Mizuho Securities USA LLC lifted its position in shares of Bunge Global SA (NYSE:BG - Free Report) by 1,585.3% during the 3rd quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The institutional investor owned 184,000 shares of the basic materials company's stock after acquiring an additional 173,082 shares during the quarter. Mizuho Securities USA LLC owned approximately 0.13% of Bunge Global worth $17,782,000 at the end of the most recent reporting period.

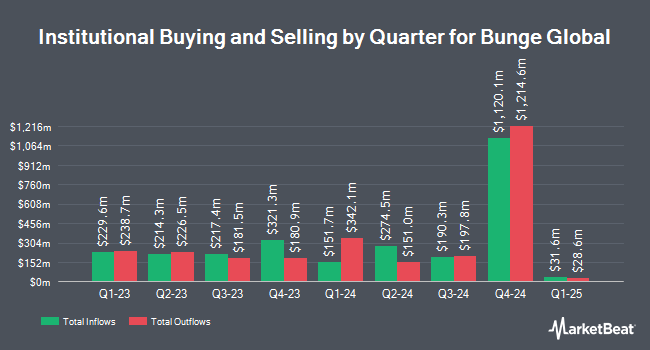

Other hedge funds and other institutional investors have also bought and sold shares of the company. Pacer Advisors Inc. boosted its position in shares of Bunge Global by 26.5% during the 2nd quarter. Pacer Advisors Inc. now owns 4,211,052 shares of the basic materials company's stock valued at $449,614,000 after purchasing an additional 883,127 shares in the last quarter. Millennium Management LLC grew its holdings in Bunge Global by 12,617.1% in the second quarter. Millennium Management LLC now owns 885,617 shares of the basic materials company's stock worth $94,557,000 after purchasing an additional 878,653 shares during the period. LSV Asset Management raised its holdings in shares of Bunge Global by 10.7% during the second quarter. LSV Asset Management now owns 2,113,229 shares of the basic materials company's stock valued at $225,629,000 after purchasing an additional 203,910 shares during the period. AQR Capital Management LLC boosted its position in shares of Bunge Global by 23.4% during the 2nd quarter. AQR Capital Management LLC now owns 970,083 shares of the basic materials company's stock worth $103,576,000 after purchasing an additional 184,245 shares in the last quarter. Finally, Swedbank AB acquired a new stake in shares of Bunge Global in the 1st quarter valued at about $17,027,000. Institutional investors own 86.23% of the company's stock.

Wall Street Analyst Weigh In

Separately, Citigroup cut Bunge Global from a "buy" rating to a "neutral" rating and cut their target price for the stock from $125.00 to $114.00 in a report on Thursday, August 1st. Four analysts have rated the stock with a hold rating and five have issued a buy rating to the company's stock. According to MarketBeat.com, the company currently has a consensus rating of "Moderate Buy" and a consensus target price of $118.00.

Check Out Our Latest Research Report on Bunge Global

Bunge Global Price Performance

BG stock traded up $2.54 during midday trading on Friday, reaching $90.60. The company had a trading volume of 3,252,661 shares, compared to its average volume of 1,570,274. The firm has a 50-day moving average price of $93.00 and a 200-day moving average price of $100.34. Bunge Global SA has a 1 year low of $82.18 and a 1 year high of $114.92. The company has a debt-to-equity ratio of 0.43, a current ratio of 2.07 and a quick ratio of 1.10. The company has a market capitalization of $12.65 billion, a P/E ratio of 11.47 and a beta of 0.67.

Bunge Global Profile

(

Free Report)

Bunge Global SA operates as an agribusiness and food company worldwide. It operates through four segments: Agribusiness, Refined and Specialty Oils, Milling, and Sugar and Bioenergy. The Agribusiness segment purchases, stores, transports, processes, and sells agricultural commodities and commodity products, including oilseeds primarily soybeans, rapeseed, canola, and sunflower seeds, as well as grains comprising wheat and corn; and processes oilseeds into vegetable oils and protein meals.

Further Reading

Before you consider Bunge Global, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Bunge Global wasn't on the list.

While Bunge Global currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.