Immunocore (NASDAQ:IMCR - Get Free Report) was downgraded by investment analysts at Mizuho from an "outperform" rating to a "neutral" rating in a report issued on Monday, MarketBeat reports. They presently have a $38.00 target price on the stock, down from their prior target price of $72.00. Mizuho's price target indicates a potential upside of 10.98% from the stock's current price.

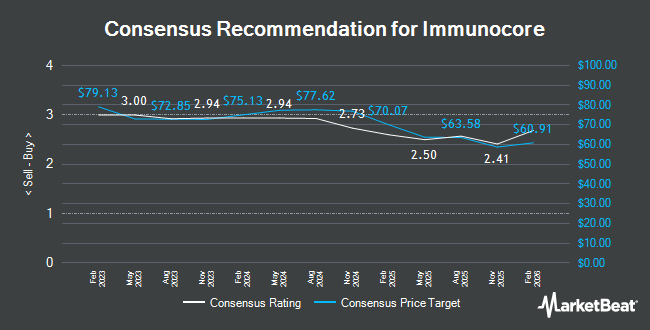

IMCR has been the subject of several other research reports. HC Wainwright restated a "buy" rating and issued a $100.00 target price on shares of Immunocore in a research note on Thursday, October 24th. Morgan Stanley cut their target price on Immunocore from $80.00 to $74.00 and set an "overweight" rating for the company in a research note on Friday, October 11th. UBS Group began coverage on Immunocore in a research note on Thursday, October 24th. They issued a "sell" rating and a $24.00 price target on the stock. Barclays cut their price objective on Immunocore from $92.00 to $66.00 and set an "overweight" rating for the company in a research report on Friday, August 9th. Finally, Guggenheim cut shares of Immunocore from a "buy" rating to a "neutral" rating in a research note on Monday, October 7th. One research analyst has rated the stock with a sell rating, three have given a hold rating and nine have given a buy rating to the stock. Based on data from MarketBeat, the stock currently has a consensus rating of "Moderate Buy" and a consensus price target of $69.18.

Check Out Our Latest Stock Analysis on Immunocore

Immunocore Stock Performance

NASDAQ IMCR traded down $0.45 during trading on Monday, reaching $34.24. The company's stock had a trading volume of 97,134 shares, compared to its average volume of 523,954. The business's fifty day moving average price is $32.64 and its 200-day moving average price is $39.26. Immunocore has a twelve month low of $29.72 and a twelve month high of $76.98. The company has a debt-to-equity ratio of 1.03, a quick ratio of 5.15 and a current ratio of 3.78. The firm has a market cap of $1.71 billion, a price-to-earnings ratio of -36.52 and a beta of 0.72.

Immunocore (NASDAQ:IMCR - Get Free Report) last posted its quarterly earnings data on Wednesday, November 6th. The company reported $0.17 earnings per share for the quarter, topping analysts' consensus estimates of ($0.33) by $0.50. The company had revenue of $80.25 million during the quarter, compared to analysts' expectations of $78.94 million. Immunocore had a negative return on equity of 12.84% and a negative net margin of 15.87%. The firm's revenue for the quarter was up 23.7% on a year-over-year basis. During the same period last year, the firm earned ($0.59) EPS. As a group, analysts anticipate that Immunocore will post -1.11 EPS for the current fiscal year.

Institutional Investors Weigh In On Immunocore

A number of hedge funds and other institutional investors have recently modified their holdings of the company. SG Americas Securities LLC increased its position in Immunocore by 1,867.3% during the second quarter. SG Americas Securities LLC now owns 160,358 shares of the company's stock worth $5,435,000 after purchasing an additional 152,207 shares during the last quarter. Candriam S.C.A. boosted its holdings in Immunocore by 65.8% in the second quarter. Candriam S.C.A. now owns 313,423 shares of the company's stock valued at $10,621,000 after acquiring an additional 124,417 shares during the last quarter. Frazier Life Sciences Management L.P. acquired a new stake in Immunocore during the second quarter worth about $3,686,000. Janus Henderson Group PLC raised its holdings in shares of Immunocore by 45.8% in the 1st quarter. Janus Henderson Group PLC now owns 257,080 shares of the company's stock worth $16,711,000 after purchasing an additional 80,748 shares during the period. Finally, BNP PARIBAS ASSET MANAGEMENT Holding S.A. lifted its stake in shares of Immunocore by 16.2% in the 2nd quarter. BNP PARIBAS ASSET MANAGEMENT Holding S.A. now owns 397,463 shares of the company's stock valued at $13,470,000 after purchasing an additional 55,463 shares in the last quarter. 84.50% of the stock is currently owned by hedge funds and other institutional investors.

Immunocore Company Profile

(

Get Free Report)

Immunocore Holdings plc, a commercial-stage biotechnology company, engages in the development of immunotherapies for the treatment of cancer, infectious, and autoimmune diseases. The company offers KIMMTRAK for the treatment of patients with unresectable or metastatic uveal melanoma. It also develops other programs for oncology, including tebentafusp that is in Phase 2/3 clinical trial to treat advanced cutaneous melanoma.

Featured Articles

Before you consider Immunocore, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Immunocore wasn't on the list.

While Immunocore currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.