services in the United States, Canada, the United Kingdom, France, Germany, Finland, China, Belgium, Netherlands, Estonia, South Korea, and Japan. It operates through two segments, Medical and Technologies.

Featured Articles

Before you consider Mirion Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Mirion Technologies wasn't on the list.

While Mirion Technologies currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.