Bamco Inc. NY lowered its position in Mitsubishi UFJ Financial Group, Inc. (NYSE:MUFG - Free Report) by 14.0% during the third quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm owned 295,681 shares of the company's stock after selling 48,069 shares during the period. Bamco Inc. NY's holdings in Mitsubishi UFJ Financial Group were worth $3,010,000 as of its most recent SEC filing.

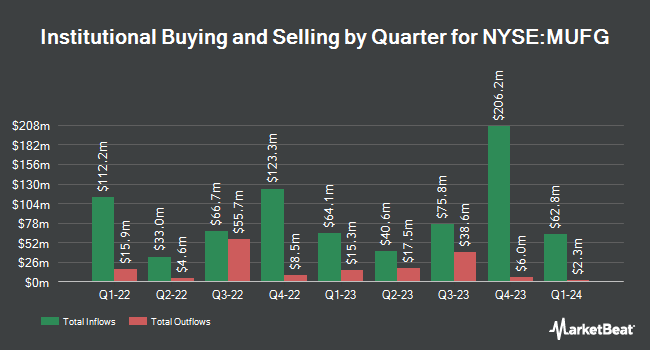

Other institutional investors and hedge funds have also modified their holdings of the company. B. Riley Wealth Advisors Inc. purchased a new position in shares of Mitsubishi UFJ Financial Group in the 1st quarter worth $155,000. Cetera Advisors LLC bought a new stake in shares of Mitsubishi UFJ Financial Group in the first quarter worth $131,000. EverSource Wealth Advisors LLC increased its stake in shares of Mitsubishi UFJ Financial Group by 60.9% in the first quarter. EverSource Wealth Advisors LLC now owns 5,870 shares of the company's stock worth $58,000 after buying an additional 2,222 shares during the last quarter. GAMMA Investing LLC increased its stake in shares of Mitsubishi UFJ Financial Group by 11.6% in the second quarter. GAMMA Investing LLC now owns 24,403 shares of the company's stock worth $264,000 after buying an additional 2,538 shares during the last quarter. Finally, Park Avenue Securities LLC increased its stake in shares of Mitsubishi UFJ Financial Group by 3.8% in the second quarter. Park Avenue Securities LLC now owns 99,299 shares of the company's stock worth $1,072,000 after buying an additional 3,628 shares during the last quarter. Institutional investors and hedge funds own 13.59% of the company's stock.

Analyst Upgrades and Downgrades

Separately, StockNews.com upgraded shares of Mitsubishi UFJ Financial Group from a "sell" rating to a "hold" rating in a research note on Saturday, November 23rd.

Check Out Our Latest Stock Report on MUFG

Mitsubishi UFJ Financial Group Stock Performance

Shares of Mitsubishi UFJ Financial Group stock traded down $0.21 during trading on Wednesday, hitting $12.02. 1,329,778 shares of the stock were exchanged, compared to its average volume of 2,420,015. The stock's fifty day moving average is $10.99 and its 200 day moving average is $10.65. The stock has a market cap of $140.12 billion, a PE ratio of 11.78, a P/E/G ratio of 1.13 and a beta of 0.61. The company has a debt-to-equity ratio of 2.04, a quick ratio of 0.92 and a current ratio of 0.91. Mitsubishi UFJ Financial Group, Inc. has a 12 month low of $8.19 and a 12 month high of $12.31.

About Mitsubishi UFJ Financial Group

(

Free Report)

Mitsubishi UFJ Financial Group, Inc operates as the bank holding company, that engages in a range of financial businesses in Japan, the United States, Europe, Asia/Oceania, and internationally. It operates through seven segments: Digital Service, Retail & Commercial Banking, Japanese Corporate & Investment Banking, Global Commercial Banking, Asset Management & Investor Services, Global Corporate & Investment Banking, and Global Markets.

See Also

Before you consider Mitsubishi UFJ Financial Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Mitsubishi UFJ Financial Group wasn't on the list.

While Mitsubishi UFJ Financial Group currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.