Mizuho Securities USA LLC lifted its position in shares of Tyler Technologies, Inc. (NYSE:TYL - Free Report) by 466.4% during the third quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor owned 18,534 shares of the technology company's stock after purchasing an additional 15,262 shares during the period. Mizuho Securities USA LLC's holdings in Tyler Technologies were worth $10,819,000 at the end of the most recent quarter.

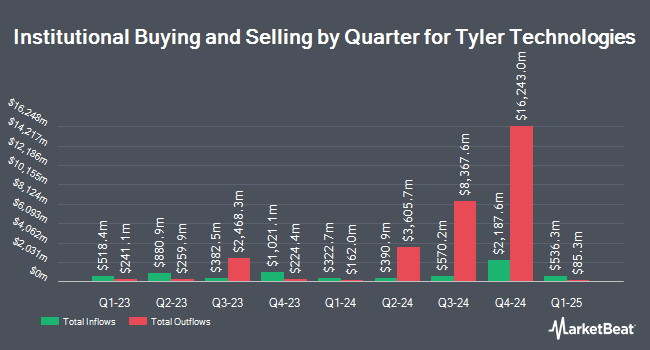

Several other hedge funds and other institutional investors have also added to or reduced their stakes in TYL. Swedbank AB bought a new position in shares of Tyler Technologies during the 2nd quarter worth approximately $251,390,000. International Assets Investment Management LLC lifted its holdings in Tyler Technologies by 252,047.5% during the third quarter. International Assets Investment Management LLC now owns 307,620 shares of the technology company's stock worth $179,564,000 after acquiring an additional 307,498 shares during the period. Janus Henderson Group PLC lifted its holdings in Tyler Technologies by 15.3% during the first quarter. Janus Henderson Group PLC now owns 532,935 shares of the technology company's stock worth $226,501,000 after acquiring an additional 70,801 shares during the period. Quantum Capital Management LLC NJ boosted its position in Tyler Technologies by 179.4% in the first quarter. Quantum Capital Management LLC NJ now owns 107,760 shares of the technology company's stock worth $45,799,000 after purchasing an additional 69,189 shares during the last quarter. Finally, Price T Rowe Associates Inc. MD grew its stake in Tyler Technologies by 18.3% in the 1st quarter. Price T Rowe Associates Inc. MD now owns 424,982 shares of the technology company's stock valued at $180,622,000 after purchasing an additional 65,814 shares during the period. 93.30% of the stock is currently owned by hedge funds and other institutional investors.

Analyst Ratings Changes

TYL has been the topic of a number of research analyst reports. Wells Fargo & Company boosted their price target on shares of Tyler Technologies from $580.00 to $600.00 and gave the stock an "overweight" rating in a report on Friday, July 26th. The Goldman Sachs Group reiterated a "buy" rating and issued a $627.00 target price on shares of Tyler Technologies in a research note on Friday, September 13th. Robert W. Baird upped their price objective on Tyler Technologies from $625.00 to $700.00 and gave the company an "outperform" rating in a research note on Friday, October 25th. Needham & Company LLC increased their price target on Tyler Technologies from $600.00 to $700.00 and gave the stock a "buy" rating in a research note on Tuesday, October 22nd. Finally, DA Davidson boosted their price objective on Tyler Technologies from $525.00 to $550.00 and gave the company a "neutral" rating in a research note on Thursday, October 17th. Two equities research analysts have rated the stock with a hold rating and thirteen have issued a buy rating to the company's stock. According to data from MarketBeat, the company has a consensus rating of "Moderate Buy" and an average target price of $642.62.

Get Our Latest Stock Report on TYL

Tyler Technologies Trading Down 2.8 %

Tyler Technologies stock opened at $597.10 on Friday. The company has a debt-to-equity ratio of 0.18, a quick ratio of 1.21 and a current ratio of 1.21. Tyler Technologies, Inc. has a fifty-two week low of $397.80 and a fifty-two week high of $631.43. The stock has a market cap of $25.56 billion, a P/E ratio of 108.96, a PEG ratio of 5.39 and a beta of 0.77. The firm's fifty day moving average price is $593.78 and its 200-day moving average price is $547.05.

Tyler Technologies (NYSE:TYL - Get Free Report) last announced its earnings results on Wednesday, October 23rd. The technology company reported $2.52 earnings per share for the quarter, topping analysts' consensus estimates of $2.43 by $0.09. Tyler Technologies had a return on equity of 9.79% and a net margin of 11.39%. The business had revenue of $543.34 million for the quarter, compared to analyst estimates of $547.34 million. During the same period in the prior year, the company earned $1.66 EPS. The company's quarterly revenue was up 9.8% compared to the same quarter last year. Equities research analysts forecast that Tyler Technologies, Inc. will post 7.39 earnings per share for the current fiscal year.

Insider Activity at Tyler Technologies

In other news, insider John S. Marr, Jr. sold 5,000 shares of the firm's stock in a transaction on Wednesday, August 21st. The shares were sold at an average price of $578.94, for a total transaction of $2,894,700.00. Following the sale, the insider now owns 6,983 shares in the company, valued at approximately $4,042,738.02. This trade represents a 41.73 % decrease in their position. The transaction was disclosed in a filing with the SEC, which can be accessed through this link. Also, Director Glenn A. Carter sold 3,350 shares of Tyler Technologies stock in a transaction on Thursday, September 5th. The stock was sold at an average price of $582.57, for a total transaction of $1,951,609.50. Following the sale, the director now directly owns 2,654 shares of the company's stock, valued at $1,546,140.78. This represents a 55.80 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold 32,600 shares of company stock valued at $19,307,295 over the last three months. 2.20% of the stock is owned by corporate insiders.

Tyler Technologies Company Profile

(

Free Report)

Tyler Technologies, Inc provides integrated information management solutions and services for the public sector. It operates in two segments, Enterprise Software and Platform Technologies. The company offers platform and transformative technology solutions, including cybersecurity for government agencies; data and insights solutions; digital solutions that helps workers and policymakers to share, communicate, and leverage data; payments solutions, such as billing, presentment, merchant onboarding, collections, reconciliation, and disbursements; platform technologies, an application development platform that enables government workers to build solutions and applications; and outdoor recreation solutions, including campsite reservations, activity registrations, licensing sales and renewals, and real-time data for conservation and park management.

Recommended Stories

Before you consider Tyler Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Tyler Technologies wasn't on the list.

While Tyler Technologies currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.