Mizuho Securities USA LLC lifted its stake in shares of Trimble Inc. (NASDAQ:TRMB - Free Report) by 361.1% in the third quarter, according to the company in its most recent filing with the SEC. The fund owned 86,836 shares of the scientific and technical instruments company's stock after buying an additional 68,005 shares during the quarter. Mizuho Securities USA LLC's holdings in Trimble were worth $5,392,000 as of its most recent SEC filing.

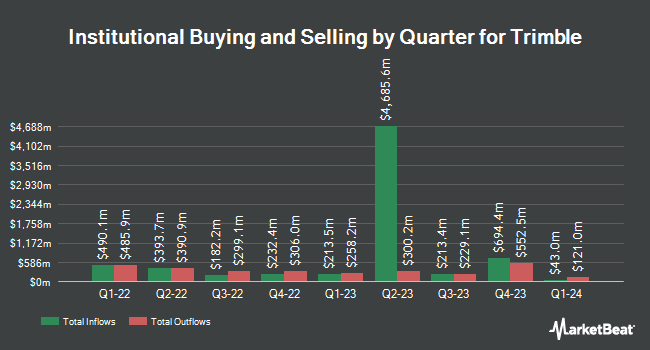

A number of other institutional investors and hedge funds have also bought and sold shares of TRMB. GPS Wealth Strategies Group LLC grew its position in shares of Trimble by 303.2% during the 2nd quarter. GPS Wealth Strategies Group LLC now owns 637 shares of the scientific and technical instruments company's stock worth $36,000 after purchasing an additional 479 shares in the last quarter. Blue Trust Inc. grew its position in Trimble by 96.0% during the second quarter. Blue Trust Inc. now owns 639 shares of the scientific and technical instruments company's stock worth $36,000 after buying an additional 313 shares in the last quarter. Ashton Thomas Private Wealth LLC bought a new position in Trimble during the 2nd quarter worth $48,000. Catalyst Capital Advisors LLC acquired a new position in Trimble in the 3rd quarter valued at $49,000. Finally, Cromwell Holdings LLC lifted its position in shares of Trimble by 86.6% during the 3rd quarter. Cromwell Holdings LLC now owns 808 shares of the scientific and technical instruments company's stock valued at $50,000 after acquiring an additional 375 shares during the period. Institutional investors and hedge funds own 93.21% of the company's stock.

Trimble Price Performance

Trimble stock traded down $0.74 during mid-day trading on Monday, reaching $69.88. The company had a trading volume of 1,419,891 shares, compared to its average volume of 1,344,413. The business has a fifty day simple moving average of $62.12 and a 200 day simple moving average of $57.89. The company has a market cap of $17.07 billion, a P/E ratio of 11.81, a P/E/G ratio of 3.02 and a beta of 1.49. Trimble Inc. has a fifty-two week low of $42.85 and a fifty-two week high of $74.22. The company has a current ratio of 1.16, a quick ratio of 1.07 and a debt-to-equity ratio of 0.24.

Analysts Set New Price Targets

A number of research analysts recently commented on the company. StockNews.com upgraded Trimble from a "hold" rating to a "buy" rating in a research report on Sunday. JPMorgan Chase & Co. boosted their target price on shares of Trimble from $66.00 to $74.00 and gave the company a "neutral" rating in a research report on Thursday, November 7th. Piper Sandler increased their price target on shares of Trimble from $73.00 to $84.00 and gave the stock an "overweight" rating in a research report on Thursday, November 7th. Robert W. Baird lifted their price objective on shares of Trimble from $66.00 to $82.00 and gave the company an "outperform" rating in a research note on Friday, November 8th. Finally, Oppenheimer restated an "outperform" rating and set a $72.00 target price on shares of Trimble in a research note on Wednesday, August 7th. One investment analyst has rated the stock with a hold rating and five have assigned a buy rating to the stock. According to data from MarketBeat.com, Trimble currently has an average rating of "Moderate Buy" and a consensus price target of $75.40.

Read Our Latest Stock Analysis on Trimble

Trimble Company Profile

(

Free Report)

Trimble Inc provides technology solutions that enable professionals and field mobile workers to enhance or transform their work processes worldwide. The company's Buildings and Infrastructure segment offers field and office software for project design and visualization; systems to guide and control construction equipment; software for 3D design and data sharing; systems to monitor, track, and manage assets, equipment, and workers; software to share and communicate data; program management solutions for construction owners; 3D conceptual design and modeling software; building information modeling software; enterprise resource planning, project management, and project collaboration solutions; integrated site layout and measurement systems; cost estimating, scheduling, and project controls solutions; and applications for sub-contractors and trades.

See Also

Before you consider Trimble, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Trimble wasn't on the list.

While Trimble currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.