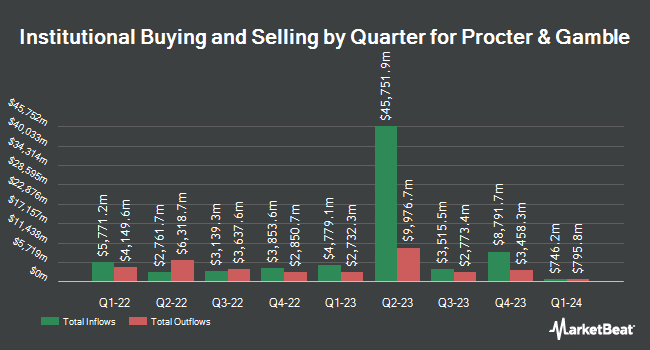

Mizuho Securities USA LLC trimmed its position in The Procter & Gamble Company (NYSE:PG - Free Report) by 16.1% during the 3rd quarter, according to its most recent disclosure with the Securities and Exchange Commission. The fund owned 152,648 shares of the company's stock after selling 29,328 shares during the quarter. Procter & Gamble comprises about 0.5% of Mizuho Securities USA LLC's investment portfolio, making the stock its 20th biggest position. Mizuho Securities USA LLC's holdings in Procter & Gamble were worth $26,439,000 at the end of the most recent reporting period.

Several other large investors have also recently made changes to their positions in the company. Pacer Advisors Inc. increased its holdings in shares of Procter & Gamble by 8.4% in the third quarter. Pacer Advisors Inc. now owns 241,210 shares of the company's stock worth $41,778,000 after purchasing an additional 18,618 shares during the last quarter. Massachusetts Financial Services Co. MA grew its position in Procter & Gamble by 253.3% in the third quarter. Massachusetts Financial Services Co. MA now owns 1,098,946 shares of the company's stock worth $190,337,000 after acquiring an additional 787,926 shares in the last quarter. Thompson Siegel & Walmsley LLC grew its position in Procter & Gamble by 0.9% in the third quarter. Thompson Siegel & Walmsley LLC now owns 70,818 shares of the company's stock worth $12,266,000 after acquiring an additional 606 shares in the last quarter. LPL Financial LLC grew its position in Procter & Gamble by 3.2% in the third quarter. LPL Financial LLC now owns 3,127,615 shares of the company's stock worth $541,703,000 after acquiring an additional 96,314 shares in the last quarter. Finally, Tradewinds LLC. grew its position in Procter & Gamble by 4.0% in the third quarter. Tradewinds LLC. now owns 54,570 shares of the company's stock worth $9,451,000 after acquiring an additional 2,108 shares in the last quarter. 65.77% of the stock is owned by institutional investors.

Procter & Gamble Stock Up 1.0 %

Shares of PG stock traded up $1.79 during trading hours on Thursday, reaching $172.68. 4,184,109 shares of the company's stock were exchanged, compared to its average volume of 6,672,316. The stock's 50 day moving average is $170.01 and its 200-day moving average is $168.51. The company has a market cap of $406.67 billion, a price-to-earnings ratio of 29.73, a P/E/G ratio of 3.69 and a beta of 0.42. The company has a current ratio of 0.75, a quick ratio of 0.55 and a debt-to-equity ratio of 0.50. The Procter & Gamble Company has a fifty-two week low of $142.50 and a fifty-two week high of $177.94.

Procter & Gamble (NYSE:PG - Get Free Report) last issued its quarterly earnings results on Friday, October 18th. The company reported $1.93 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $1.90 by $0.03. The business had revenue of $21.74 billion for the quarter, compared to the consensus estimate of $21.99 billion. Procter & Gamble had a return on equity of 33.25% and a net margin of 17.07%. The business's quarterly revenue was down .6% on a year-over-year basis. During the same period in the prior year, the firm posted $1.83 earnings per share. Analysts predict that The Procter & Gamble Company will post 6.94 earnings per share for the current fiscal year.

Procter & Gamble Dividend Announcement

The business also recently disclosed a quarterly dividend, which was paid on Friday, November 15th. Stockholders of record on Friday, October 18th were issued a dividend of $1.0065 per share. This represents a $4.03 dividend on an annualized basis and a dividend yield of 2.33%. The ex-dividend date was Friday, October 18th. Procter & Gamble's dividend payout ratio (DPR) is presently 69.48%.

Wall Street Analysts Forecast Growth

PG has been the subject of several recent research reports. DA Davidson reiterated a "neutral" rating and issued a $160.00 price target on shares of Procter & Gamble in a research report on Wednesday. Jefferies Financial Group lowered Procter & Gamble from a "buy" rating to a "hold" rating and dropped their price target for the stock from $182.00 to $175.00 in a research report on Wednesday, July 24th. Dbs Bank lowered Procter & Gamble from a "strong-buy" rating to a "hold" rating in a research report on Thursday, August 1st. Hsbc Global Res upgraded Procter & Gamble to a "strong-buy" rating in a research report on Friday, October 4th. Finally, Barclays lowered Procter & Gamble from an "overweight" rating to an "equal weight" rating and set a $163.00 target price for the company. in a research report on Monday, September 30th. Nine equities research analysts have rated the stock with a hold rating, thirteen have assigned a buy rating and two have assigned a strong buy rating to the company's stock. According to data from MarketBeat.com, the company currently has a consensus rating of "Moderate Buy" and an average price target of $177.00.

Check Out Our Latest Analysis on PG

Insider Activity

In other Procter & Gamble news, CEO Jon R. Moeller sold 87,979 shares of the company's stock in a transaction on Monday, August 26th. The shares were sold at an average price of $170.40, for a total value of $14,991,621.60. Following the sale, the chief executive officer now directly owns 300,777 shares of the company's stock, valued at approximately $51,252,400.80. This represents a 22.63 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this link. Also, insider Susan Street Whaley sold 634 shares of Procter & Gamble stock in a transaction dated Wednesday, October 2nd. The shares were sold at an average price of $171.65, for a total value of $108,826.10. Following the transaction, the insider now owns 19,341 shares of the company's stock, valued at $3,319,882.65. The trade was a 3.17 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold 174,727 shares of company stock valued at $29,694,037 over the last ninety days. 0.18% of the stock is currently owned by insiders.

Procter & Gamble Company Profile

(

Free Report)

The Procter & Gamble Company engages in the provision of branded consumer packaged goods worldwide. The company operates through five segments: Beauty; Grooming; Health Care; Fabric & Home Care; and Baby, Feminine & Family Care. The Beauty segment offers conditioners, shampoos, styling aids, and treatments under the Head & Shoulders, Herbal Essences, Pantene, and Rejoice brands; and antiperspirants and deodorants, personal cleansing, and skin care products under the Olay, Old Spice, Safeguard, Secret, SK-II, and Native brands.

Featured Stories

Before you consider Procter & Gamble, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Procter & Gamble wasn't on the list.

While Procter & Gamble currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report