CyberArk Software (NASDAQ:CYBR - Free Report) had its price objective lifted by Mizuho from $345.00 to $365.00 in a research note issued to investors on Friday,Benzinga reports. They currently have an outperform rating on the technology company's stock.

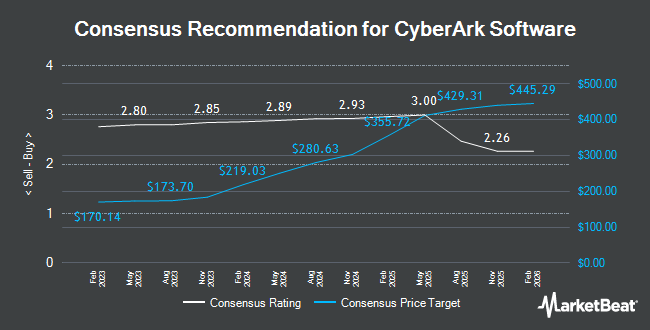

Several other brokerages have also issued reports on CYBR. Oppenheimer boosted their price target on shares of CyberArk Software from $310.00 to $360.00 and gave the company an "outperform" rating in a report on Tuesday, October 22nd. Wedbush raised their price objective on shares of CyberArk Software from $300.00 to $325.00 and gave the company an "outperform" rating in a research report on Tuesday, October 1st. KeyCorp boosted their price target on shares of CyberArk Software from $340.00 to $355.00 and gave the stock an "overweight" rating in a research note on Thursday, November 14th. Royal Bank of Canada lifted their price objective on shares of CyberArk Software from $328.00 to $358.00 and gave the stock an "outperform" rating in a research note on Thursday, November 14th. Finally, StockNews.com upgraded shares of CyberArk Software from a "hold" rating to a "buy" rating in a report on Monday. One investment analyst has rated the stock with a hold rating and twenty-six have assigned a buy rating to the company. According to MarketBeat, CyberArk Software has an average rating of "Moderate Buy" and a consensus price target of $333.00.

Get Our Latest Analysis on CYBR

CyberArk Software Stock Down 2.5 %

NASDAQ CYBR traded down $8.18 during midday trading on Friday, hitting $313.36. The company had a trading volume of 385,808 shares, compared to its average volume of 517,724. The firm has a fifty day simple moving average of $302.18 and a two-hundred day simple moving average of $277.92. The stock has a market cap of $13.65 billion, a price-to-earnings ratio of 1,190.93 and a beta of 1.13. CyberArk Software has a fifty-two week low of $198.01 and a fifty-two week high of $333.32.

CyberArk Software (NASDAQ:CYBR - Get Free Report) last posted its quarterly earnings results on Wednesday, November 13th. The technology company reported $0.94 EPS for the quarter, beating the consensus estimate of $0.46 by $0.48. CyberArk Software had a return on equity of 2.29% and a net margin of 1.38%. The firm had revenue of $240.10 million during the quarter, compared to analysts' expectations of $234.10 million. During the same quarter in the prior year, the firm posted ($0.31) EPS. The company's revenue for the quarter was up 25.6% on a year-over-year basis. As a group, equities analysts predict that CyberArk Software will post -0.58 earnings per share for the current year.

Hedge Funds Weigh In On CyberArk Software

A number of large investors have recently made changes to their positions in the business. ORG Partners LLC purchased a new position in shares of CyberArk Software in the second quarter worth $33,000. 1620 Investment Advisors Inc. acquired a new stake in CyberArk Software during the 2nd quarter worth about $39,000. Assetmark Inc. grew its stake in CyberArk Software by 1,025.0% during the 3rd quarter. Assetmark Inc. now owns 135 shares of the technology company's stock valued at $39,000 after purchasing an additional 123 shares during the last quarter. Arcadia Investment Management Corp MI increased its holdings in shares of CyberArk Software by 42.2% in the second quarter. Arcadia Investment Management Corp MI now owns 182 shares of the technology company's stock valued at $50,000 after purchasing an additional 54 shares during the period. Finally, Transcendent Capital Group LLC purchased a new position in shares of CyberArk Software in the third quarter worth about $51,000. 91.84% of the stock is owned by institutional investors and hedge funds.

CyberArk Software Company Profile

(

Get Free Report)

CyberArk Software Ltd., together with its subsidiaries, develops, markets, and sells software-based identity security solutions and services in the United States, Europe, the Middle East, Africa, and internationally. Its solutions include Privileged Access Manager, which offers risk-based credential security and session; Vendor Privileged Access Manager combines Privileged Access Manager and Remote Access to provide secure access to third-party vendors; Dynamic Privileged Access, a SaaS solution that provides just-in-time access to Linux Virtual Machines; Endpoint Privilege Manager, a SaaS solution that secures privileges on the endpoint; and Secure Desktop, a solution that protects access to endpoints.

Read More

Before you consider CyberArk Software, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CyberArk Software wasn't on the list.

While CyberArk Software currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.