Mizuho Securities USA LLC grew its holdings in shares of Humana Inc. (NYSE:HUM - Free Report) by 914.2% in the 3rd quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The fund owned 94,183 shares of the insurance provider's stock after purchasing an additional 84,897 shares during the period. Mizuho Securities USA LLC owned approximately 0.08% of Humana worth $29,832,000 at the end of the most recent quarter.

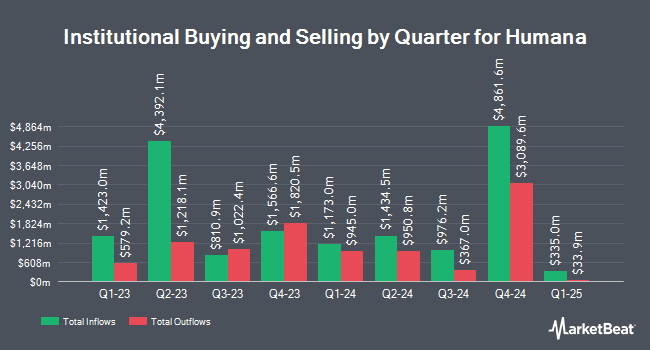

A number of other institutional investors have also recently made changes to their positions in HUM. Pzena Investment Management LLC raised its stake in Humana by 538.7% in the second quarter. Pzena Investment Management LLC now owns 2,318,347 shares of the insurance provider's stock valued at $866,250,000 after buying an additional 1,955,375 shares during the last quarter. Ontario Teachers Pension Plan Board raised its position in shares of Humana by 11,647.2% in the 1st quarter. Ontario Teachers Pension Plan Board now owns 1,059,478 shares of the insurance provider's stock valued at $367,342,000 after purchasing an additional 1,050,459 shares during the last quarter. Marshall Wace LLP raised its position in shares of Humana by 118.9% in the 2nd quarter. Marshall Wace LLP now owns 1,425,302 shares of the insurance provider's stock valued at $532,564,000 after purchasing an additional 774,085 shares during the last quarter. International Assets Investment Management LLC boosted its stake in Humana by 261,025.1% in the 3rd quarter. International Assets Investment Management LLC now owns 738,984 shares of the insurance provider's stock worth $2,340,660,000 after purchasing an additional 738,701 shares in the last quarter. Finally, Steadfast Capital Management LP purchased a new stake in Humana during the 1st quarter worth approximately $158,813,000. Institutional investors and hedge funds own 92.38% of the company's stock.

Humana Stock Down 2.6 %

NYSE HUM traded down $7.47 during trading hours on Friday, reaching $275.67. 1,842,901 shares of the company traded hands, compared to its average volume of 1,875,008. The company has a current ratio of 1.76, a quick ratio of 1.76 and a debt-to-equity ratio of 0.67. Humana Inc. has a 12 month low of $213.31 and a 12 month high of $527.18. The company has a 50 day moving average of $281.36 and a two-hundred day moving average of $331.61. The stock has a market capitalization of $33.19 billion, a PE ratio of 24.42, a PEG ratio of 2.29 and a beta of 0.52.

Humana (NYSE:HUM - Get Free Report) last posted its earnings results on Wednesday, October 30th. The insurance provider reported $4.16 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $3.48 by $0.68. The firm had revenue of $29.30 billion during the quarter, compared to analyst estimates of $28.66 billion. Humana had a net margin of 1.18% and a return on equity of 13.20%. As a group, equities analysts expect that Humana Inc. will post 15.83 earnings per share for the current year.

Humana Announces Dividend

The business also recently declared a quarterly dividend, which will be paid on Friday, January 31st. Investors of record on Tuesday, December 31st will be given a $0.885 dividend. The ex-dividend date of this dividend is Tuesday, December 31st. This represents a $3.54 dividend on an annualized basis and a dividend yield of 1.28%. Humana's dividend payout ratio (DPR) is 31.36%.

Analyst Ratings Changes

A number of brokerages have recently weighed in on HUM. Bank of America raised shares of Humana from an "underperform" rating to a "neutral" rating and boosted their price objective for the company from $247.00 to $308.00 in a report on Wednesday, November 6th. Deutsche Bank Aktiengesellschaft cut their price objective on Humana from $349.00 to $250.00 and set a "hold" rating on the stock in a report on Thursday, October 3rd. Oppenheimer decreased their target price on Humana from $400.00 to $280.00 and set an "outperform" rating for the company in a report on Thursday, October 3rd. Royal Bank of Canada reduced their price target on shares of Humana from $400.00 to $265.00 and set an "outperform" rating for the company in a research report on Tuesday, October 8th. Finally, JPMorgan Chase & Co. upped their price objective on shares of Humana from $332.00 to $396.00 and gave the company a "neutral" rating in a report on Wednesday, August 21st. Twenty analysts have rated the stock with a hold rating and six have assigned a buy rating to the stock. According to data from MarketBeat.com, Humana presently has an average rating of "Hold" and a consensus price target of $315.86.

Get Our Latest Analysis on Humana

Humana Profile

(

Free Report)

Humana Inc, together with its subsidiaries, provides medical and specialty insurance products in the United States. It operates through two segments, Insurance and CenterWell. The company offers medical and supplemental benefit plans to individuals. It has a contract with Centers for Medicare and Medicaid Services to administer the Limited Income Newly Eligible Transition prescription drug plan program; and contracts with various states to provide Medicaid, dual eligible, and long-term support services benefits.

Recommended Stories

Before you consider Humana, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Humana wasn't on the list.

While Humana currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.