Mizuho Markets Americas LLC grew its holdings in Dynavax Technologies Co. (NASDAQ:DVAX - Free Report) by 17.4% in the 3rd quarter, according to its most recent disclosure with the Securities and Exchange Commission. The firm owned 1,379,582 shares of the biopharmaceutical company's stock after acquiring an additional 204,475 shares during the quarter. Mizuho Markets Americas LLC owned 1.05% of Dynavax Technologies worth $15,369,000 as of its most recent filing with the Securities and Exchange Commission.

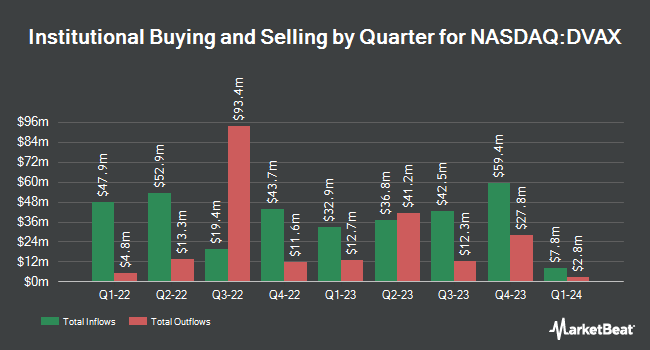

Several other hedge funds also recently modified their holdings of DVAX. ProShare Advisors LLC lifted its position in Dynavax Technologies by 8.3% in the first quarter. ProShare Advisors LLC now owns 35,269 shares of the biopharmaceutical company's stock worth $438,000 after purchasing an additional 2,691 shares during the period. Vanguard Group Inc. lifted its position in Dynavax Technologies by 1.4% in the first quarter. Vanguard Group Inc. now owns 9,402,246 shares of the biopharmaceutical company's stock worth $116,682,000 after purchasing an additional 126,458 shares during the period. CANADA LIFE ASSURANCE Co lifted its position in Dynavax Technologies by 4.1% in the first quarter. CANADA LIFE ASSURANCE Co now owns 150,265 shares of the biopharmaceutical company's stock worth $1,866,000 after purchasing an additional 5,934 shares during the period. Price T Rowe Associates Inc. MD lifted its position in Dynavax Technologies by 11.5% in the first quarter. Price T Rowe Associates Inc. MD now owns 95,537 shares of the biopharmaceutical company's stock worth $1,186,000 after purchasing an additional 9,839 shares during the period. Finally, Kynam Capital Management LP lifted its position in Dynavax Technologies by 180.0% in the first quarter. Kynam Capital Management LP now owns 4,239,780 shares of the biopharmaceutical company's stock worth $52,616,000 after purchasing an additional 2,725,397 shares during the period. 96.96% of the stock is owned by institutional investors.

Analysts Set New Price Targets

Several research analysts recently commented on DVAX shares. The Goldman Sachs Group reduced their target price on Dynavax Technologies from $20.00 to $15.00 and set a "neutral" rating for the company in a research report on Thursday, August 8th. HC Wainwright reiterated a "buy" rating and set a $29.00 price objective on shares of Dynavax Technologies in a research note on Friday, November 8th.

Read Our Latest Research Report on DVAX

Dynavax Technologies Price Performance

Shares of NASDAQ:DVAX traded down $1.18 during midday trading on Friday, reaching $12.21. The company's stock had a trading volume of 8,112,419 shares, compared to its average volume of 2,172,531. The business's fifty day simple moving average is $11.39 and its 200-day simple moving average is $11.31. The company has a market capitalization of $1.61 billion, a P/E ratio of 93.93 and a beta of 1.34. Dynavax Technologies Co. has a fifty-two week low of $9.74 and a fifty-two week high of $15.01. The company has a debt-to-equity ratio of 0.33, a current ratio of 13.23 and a quick ratio of 12.34.

Dynavax Technologies Company Profile

(

Free Report)

Dynavax Technologies Corporation, a commercial stage biopharmaceutical company, focuses on developing and commercializing vaccines in the United States. It markets HEPLISAV-B, a hepatitis B vaccine for prevention of infection caused by all known subtypes of hepatitis B virus in age 18 years and older in the United States and Europe.

Featured Articles

Before you consider Dynavax Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Dynavax Technologies wasn't on the list.

While Dynavax Technologies currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.