Mitsubishi UFJ Trust & Banking Corp grew its holdings in Medpace Holdings, Inc. (NASDAQ:MEDP - Free Report) by 40.3% in the fourth quarter, according to its most recent filing with the Securities & Exchange Commission. The institutional investor owned 38,630 shares of the company's stock after buying an additional 11,099 shares during the period. Mitsubishi UFJ Trust & Banking Corp owned approximately 0.12% of Medpace worth $12,834,000 as of its most recent filing with the Securities & Exchange Commission.

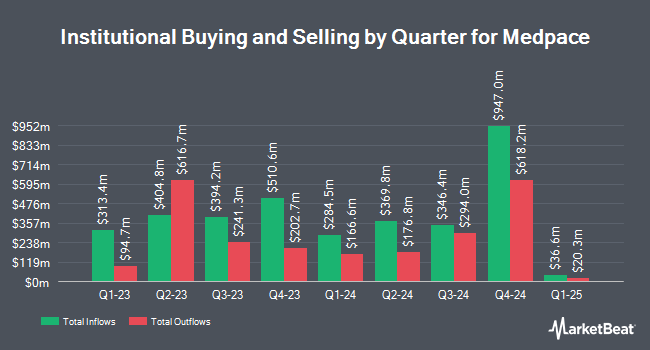

A number of other large investors have also recently made changes to their positions in MEDP. Vanguard Group Inc. lifted its position in Medpace by 1.0% in the fourth quarter. Vanguard Group Inc. now owns 2,570,770 shares of the company's stock worth $854,087,000 after buying an additional 25,704 shares during the last quarter. State Street Corp raised its stake in shares of Medpace by 7.2% in the third quarter. State Street Corp now owns 752,957 shares of the company's stock valued at $251,337,000 after acquiring an additional 50,312 shares during the period. Geode Capital Management LLC lifted its holdings in shares of Medpace by 7.6% in the 3rd quarter. Geode Capital Management LLC now owns 628,054 shares of the company's stock worth $209,885,000 after acquiring an additional 44,371 shares during the last quarter. Wellington Management Group LLP grew its holdings in Medpace by 36.0% during the 3rd quarter. Wellington Management Group LLP now owns 415,255 shares of the company's stock valued at $138,612,000 after purchasing an additional 109,886 shares during the last quarter. Finally, American Capital Management Inc. raised its position in Medpace by 2.6% in the 3rd quarter. American Capital Management Inc. now owns 380,646 shares of the company's stock worth $127,060,000 after purchasing an additional 9,592 shares during the period. 77.98% of the stock is currently owned by institutional investors.

Medpace Price Performance

Medpace stock traded up $10.49 during trading hours on Wednesday, hitting $308.22. 240,441 shares of the stock traded hands, compared to its average volume of 333,469. The firm's 50 day moving average price is $334.26 and its 200-day moving average price is $338.52. The stock has a market capitalization of $9.39 billion, a price-to-earnings ratio of 24.39, a P/E/G ratio of 3.81 and a beta of 1.47. Medpace Holdings, Inc. has a 1 year low of $289.01 and a 1 year high of $459.77.

Medpace (NASDAQ:MEDP - Get Free Report) last issued its earnings results on Monday, February 10th. The company reported $3.67 earnings per share (EPS) for the quarter, topping the consensus estimate of $2.96 by $0.71. Medpace had a net margin of 19.17% and a return on equity of 51.48%. Research analysts forecast that Medpace Holdings, Inc. will post 12.29 earnings per share for the current fiscal year.

Analyst Ratings Changes

Several research firms recently commented on MEDP. Leerink Partners initiated coverage on shares of Medpace in a research note on Monday, March 24th. They issued a "market perform" rating and a $330.00 price target on the stock. Leerink Partnrs upgraded Medpace to a "hold" rating in a report on Monday, March 24th. Finally, Robert W. Baird increased their price target on Medpace from $354.00 to $362.00 and gave the stock a "neutral" rating in a research report on Monday, January 27th. Nine investment analysts have rated the stock with a hold rating and five have issued a buy rating to the company. According to data from MarketBeat, Medpace presently has an average rating of "Hold" and an average target price of $376.30.

Read Our Latest Analysis on Medpace

Medpace Company Profile

(

Free Report)

Medpace Holdings, Inc engages in the provision of outsourced clinical development services to the biotechnology, pharmaceutical and medical device industries. Its services include medical department, clinical trial management, data-driven feasibility, study-start-up, clinical monitoring, regulatory affairs, patient recruitment and retention, medical writing, biometrics and data sciences, pharmacovigilance, core laboratory, laboratories, clinics, and quality assurance.

Featured Articles

Before you consider Medpace, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Medpace wasn't on the list.

While Medpace currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are hedge funds and endowments buying in today's market? Enter your email address and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying now.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.