Mizuho Markets Americas LLC acquired a new position in Enphase Energy, Inc. (NASDAQ:ENPH - Free Report) during the third quarter, according to the company in its most recent disclosure with the SEC. The firm acquired 52,322 shares of the semiconductor company's stock, valued at approximately $5,913,000.

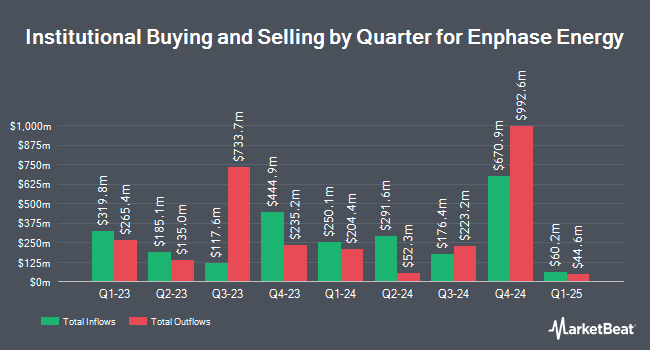

Several other hedge funds have also recently bought and sold shares of ENPH. M&G Plc acquired a new position in Enphase Energy in the 1st quarter worth approximately $7,244,000. Mitsubishi UFJ Trust & Banking Corp boosted its stake in shares of Enphase Energy by 25.9% during the 1st quarter. Mitsubishi UFJ Trust & Banking Corp now owns 257,883 shares of the semiconductor company's stock worth $31,197,000 after acquiring an additional 53,041 shares in the last quarter. Seven Eight Capital LP raised its stake in shares of Enphase Energy by 61.2% in the 1st quarter. Seven Eight Capital LP now owns 14,971 shares of the semiconductor company's stock valued at $1,811,000 after acquiring an additional 5,681 shares in the last quarter. Clearbridge Investments LLC bought a new stake in Enphase Energy during the first quarter worth approximately $12,624,000. Finally, UniSuper Management Pty Ltd grew its holdings in Enphase Energy by 1.2% during the first quarter. UniSuper Management Pty Ltd now owns 637,331 shares of the semiconductor company's stock valued at $77,104,000 after purchasing an additional 7,423 shares during the last quarter. 72.12% of the stock is currently owned by institutional investors.

Analysts Set New Price Targets

Several analysts have issued reports on ENPH shares. Canaccord Genuity Group lowered shares of Enphase Energy from a "buy" rating to a "hold" rating in a research report on Wednesday, October 23rd. Morgan Stanley reduced their price objective on shares of Enphase Energy from $93.00 to $74.00 and set an "equal weight" rating on the stock in a research note on Friday. BMO Capital Markets cut their price target on shares of Enphase Energy from $114.00 to $104.00 and set a "market perform" rating on the stock in a research report on Monday, October 14th. William Blair started coverage on Enphase Energy in a research report on Thursday, August 29th. They issued a "market perform" rating for the company. Finally, Janney Montgomery Scott cut Enphase Energy from a "buy" rating to a "neutral" rating and set a $83.00 price objective for the company. in a research report on Wednesday, October 23rd. Four equities research analysts have rated the stock with a sell rating, sixteen have given a hold rating and fourteen have issued a buy rating to the company. According to data from MarketBeat.com, the company currently has a consensus rating of "Hold" and a consensus target price of $102.76.

Read Our Latest Stock Report on Enphase Energy

Enphase Energy Trading Down 6.4 %

Enphase Energy stock traded down $4.04 during trading on Friday, hitting $59.52. The company had a trading volume of 6,882,178 shares, compared to its average volume of 7,145,747. The company has a current ratio of 4.16, a quick ratio of 3.88 and a debt-to-equity ratio of 1.29. The stock has a market cap of $8.04 billion, a price-to-earnings ratio of 135.27, a price-to-earnings-growth ratio of 18.20 and a beta of 1.77. Enphase Energy, Inc. has a 1-year low of $59.12 and a 1-year high of $141.63. The company's 50 day simple moving average is $95.27 and its 200-day simple moving average is $107.75.

Enphase Energy (NASDAQ:ENPH - Get Free Report) last released its earnings results on Tuesday, October 22nd. The semiconductor company reported $0.65 earnings per share for the quarter, missing analysts' consensus estimates of $0.77 by ($0.12). The firm had revenue of $380.90 million for the quarter, compared to analysts' expectations of $392.51 million. Enphase Energy had a return on equity of 10.56% and a net margin of 4.91%. The firm's quarterly revenue was down 30.9% on a year-over-year basis. During the same quarter in the previous year, the company posted $0.84 earnings per share. As a group, analysts expect that Enphase Energy, Inc. will post 0.91 EPS for the current fiscal year.

Enphase Energy Profile

(

Free Report)

Enphase Energy, Inc, together with its subsidiaries, designs, develops, manufactures, and sells home energy solutions for the solar photovoltaic industry in the United States and internationally. The company offers semiconductor-based microinverter, which converts energy at the individual solar module level and combines with its proprietary networking and software technologies to provide energy monitoring and control.

Read More

Before you consider Enphase Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Enphase Energy wasn't on the list.

While Enphase Energy currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for December 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.