Mitsubishi UFJ Asset Management Co. Ltd. lowered its position in shares of Cabot Co. (NYSE:CBT - Free Report) by 18.0% during the fourth quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The firm owned 16,311 shares of the specialty chemicals company's stock after selling 3,577 shares during the period. Mitsubishi UFJ Asset Management Co. Ltd.'s holdings in Cabot were worth $1,444,000 as of its most recent filing with the Securities and Exchange Commission.

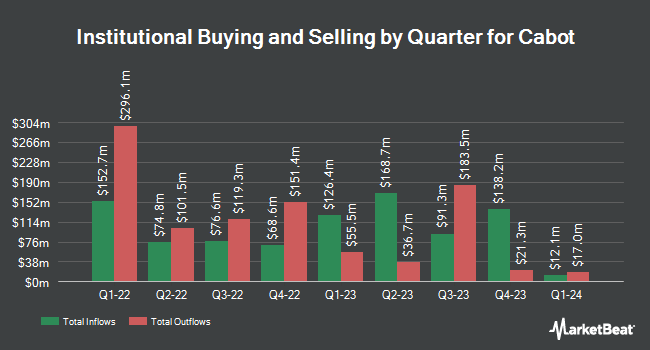

Several other hedge funds have also added to or reduced their stakes in CBT. American Century Companies Inc. lifted its holdings in shares of Cabot by 8.5% during the fourth quarter. American Century Companies Inc. now owns 1,323,347 shares of the specialty chemicals company's stock worth $120,835,000 after buying an additional 103,380 shares in the last quarter. Geode Capital Management LLC raised its stake in Cabot by 1.8% in the 3rd quarter. Geode Capital Management LLC now owns 1,283,686 shares of the specialty chemicals company's stock worth $143,504,000 after purchasing an additional 22,719 shares in the last quarter. Sei Investments Co. boosted its holdings in Cabot by 6.0% in the 4th quarter. Sei Investments Co. now owns 942,273 shares of the specialty chemicals company's stock valued at $86,039,000 after purchasing an additional 53,090 shares during the period. Copeland Capital Management LLC grew its position in shares of Cabot by 21.6% during the 4th quarter. Copeland Capital Management LLC now owns 761,372 shares of the specialty chemicals company's stock worth $69,521,000 after purchasing an additional 135,119 shares in the last quarter. Finally, Charles Schwab Investment Management Inc. increased its holdings in shares of Cabot by 0.4% during the fourth quarter. Charles Schwab Investment Management Inc. now owns 710,608 shares of the specialty chemicals company's stock worth $64,886,000 after purchasing an additional 3,175 shares during the period. 93.18% of the stock is owned by institutional investors and hedge funds.

Analyst Ratings Changes

Several equities research analysts recently issued reports on the company. Mizuho cut their price target on Cabot from $122.00 to $110.00 and set an "outperform" rating for the company in a research note on Tuesday, January 7th. JPMorgan Chase & Co. reduced their target price on Cabot from $105.00 to $85.00 and set an "underweight" rating on the stock in a report on Friday, February 21st. Finally, StockNews.com raised Cabot from a "hold" rating to a "buy" rating in a research note on Tuesday, April 1st. One analyst has rated the stock with a sell rating, two have assigned a hold rating and two have assigned a buy rating to the company. Based on data from MarketBeat, the stock currently has a consensus rating of "Hold" and a consensus target price of $97.00.

View Our Latest Analysis on CBT

Cabot Price Performance

Shares of CBT traded down $1.45 during midday trading on Friday, hitting $78.39. The company's stock had a trading volume of 702,871 shares, compared to its average volume of 381,238. The company has a quick ratio of 1.29, a current ratio of 2.00 and a debt-to-equity ratio of 0.72. Cabot Co. has a one year low of $75.51 and a one year high of $117.46. The stock has a market capitalization of $4.25 billion, a price-to-earnings ratio of 10.41, a price-to-earnings-growth ratio of 0.74 and a beta of 1.04. The company's fifty day simple moving average is $84.85 and its two-hundred day simple moving average is $97.31.

Cabot (NYSE:CBT - Get Free Report) last released its earnings results on Monday, February 3rd. The specialty chemicals company reported $1.76 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $1.74 by $0.02. Cabot had a return on equity of 26.79% and a net margin of 10.60%. As a group, equities analysts expect that Cabot Co. will post 7.57 earnings per share for the current fiscal year.

Cabot Announces Dividend

The business also recently announced a quarterly dividend, which was paid on Friday, March 14th. Shareholders of record on Friday, February 28th were given a $0.43 dividend. The ex-dividend date was Friday, February 28th. This represents a $1.72 dividend on an annualized basis and a yield of 2.19%. Cabot's dividend payout ratio is currently 22.84%.

About Cabot

(

Free Report)

Cabot Corporation operates as a specialty chemicals and performance materials company. The company operates through two segments, Reinforcement Materials and Performance Chemicals. It offers reinforcing carbons that are used in tires as a rubber reinforcing agent and performance additive, as well as in industrial products, such as hoses, belts, extruded profiles, and molded goods; and engineered elastomer composites solutions.

Featured Stories

Before you consider Cabot, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cabot wasn't on the list.

While Cabot currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.