Mizuho Securities Co. Ltd. lifted its stake in Tesla, Inc. (NASDAQ:TSLA - Free Report) by 56.4% in the third quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor owned 12,060 shares of the electric vehicle producer's stock after purchasing an additional 4,350 shares during the period. Tesla accounts for 7.8% of Mizuho Securities Co. Ltd.'s portfolio, making the stock its 3rd largest position. Mizuho Securities Co. Ltd.'s holdings in Tesla were worth $3,155,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

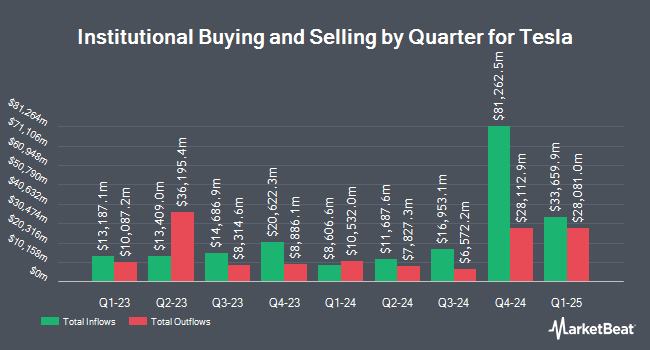

Several other hedge funds and other institutional investors have also made changes to their positions in TSLA. Bank & Trust Co bought a new stake in Tesla during the 2nd quarter worth $25,000. Valley Wealth Managers Inc. bought a new position in shares of Tesla during the 2nd quarter valued at approximately $26,000. Abich Financial Wealth Management LLC boosted its position in shares of Tesla by 168.8% during the 2nd quarter. Abich Financial Wealth Management LLC now owns 129 shares of the electric vehicle producer's stock valued at $26,000 after acquiring an additional 81 shares during the last quarter. Transcendent Capital Group LLC purchased a new position in shares of Tesla during the 3rd quarter valued at about $29,000. Finally, Clean Yield Group increased its stake in Tesla by 60.0% in the 3rd quarter. Clean Yield Group now owns 128 shares of the electric vehicle producer's stock worth $33,000 after purchasing an additional 48 shares during the period. 66.20% of the stock is currently owned by institutional investors.

Tesla Trading Up 0.5 %

Shares of NASDAQ TSLA traded up $1.75 during midday trading on Wednesday, reaching $330.24. 124,665,637 shares of the stock were exchanged, compared to its average volume of 95,829,703. The stock has a market capitalization of $1.06 trillion, a P/E ratio of 88.91, a PEG ratio of 10.67 and a beta of 2.29. Tesla, Inc. has a twelve month low of $138.80 and a twelve month high of $358.64. The company has a debt-to-equity ratio of 0.08, a quick ratio of 1.37 and a current ratio of 1.84. The company has a 50 day simple moving average of $246.26 and a 200 day simple moving average of $218.16.

Tesla (NASDAQ:TSLA - Get Free Report) last issued its quarterly earnings data on Wednesday, October 23rd. The electric vehicle producer reported $0.72 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.58 by $0.14. The firm had revenue of $25.18 billion during the quarter, compared to the consensus estimate of $25.47 billion. Tesla had a return on equity of 10.24% and a net margin of 13.07%. The company's quarterly revenue was up 7.8% on a year-over-year basis. During the same period last year, the company earned $0.53 EPS. As a group, equities analysts expect that Tesla, Inc. will post 1.99 earnings per share for the current year.

Insider Activity at Tesla

In related news, Director Kathleen Wilson-Thompson sold 100,000 shares of Tesla stock in a transaction on Monday, November 11th. The stock was sold at an average price of $346.02, for a total value of $34,602,000.00. Following the completion of the transaction, the director now directly owns 5,400 shares in the company, valued at approximately $1,868,508. This trade represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is accessible through this hyperlink. In other Tesla news, Director Kimbal Musk sold 60,500 shares of Tesla stock in a transaction dated Friday, November 1st. The stock was sold at an average price of $250.23, for a total transaction of $15,138,915.00. Following the completion of the sale, the director now directly owns 1,563,220 shares of the company's stock, valued at $391,164,540.60. The trade was a 0.00 % decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available at this link. Also, Director Kathleen Wilson-Thompson sold 100,000 shares of the stock in a transaction dated Monday, November 11th. The shares were sold at an average price of $346.02, for a total value of $34,602,000.00. Following the completion of the transaction, the director now owns 5,400 shares in the company, valued at approximately $1,868,508. The trade was a 0.00 % decrease in their position. The disclosure for this sale can be found here. In the last 90 days, insiders have sold 188,797 shares of company stock worth $57,616,781. 20.70% of the stock is currently owned by company insiders.

Wall Street Analyst Weigh In

Several brokerages have commented on TSLA. StockNews.com raised Tesla from a "sell" rating to a "hold" rating in a research report on Thursday, October 24th. Phillip Securities raised shares of Tesla to a "moderate sell" rating in a report on Friday, October 25th. Needham & Company LLC reiterated a "hold" rating on shares of Tesla in a report on Thursday, October 24th. Oppenheimer reiterated a "market perform" rating on shares of Tesla in a research report on Tuesday, October 8th. Finally, Guggenheim lifted their price objective on shares of Tesla from $153.00 to $156.00 and gave the company a "sell" rating in a report on Thursday, October 24th. Eight analysts have rated the stock with a sell rating, seventeen have issued a hold rating and fourteen have issued a buy rating to the stock. According to data from MarketBeat.com, Tesla presently has a consensus rating of "Hold" and an average target price of $225.06.

Read Our Latest Research Report on TSLA

Tesla Profile

(

Free Report)

Tesla, Inc designs, develops, manufactures, leases, and sells electric vehicles, and energy generation and storage systems in the United States, China, and internationally. The company operates in two segments, Automotive, and Energy Generation and Storage. The Automotive segment offers electric vehicles, as well as sells automotive regulatory credits; and non-warranty after-sales vehicle, used vehicles, body shop and parts, supercharging, retail merchandise, and vehicle insurance services.

Further Reading

Before you consider Tesla, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Tesla wasn't on the list.

While Tesla currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, Starlink, or X.AI? Enter your email address to learn when Elon Musk will let these companies finally IPO.

Get This Free Report