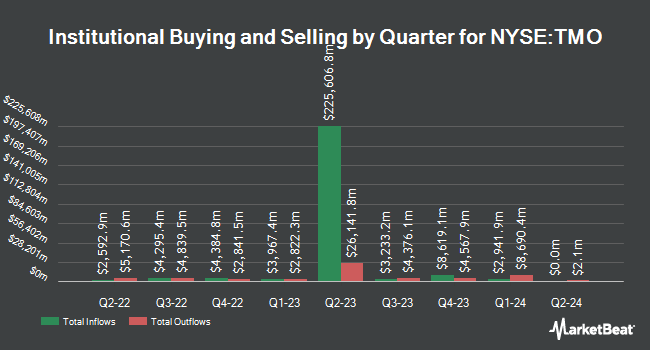

Mizuho Securities USA LLC increased its position in shares of Thermo Fisher Scientific Inc. (NYSE:TMO - Free Report) by 149.0% during the 3rd quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The firm owned 73,284 shares of the medical research company's stock after buying an additional 43,856 shares during the period. Mizuho Securities USA LLC's holdings in Thermo Fisher Scientific were worth $45,331,000 at the end of the most recent quarter.

Other hedge funds also recently added to or reduced their stakes in the company. Signature Resources Capital Management LLC boosted its position in Thermo Fisher Scientific by 318.2% during the second quarter. Signature Resources Capital Management LLC now owns 46 shares of the medical research company's stock valued at $25,000 after purchasing an additional 35 shares in the last quarter. New Millennium Group LLC acquired a new position in Thermo Fisher Scientific during the 2nd quarter valued at about $29,000. Stephens Consulting LLC boosted its holdings in Thermo Fisher Scientific by 116.0% in the second quarter. Stephens Consulting LLC now owns 54 shares of the medical research company's stock worth $30,000 after acquiring an additional 29 shares in the last quarter. Headlands Technologies LLC acquired a new position in shares of Thermo Fisher Scientific during the first quarter valued at about $32,000. Finally, Bank & Trust Co purchased a new stake in Thermo Fisher Scientific during the 2nd quarter worth approximately $33,000. 89.23% of the stock is owned by hedge funds and other institutional investors.

Thermo Fisher Scientific Price Performance

Shares of Thermo Fisher Scientific stock traded down $19.94 during mid-day trading on Friday, reaching $513.08. 3,953,117 shares of the stock traded hands, compared to its average volume of 1,474,214. The company has a quick ratio of 1.26, a current ratio of 1.63 and a debt-to-equity ratio of 0.64. Thermo Fisher Scientific Inc. has a fifty-two week low of $464.17 and a fifty-two week high of $627.88. The stock has a market capitalization of $196.25 billion, a PE ratio of 32.17, a PEG ratio of 3.58 and a beta of 0.79. The business has a 50-day moving average of $586.43 and a 200 day moving average of $582.24.

Thermo Fisher Scientific (NYSE:TMO - Get Free Report) last released its earnings results on Wednesday, October 23rd. The medical research company reported $5.28 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $5.25 by $0.03. The business had revenue of $10.60 billion during the quarter, compared to analyst estimates of $10.63 billion. Thermo Fisher Scientific had a net margin of 14.48% and a return on equity of 17.49%. The company's revenue for the quarter was up .2% compared to the same quarter last year. During the same quarter in the prior year, the firm earned $5.69 earnings per share. On average, analysts predict that Thermo Fisher Scientific Inc. will post 21.69 EPS for the current year.

Thermo Fisher Scientific Dividend Announcement

The business also recently disclosed a quarterly dividend, which will be paid on Wednesday, January 15th. Investors of record on Friday, December 13th will be given a dividend of $0.39 per share. The ex-dividend date of this dividend is Friday, December 13th. This represents a $1.56 dividend on an annualized basis and a yield of 0.30%. Thermo Fisher Scientific's payout ratio is 9.78%.

Thermo Fisher Scientific declared that its board has approved a share repurchase program on Friday, November 15th that permits the company to buyback $4.00 billion in outstanding shares. This buyback authorization permits the medical research company to purchase up to 2% of its stock through open market purchases. Stock buyback programs are usually a sign that the company's leadership believes its shares are undervalued.

Wall Street Analysts Forecast Growth

TMO has been the subject of several research reports. Stephens began coverage on shares of Thermo Fisher Scientific in a research note on Tuesday, October 1st. They set an "overweight" rating and a $680.00 price objective for the company. JPMorgan Chase & Co. boosted their price target on Thermo Fisher Scientific from $650.00 to $670.00 and gave the company an "overweight" rating in a research note on Friday, September 20th. TD Cowen raised their price objective on Thermo Fisher Scientific from $656.00 to $686.00 in a research note on Tuesday, October 22nd. Bernstein Bank upped their target price on Thermo Fisher Scientific from $565.00 to $625.00 and gave the company a "market perform" rating in a research report on Tuesday, October 22nd. Finally, Bank of America upped their price objective on shares of Thermo Fisher Scientific from $600.00 to $675.00 and gave the company a "buy" rating in a report on Monday, September 16th. Four analysts have rated the stock with a hold rating, seventeen have given a buy rating and one has assigned a strong buy rating to the company's stock. According to data from MarketBeat, the company has a consensus rating of "Moderate Buy" and an average price target of $649.33.

Check Out Our Latest Stock Analysis on TMO

Insiders Place Their Bets

In other news, CEO Marc N. Casper sold 10,000 shares of the company's stock in a transaction on Monday, October 28th. The stock was sold at an average price of $554.29, for a total value of $5,542,900.00. Following the transaction, the chief executive officer now owns 121,192 shares of the company's stock, valued at $67,175,513.68. This represents a 7.62 % decrease in their position. The sale was disclosed in a document filed with the SEC, which is available at this hyperlink. Also, SVP Michael A. Boxer sold 2,000 shares of Thermo Fisher Scientific stock in a transaction dated Friday, October 25th. The shares were sold at an average price of $560.16, for a total transaction of $1,120,320.00. Following the sale, the senior vice president now owns 12,736 shares of the company's stock, valued at approximately $7,134,197.76. This represents a 13.57 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 37,150 shares of company stock valued at $20,651,865 in the last three months. 0.34% of the stock is currently owned by insiders.

Thermo Fisher Scientific Company Profile

(

Free Report)

Thermo Fisher Scientific Inc provides life sciences solutions, analytical instruments, specialty diagnostics, and laboratory products and biopharma services in the North America, Europe, Asia-Pacific, and internationally. The company's Life Sciences Solutions segment offers reagents, instruments, and consumables for biological and medical research, discovery, and production of drugs and vaccines, as well as diagnosis of infections and diseases; and solutions include biosciences, genetic sciences, and bio production to pharmaceutical, biotechnology, agricultural, clinical, healthcare, academic, and government markets.

Further Reading

Before you consider Thermo Fisher Scientific, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Thermo Fisher Scientific wasn't on the list.

While Thermo Fisher Scientific currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.