Immunocore (NASDAQ:IMCR - Free Report) had its price objective trimmed by Mizuho from $38.00 to $33.00 in a research note released on Monday,Benzinga reports. The firm currently has a neutral rating on the stock.

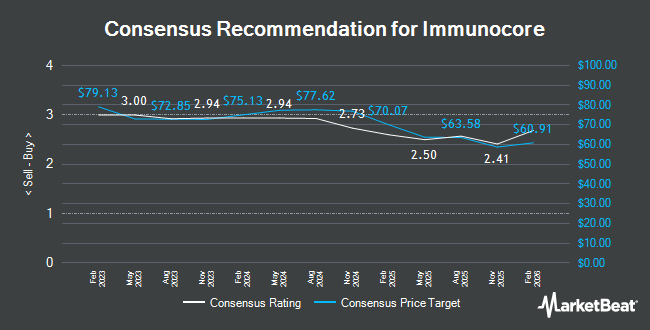

A number of other brokerages have also commented on IMCR. Needham & Company LLC reiterated a "buy" rating and issued a $71.00 price objective on shares of Immunocore in a research report on Wednesday, March 12th. Morgan Stanley reiterated an "equal weight" rating and issued a $35.00 price target on shares of Immunocore in a report on Friday, March 7th. Finally, HC Wainwright reissued a "buy" rating and set a $100.00 price objective on shares of Immunocore in a report on Wednesday, March 12th. One research analyst has rated the stock with a sell rating, four have assigned a hold rating and eight have issued a buy rating to the stock. Based on data from MarketBeat.com, the company has a consensus rating of "Moderate Buy" and an average target price of $65.18.

Read Our Latest Stock Analysis on IMCR

Immunocore Price Performance

Shares of NASDAQ IMCR traded up $0.77 during trading on Monday, reaching $26.59. The company had a trading volume of 253,093 shares, compared to its average volume of 443,283. Immunocore has a 52 week low of $23.15 and a 52 week high of $62.74. The company has a debt-to-equity ratio of 1.03, a quick ratio of 3.76 and a current ratio of 3.78. The business's 50 day moving average price is $28.93 and its 200-day moving average price is $30.49. The stock has a market cap of $1.33 billion, a PE ratio of -27.99 and a beta of 0.75.

Insider Buying and Selling

In other Immunocore news, Director Bros. Advisors Lp Baker acquired 807,338 shares of the company's stock in a transaction that occurred on Monday, March 17th. The shares were acquired at an average price of $29.72 per share, with a total value of $23,994,085.36. Following the purchase, the director now owns 2,144,060 shares of the company's stock, valued at $63,721,463.20. This represents a 60.40 % increase in their position. The purchase was disclosed in a filing with the Securities & Exchange Commission, which is available at this link. 9.10% of the stock is owned by insiders.

Institutional Inflows and Outflows

Institutional investors and hedge funds have recently added to or reduced their stakes in the business. GF Fund Management CO. LTD. bought a new position in shares of Immunocore during the 4th quarter valued at about $25,000. China Universal Asset Management Co. Ltd. raised its holdings in Immunocore by 12.9% during the 4th quarter. China Universal Asset Management Co. Ltd. now owns 8,393 shares of the company's stock worth $248,000 after buying an additional 960 shares during the period. NEOS Investment Management LLC boosted its holdings in shares of Immunocore by 10.9% in the fourth quarter. NEOS Investment Management LLC now owns 11,194 shares of the company's stock valued at $330,000 after buying an additional 1,102 shares during the period. Tema Etfs LLC bought a new stake in shares of Immunocore during the fourth quarter worth $330,000. Finally, Virtus ETF Advisers LLC raised its holdings in shares of Immunocore by 39.0% during the fourth quarter. Virtus ETF Advisers LLC now owns 11,536 shares of the company's stock worth $340,000 after acquiring an additional 3,238 shares during the period. 84.50% of the stock is owned by institutional investors and hedge funds.

About Immunocore

(

Get Free Report)

Immunocore Holdings plc, a commercial-stage biotechnology company, engages in the development of immunotherapies for the treatment of cancer, infectious, and autoimmune diseases. The company offers KIMMTRAK for the treatment of patients with unresectable or metastatic uveal melanoma. It also develops other programs for oncology, including tebentafusp that is in Phase 2/3 clinical trial to treat advanced cutaneous melanoma.

See Also

Before you consider Immunocore, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Immunocore wasn't on the list.

While Immunocore currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.