MML Investors Services LLC increased its holdings in Banco Bilbao Vizcaya Argentaria, S.A. (NYSE:BBVA - Free Report) by 52.4% during the 3rd quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The firm owned 233,503 shares of the bank's stock after buying an additional 80,267 shares during the quarter. MML Investors Services LLC's holdings in Banco Bilbao Vizcaya Argentaria were worth $2,531,000 at the end of the most recent reporting period.

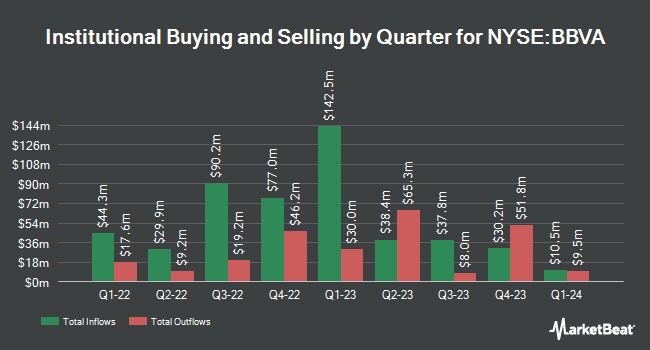

Several other institutional investors and hedge funds have also bought and sold shares of the business. Cetera Advisors LLC acquired a new position in shares of Banco Bilbao Vizcaya Argentaria in the 1st quarter valued at about $191,000. Wealth Enhancement Advisory Services LLC lifted its holdings in Banco Bilbao Vizcaya Argentaria by 5.0% in the second quarter. Wealth Enhancement Advisory Services LLC now owns 29,099 shares of the bank's stock valued at $292,000 after acquiring an additional 1,397 shares during the period. Envestnet Portfolio Solutions Inc. boosted its position in Banco Bilbao Vizcaya Argentaria by 7.0% in the 2nd quarter. Envestnet Portfolio Solutions Inc. now owns 65,695 shares of the bank's stock worth $659,000 after purchasing an additional 4,275 shares in the last quarter. Blue Trust Inc. grew its stake in shares of Banco Bilbao Vizcaya Argentaria by 390.4% during the 2nd quarter. Blue Trust Inc. now owns 22,994 shares of the bank's stock worth $231,000 after purchasing an additional 18,305 shares during the period. Finally, Raymond James & Associates increased its holdings in shares of Banco Bilbao Vizcaya Argentaria by 266.0% during the 2nd quarter. Raymond James & Associates now owns 406,418 shares of the bank's stock valued at $4,076,000 after purchasing an additional 295,378 shares in the last quarter. 2.96% of the stock is currently owned by institutional investors and hedge funds.

Banco Bilbao Vizcaya Argentaria Price Performance

NYSE BBVA remained flat at $10.19 during trading hours on Monday. The company had a trading volume of 3,384,107 shares, compared to its average volume of 1,503,024. The stock has a market capitalization of $59.46 billion, a price-to-earnings ratio of 5.85, a price-to-earnings-growth ratio of 0.98 and a beta of 1.28. The firm has a fifty day moving average price of $9.86 and a 200-day moving average price of $10.18. Banco Bilbao Vizcaya Argentaria, S.A. has a 12 month low of $8.63 and a 12 month high of $12.20.

Banco Bilbao Vizcaya Argentaria Increases Dividend

The firm also recently announced a Semi-Annual dividend, which was paid on Friday, October 25th. Stockholders of record on Wednesday, October 9th were given a dividend of $0.3244 per share. This is a positive change from Banco Bilbao Vizcaya Argentaria's previous Semi-Annual dividend of $0.11. The ex-dividend date was Wednesday, October 9th. This represents a dividend yield of 5.6%. Banco Bilbao Vizcaya Argentaria's dividend payout ratio (DPR) is 29.31%.

Analysts Set New Price Targets

Separately, StockNews.com upgraded shares of Banco Bilbao Vizcaya Argentaria from a "hold" rating to a "buy" rating in a research report on Tuesday, November 12th. One investment analyst has rated the stock with a sell rating, one has issued a hold rating, one has given a buy rating and one has assigned a strong buy rating to the company. Based on data from MarketBeat.com, Banco Bilbao Vizcaya Argentaria presently has an average rating of "Moderate Buy".

Check Out Our Latest Analysis on Banco Bilbao Vizcaya Argentaria

Banco Bilbao Vizcaya Argentaria Profile

(

Free Report)

Banco Bilbao Vizcaya Argentaria, SA provides retail banking, wholesale banking, and asset management services in the United States, Spain, Mexico, Turkey, South America, and internationally. The company offers savings account, demand deposits, and time deposits; and loan products, such as residential mortgages, other households, credit card loans, loans to enterprises and public sector, as well as consumer finance.

Featured Articles

Before you consider Banco Bilbao Vizcaya Argentaria, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Banco Bilbao Vizcaya Argentaria wasn't on the list.

While Banco Bilbao Vizcaya Argentaria currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.