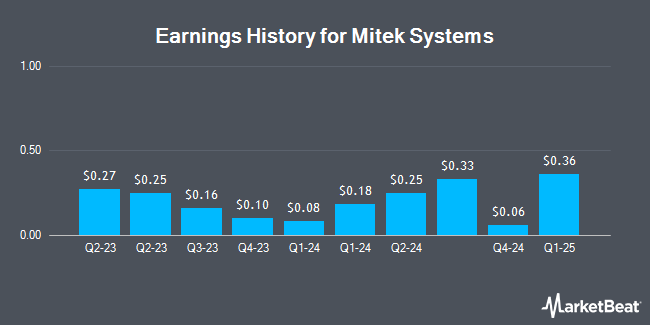

Mitek Systems (NASDAQ:MITK - Get Free Report) posted its quarterly earnings data on Monday. The software maker reported $0.33 earnings per share for the quarter, topping the consensus estimate of $0.17 by $0.16, Briefing.com reports. The firm had revenue of $43.22 million during the quarter, compared to analysts' expectations of $41.30 million. Mitek Systems had a negative net margin of 4.05% and a positive return on equity of 12.32%. Mitek Systems's revenue was up 14.8% on a year-over-year basis. During the same quarter in the previous year, the company posted $0.15 EPS. Mitek Systems updated its FY 2025 guidance to EPS.

Mitek Systems Trading Up 8.1 %

Mitek Systems stock traded up $0.71 during midday trading on Monday, hitting $9.49. 2,054,507 shares of the stock were exchanged, compared to its average volume of 542,619. The stock has a market capitalization of $438.48 million, a PE ratio of -63.27 and a beta of 1.12. The company has a fifty day simple moving average of $9.04 and a two-hundred day simple moving average of $9.91. The company has a quick ratio of 4.46, a current ratio of 4.46 and a debt-to-equity ratio of 0.68. Mitek Systems has a 52 week low of $7.35 and a 52 week high of $16.24.

Insider Buying and Selling at Mitek Systems

In other Mitek Systems news, insider Jason Gray sold 6,222 shares of the firm's stock in a transaction that occurred on Wednesday, December 11th. The shares were sold at an average price of $9.07, for a total transaction of $56,433.54. Following the sale, the insider now directly owns 164,342 shares in the company, valued at approximately $1,490,581.94. This trade represents a 3.65 % decrease in their position. The sale was disclosed in a filing with the SEC, which is accessible through this link. Also, SVP Christopher H. Briggs sold 3,320 shares of the company's stock in a transaction that occurred on Tuesday, December 3rd. The shares were sold at an average price of $9.08, for a total transaction of $30,145.60. Following the completion of the transaction, the senior vice president now owns 65,353 shares of the company's stock, valued at $593,405.24. This trade represents a 4.83 % decrease in their position. The disclosure for this sale can be found here. Over the last 90 days, insiders sold 16,699 shares of company stock valued at $152,140. Corporate insiders own 2.10% of the company's stock.

Analysts Set New Price Targets

Several equities research analysts have recently commented on MITK shares. Jefferies Financial Group cut shares of Mitek Systems from a "buy" rating to a "hold" rating and lowered their price target for the stock from $17.00 to $9.50 in a research report on Wednesday, September 4th. StockNews.com raised shares of Mitek Systems from a "hold" rating to a "buy" rating in a report on Friday, December 6th. One equities research analyst has rated the stock with a hold rating and four have assigned a buy rating to the company. According to MarketBeat, the stock presently has an average rating of "Moderate Buy" and a consensus target price of $12.13.

Read Our Latest Stock Analysis on MITK

Mitek Systems Company Profile

(

Get Free Report)

Mitek Systems, Inc provides mobile image capture and digital identity verification solutions worldwide. Its product portfolio includes Mobile Deposit that enables individuals and businesses to remotely deposit checks using their camera-equipped smartphone or tablet; Mobile Verify, an identity verification solution that is integrated into mobile apps, mobile websites, and desktop applications; and Mobile Fill, which includes automatic image capture, minimizes the numbers of clicks, and expedites form fill completion.

Featured Stories

Before you consider Mitek Systems, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Mitek Systems wasn't on the list.

While Mitek Systems currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.