Marqeta (NASDAQ:MQ - Get Free Report) had its target price decreased by equities researchers at Mizuho from $7.00 to $5.00 in a report issued on Tuesday, Benzinga reports. The brokerage presently has an "outperform" rating on the stock. Mizuho's target price suggests a potential upside of 46.20% from the company's current price.

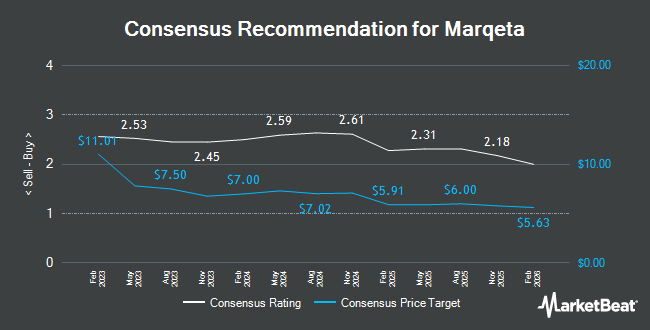

Several other brokerages have also recently issued reports on MQ. Monness Crespi & Hardt cut shares of Marqeta from a "buy" rating to a "neutral" rating and set a $7.50 target price on the stock. in a research report on Tuesday. Morgan Stanley decreased their price objective on Marqeta from $7.00 to $5.00 and set an "equal weight" rating on the stock in a research report on Tuesday. Keefe, Bruyette & Woods lowered their price objective on Marqeta from $6.00 to $5.00 and set a "market perform" rating for the company in a research note on Tuesday. William Blair downgraded Marqeta from an "outperform" rating to a "market perform" rating in a research report on Tuesday. Finally, KeyCorp downgraded Marqeta from an "overweight" rating to a "sector weight" rating in a research report on Tuesday. Ten analysts have rated the stock with a hold rating and six have given a buy rating to the stock. According to MarketBeat.com, Marqeta presently has an average rating of "Hold" and an average price target of $6.33.

Get Our Latest Analysis on MQ

Marqeta Trading Down 42.5 %

Shares of MQ traded down $2.53 during trading hours on Tuesday, reaching $3.42. 80,296,446 shares of the stock traded hands, compared to its average volume of 4,888,700. The company has a market cap of $1.74 billion, a P/E ratio of -171.91 and a beta of 1.73. The company's 50-day moving average price is $5.14 and its two-hundred day moving average price is $5.30. Marqeta has a 52-week low of $3.37 and a 52-week high of $7.36.

Marqeta (NASDAQ:MQ - Get Free Report) last issued its earnings results on Monday, November 4th. The company reported ($0.06) earnings per share (EPS) for the quarter, missing the consensus estimate of ($0.05) by ($0.01). Marqeta had a negative net margin of 2.62% and a positive return on equity of 0.51%. The business had revenue of $127.90 million for the quarter, compared to the consensus estimate of $128.05 million. During the same period last year, the business posted ($0.07) EPS. The firm's revenue for the quarter was up 20.8% compared to the same quarter last year. On average, research analysts forecast that Marqeta will post 0.06 EPS for the current year.

Institutional Investors Weigh In On Marqeta

A number of hedge funds and other institutional investors have recently added to or reduced their stakes in the business. Visa Foundation purchased a new position in shares of Marqeta in the second quarter worth $68,197,000. Congress Asset Management Co. raised its stake in shares of Marqeta by 46.8% in the third quarter. Congress Asset Management Co. now owns 1,055,681 shares of the company's stock worth $5,194,000 after purchasing an additional 336,349 shares during the last quarter. Vanguard Group Inc. lifted its holdings in shares of Marqeta by 3.6% during the first quarter. Vanguard Group Inc. now owns 47,435,778 shares of the company's stock worth $282,717,000 after purchasing an additional 1,642,621 shares during the period. Westfield Capital Management Co. LP boosted its position in Marqeta by 27.6% in the first quarter. Westfield Capital Management Co. LP now owns 7,418,851 shares of the company's stock valued at $44,216,000 after buying an additional 1,604,223 shares during the last quarter. Finally, Comerica Bank increased its holdings in Marqeta by 27.8% in the 1st quarter. Comerica Bank now owns 1,007,954 shares of the company's stock worth $6,007,000 after buying an additional 219,001 shares during the period. 78.64% of the stock is currently owned by hedge funds and other institutional investors.

About Marqeta

(

Get Free Report)

Marqeta, Inc operates a cloud-based open application programming interface platform that delivers card issuing and transaction processing services. It offers its solutions in various verticals, including financial services, on-demand services, expense management, and e-commerce enablement, as well as buy now, pay later.

Featured Stories

Before you consider Marqeta, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Marqeta wasn't on the list.

While Marqeta currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.