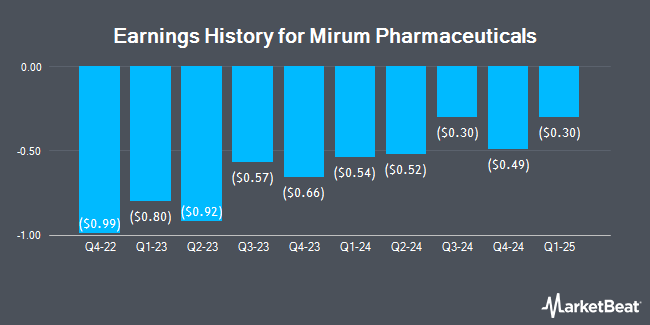

Mirum Pharmaceuticals (NASDAQ:MIRM - Get Free Report) released its quarterly earnings results on Tuesday. The company reported ($0.30) EPS for the quarter, topping the consensus estimate of ($0.45) by $0.15, Briefing.com reports. Mirum Pharmaceuticals had a negative return on equity of 40.98% and a negative net margin of 31.69%. The business had revenue of $90.38 million during the quarter, compared to analysts' expectations of $81.99 million. During the same quarter in the prior year, the business earned ($0.57) earnings per share. The company's quarterly revenue was up 89.4% compared to the same quarter last year. Mirum Pharmaceuticals updated its FY 2024 guidance to EPS.

Mirum Pharmaceuticals Price Performance

Shares of NASDAQ:MIRM traded up $1.64 on Wednesday, hitting $43.92. The company had a trading volume of 622,288 shares, compared to its average volume of 558,213. The company has a current ratio of 3.28, a quick ratio of 3.09 and a debt-to-equity ratio of 1.34. Mirum Pharmaceuticals has a 52-week low of $23.14 and a 52-week high of $45.81. The business has a 50 day moving average of $39.92 and a 200 day moving average of $35.73. The company has a market cap of $2.10 billion, a PE ratio of -21.81 and a beta of 1.16.

Analysts Set New Price Targets

MIRM has been the subject of several analyst reports. Leerink Partners upped their price target on Mirum Pharmaceuticals from $47.00 to $49.00 and gave the stock an "outperform" rating in a research note on Thursday, October 17th. Cantor Fitzgerald upped their price objective on Mirum Pharmaceuticals from $50.00 to $60.00 and gave the stock an "overweight" rating in a report on Thursday, August 8th. HC Wainwright reaffirmed a "buy" rating and set a $66.00 price objective on shares of Mirum Pharmaceuticals in a report on Wednesday. Citigroup upped their price objective on Mirum Pharmaceuticals from $65.00 to $68.00 and gave the stock a "buy" rating in a report on Wednesday. Finally, Robert W. Baird upped their target price on Mirum Pharmaceuticals from $44.00 to $50.00 and gave the company an "outperform" rating in a report on Wednesday. Ten investment analysts have rated the stock with a buy rating and two have assigned a strong buy rating to the stock. Based on data from MarketBeat, the stock has an average rating of "Buy" and an average target price of $57.73.

Read Our Latest Report on MIRM

Mirum Pharmaceuticals Company Profile

(

Get Free Report)

Mirum Pharmaceuticals, Inc, a biopharmaceutical company, focuses on the development and commercialization of novel therapies for debilitating rare and orphan diseases. Its lead product candidate is LIVMARLI (maralixibat), an orally administered and minimally absorbed ileal bile acid transporter (IBAT) inhibitor that is approved for the treatment of cholestatic pruritus in patients with Alagille syndrome in the United States and internationally.

Featured Stories

Before you consider Mirum Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Mirum Pharmaceuticals wasn't on the list.

While Mirum Pharmaceuticals currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.