Mizuho Securities USA LLC grew its stake in shares of Builders FirstSource, Inc. (NYSE:BLDR - Free Report) by 4,099.0% during the 3rd quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The firm owned 395,000 shares of the company's stock after purchasing an additional 385,593 shares during the period. Mizuho Securities USA LLC owned approximately 0.34% of Builders FirstSource worth $76,575,000 as of its most recent filing with the Securities and Exchange Commission.

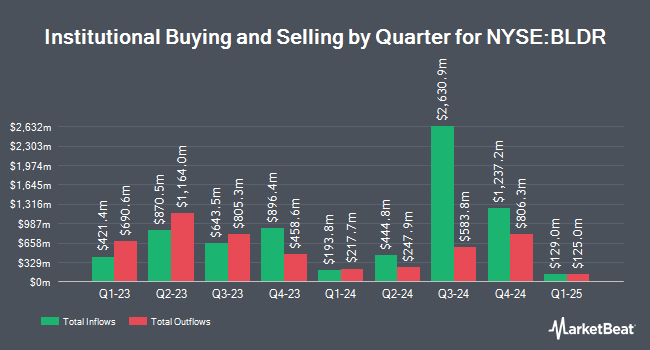

Other institutional investors and hedge funds also recently made changes to their positions in the company. Forsta AP Fonden increased its stake in Builders FirstSource by 12.1% during the 3rd quarter. Forsta AP Fonden now owns 26,800 shares of the company's stock valued at $5,195,000 after purchasing an additional 2,900 shares in the last quarter. Cetera Investment Advisers raised its holdings in shares of Builders FirstSource by 762.2% in the 1st quarter. Cetera Investment Advisers now owns 50,982 shares of the company's stock worth $10,632,000 after acquiring an additional 45,069 shares during the last quarter. Janus Henderson Group PLC lifted its position in Builders FirstSource by 21.1% in the 1st quarter. Janus Henderson Group PLC now owns 20,013 shares of the company's stock valued at $4,173,000 after acquiring an additional 3,483 shares in the last quarter. Raymond James Financial Services Advisors Inc. boosted its stake in Builders FirstSource by 18.6% during the 2nd quarter. Raymond James Financial Services Advisors Inc. now owns 115,995 shares of the company's stock valued at $16,055,000 after purchasing an additional 18,223 shares during the last quarter. Finally, Acadian Asset Management LLC bought a new stake in Builders FirstSource during the 1st quarter worth approximately $3,448,000. Institutional investors own 95.53% of the company's stock.

Insider Buying and Selling at Builders FirstSource

In other news, Director Cleveland A. Christophe sold 10,000 shares of Builders FirstSource stock in a transaction on Thursday, November 7th. The shares were sold at an average price of $178.41, for a total transaction of $1,784,100.00. Following the completion of the sale, the director now directly owns 33,083 shares of the company's stock, valued at approximately $5,902,338.03. The trade was a 23.21 % decrease in their position. The transaction was disclosed in a legal filing with the SEC, which is accessible through this link. Insiders own 1.80% of the company's stock.

Builders FirstSource Stock Performance

Shares of Builders FirstSource stock traded down $4.92 during trading hours on Friday, reaching $176.28. The company had a trading volume of 1,073,012 shares, compared to its average volume of 1,568,045. The firm has a market cap of $20.29 billion, a PE ratio of 17.21, a price-to-earnings-growth ratio of 1.00 and a beta of 2.08. Builders FirstSource, Inc. has a one year low of $129.80 and a one year high of $214.70. The company has a debt-to-equity ratio of 0.83, a current ratio of 1.77 and a quick ratio of 1.16. The business has a fifty day simple moving average of $185.83 and a 200 day simple moving average of $168.28.

Builders FirstSource (NYSE:BLDR - Get Free Report) last announced its quarterly earnings results on Tuesday, November 5th. The company reported $3.07 earnings per share for the quarter, missing the consensus estimate of $3.09 by ($0.02). Builders FirstSource had a net margin of 7.40% and a return on equity of 33.55%. The company had revenue of $4.23 billion for the quarter, compared to the consensus estimate of $4.44 billion. During the same quarter in the prior year, the company earned $4.24 earnings per share. The company's quarterly revenue was down 6.7% on a year-over-year basis. On average, analysts anticipate that Builders FirstSource, Inc. will post 11.56 earnings per share for the current fiscal year.

Builders FirstSource announced that its Board of Directors has initiated a stock buyback program on Tuesday, August 6th that permits the company to buyback $1.00 billion in shares. This buyback authorization permits the company to reacquire up to 5.3% of its shares through open market purchases. Shares buyback programs are usually an indication that the company's leadership believes its stock is undervalued.

Wall Street Analyst Weigh In

Several research analysts recently issued reports on the company. Baird R W raised Builders FirstSource from a "hold" rating to a "strong-buy" rating in a research report on Wednesday, August 7th. Jefferies Financial Group increased their target price on shares of Builders FirstSource from $185.00 to $223.00 and gave the company a "buy" rating in a report on Wednesday, October 9th. Barclays boosted their price target on shares of Builders FirstSource from $182.00 to $211.00 and gave the stock an "overweight" rating in a report on Wednesday, October 9th. Wedbush restated an "outperform" rating and issued a $230.00 target price on shares of Builders FirstSource in a research note on Wednesday, November 6th. Finally, B. Riley decreased their price target on Builders FirstSource from $197.00 to $187.00 and set a "buy" rating for the company in a research report on Wednesday, August 7th. Five research analysts have rated the stock with a hold rating, fourteen have assigned a buy rating and one has issued a strong buy rating to the company. According to data from MarketBeat, Builders FirstSource has a consensus rating of "Moderate Buy" and a consensus target price of $206.47.

Check Out Our Latest Analysis on BLDR

Builders FirstSource Profile

(

Free Report)

Builders FirstSource, Inc, together with its subsidiaries, manufactures and supplies building materials, manufactured components, and construction services to professional homebuilders, sub-contractors, remodelers, and consumers in the United States. It offers lumber and lumber sheet goods comprising dimensional lumber, plywood, and oriented strand board products that are used in on-site house framing; manufactured products, such as wood floor and roof trusses, floor trusses, wall panels, stairs, and engineered wood products; and windows, and interior and exterior door units, as well as interior trims and custom products comprising intricate mouldings, stair parts, and columns under the Synboard brand name.

See Also

Before you consider Builders FirstSource, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Builders FirstSource wasn't on the list.

While Builders FirstSource currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.