Mizuho Securities USA LLC boosted its holdings in APA Co. (NASDAQ:APA - Free Report) by 3,450.8% in the 3rd quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund owned 985,907 shares of the company's stock after purchasing an additional 958,141 shares during the quarter. Mizuho Securities USA LLC owned about 0.27% of APA worth $24,115,000 at the end of the most recent quarter.

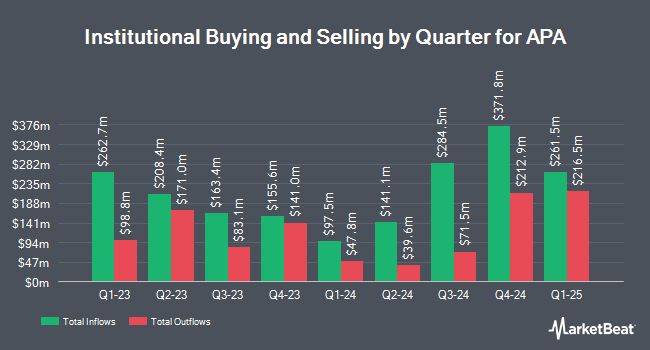

A number of other hedge funds and other institutional investors have also recently made changes to their positions in the stock. Russell Investments Group Ltd. lifted its stake in shares of APA by 67.7% during the first quarter. Russell Investments Group Ltd. now owns 123,843 shares of the company's stock valued at $4,257,000 after buying an additional 50,016 shares during the period. US Bancorp DE boosted its position in APA by 16.3% in the 1st quarter. US Bancorp DE now owns 48,479 shares of the company's stock valued at $1,667,000 after buying an additional 6,807 shares during the last quarter. BNP PARIBAS ASSET MANAGEMENT Holding S.A. increased its holdings in APA by 22.9% during the 1st quarter. BNP PARIBAS ASSET MANAGEMENT Holding S.A. now owns 8,626 shares of the company's stock worth $297,000 after purchasing an additional 1,610 shares during the last quarter. State Board of Administration of Florida Retirement System boosted its stake in APA by 10.5% during the 1st quarter. State Board of Administration of Florida Retirement System now owns 392,790 shares of the company's stock valued at $14,164,000 after acquiring an additional 37,212 shares during the last quarter. Finally, Mitsubishi UFJ Asset Management Co. Ltd. increased its holdings in APA by 23.0% in the first quarter. Mitsubishi UFJ Asset Management Co. Ltd. now owns 365,474 shares of the company's stock valued at $12,565,000 after buying an additional 68,244 shares during the last quarter. Hedge funds and other institutional investors own 83.01% of the company's stock.

Wall Street Analysts Forecast Growth

Several analysts recently issued reports on APA shares. Piper Sandler cut their price target on APA from $29.00 to $28.00 and set a "neutral" rating on the stock in a report on Tuesday, October 15th. Wells Fargo & Company decreased their price objective on shares of APA from $49.00 to $47.00 and set an "overweight" rating for the company in a research note on Tuesday, October 1st. JPMorgan Chase & Co. cut their price objective on APA from $29.00 to $25.00 and set a "neutral" rating for the company in a report on Wednesday. The Goldman Sachs Group cut their price objective on APA from $26.00 to $25.00 in a research note on Friday, October 18th. Finally, Citigroup dropped their target price on shares of APA from $32.00 to $29.00 in a research report on Friday, October 18th. Four investment analysts have rated the stock with a sell rating, eleven have given a hold rating, five have issued a buy rating and one has given a strong buy rating to the stock. According to MarketBeat, APA has an average rating of "Hold" and an average target price of $32.95.

View Our Latest Stock Report on APA

APA Stock Down 1.0 %

Shares of NASDAQ APA traded down $0.22 during trading on Friday, reaching $22.38. The company had a trading volume of 7,335,787 shares, compared to its average volume of 6,269,920. APA Co. has a 12-month low of $21.15 and a 12-month high of $37.82. The stock has a market cap of $8.28 billion, a PE ratio of 3.16 and a beta of 3.24. The business's 50-day moving average is $24.51 and its 200 day moving average is $27.69. The company has a quick ratio of 1.24, a current ratio of 1.24 and a debt-to-equity ratio of 1.03.

APA Announces Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Friday, November 22nd. Stockholders of record on Tuesday, October 22nd will be given a dividend of $0.25 per share. This represents a $1.00 annualized dividend and a dividend yield of 4.47%. The ex-dividend date is Tuesday, October 22nd. APA's payout ratio is currently 14.12%.

About APA

(

Free Report)

APA Corporation, an independent energy company, explores for, develops, and produces natural gas, crude oil, and natural gas liquids. It has oil and gas operations in the United States, Egypt, and North Sea. The company also has exploration and appraisal activities in Suriname, as well as holds interests in projects located in Uruguay and internationally.

Read More

Before you consider APA, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and APA wasn't on the list.

While APA currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.