MML Investors Services LLC lifted its holdings in Tetra Tech, Inc. (NASDAQ:TTEK - Free Report) by 405.1% in the 3rd quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The firm owned 39,412 shares of the industrial products company's stock after buying an additional 31,609 shares during the period. MML Investors Services LLC's holdings in Tetra Tech were worth $1,859,000 as of its most recent SEC filing.

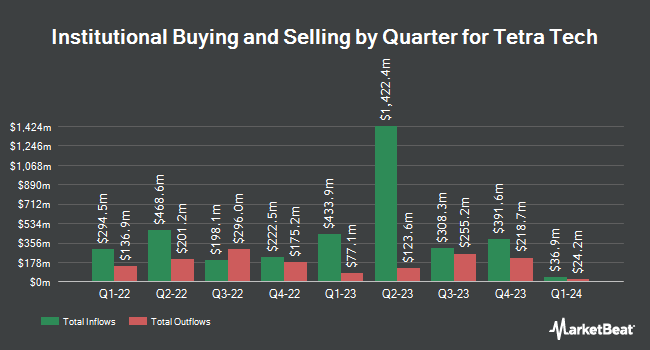

Several other large investors have also recently bought and sold shares of the business. Harbor Capital Advisors Inc. boosted its position in Tetra Tech by 630.8% during the third quarter. Harbor Capital Advisors Inc. now owns 36,430 shares of the industrial products company's stock valued at $1,718,000 after purchasing an additional 31,445 shares during the last quarter. Arkadios Wealth Advisors lifted its holdings in shares of Tetra Tech by 615.8% during the 3rd quarter. Arkadios Wealth Advisors now owns 22,310 shares of the industrial products company's stock valued at $1,052,000 after buying an additional 19,193 shares during the last quarter. SFE Investment Counsel grew its stake in shares of Tetra Tech by 374.8% in the 3rd quarter. SFE Investment Counsel now owns 36,330 shares of the industrial products company's stock valued at $1,713,000 after buying an additional 28,679 shares in the last quarter. Caldwell Investment Management Ltd. increased its holdings in Tetra Tech by 400.0% in the third quarter. Caldwell Investment Management Ltd. now owns 46,500 shares of the industrial products company's stock worth $2,157,000 after buying an additional 37,200 shares during the last quarter. Finally, Banque Cantonale Vaudoise raised its position in Tetra Tech by 400.0% during the third quarter. Banque Cantonale Vaudoise now owns 695 shares of the industrial products company's stock valued at $33,000 after acquiring an additional 556 shares in the last quarter. 93.89% of the stock is owned by institutional investors and hedge funds.

Analyst Ratings Changes

TTEK has been the topic of a number of recent research reports. KeyCorp cut their price target on shares of Tetra Tech from $56.00 to $49.00 and set an "overweight" rating on the stock in a report on Friday, November 15th. Royal Bank of Canada restated an "outperform" rating and set a $52.00 target price on shares of Tetra Tech in a report on Friday, November 15th. StockNews.com downgraded Tetra Tech from a "buy" rating to a "hold" rating in a research note on Friday, November 15th. Finally, Robert W. Baird raised their price objective on Tetra Tech from $46.00 to $47.00 and gave the company a "neutral" rating in a research note on Thursday, November 14th. Two analysts have rated the stock with a hold rating and four have issued a buy rating to the company's stock. Based on data from MarketBeat, the stock has an average rating of "Moderate Buy" and a consensus price target of $49.32.

View Our Latest Report on TTEK

Tetra Tech Trading Down 0.1 %

Shares of TTEK traded down $0.05 on Tuesday, reaching $41.49. 2,486,245 shares of the company's stock were exchanged, compared to its average volume of 1,528,494. Tetra Tech, Inc. has a 12 month low of $31.61 and a 12 month high of $51.20. The stock has a market capitalization of $11.11 billion, a P/E ratio of 33.83 and a beta of 0.88. The company has a current ratio of 1.25, a quick ratio of 1.25 and a debt-to-equity ratio of 0.44. The business has a 50 day moving average price of $45.48 and a two-hundred day moving average price of $44.49.

Tetra Tech Dividend Announcement

The business also recently declared a quarterly dividend, which was paid on Friday, December 13th. Shareholders of record on Wednesday, November 27th were paid a $0.058 dividend. The ex-dividend date was Wednesday, November 27th. This represents a $0.23 dividend on an annualized basis and a yield of 0.56%. Tetra Tech's dividend payout ratio is 18.70%.

About Tetra Tech

(

Free Report)

Tetra Tech, Inc provides consulting and engineering services in the United States and internationally. The company operates through two segments, Government Services Group (GSG) and Commercial/International Services Group (CIG). The GSG segment offers early data collection and monitoring, data analysis and information management, science and engineering applied research, engineering design, project management, and operations and maintenance services; and climate change and energy management consulting, as well as greenhouse gas inventory assessment, certification, reduction, and management services.

Featured Articles

Before you consider Tetra Tech, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Tetra Tech wasn't on the list.

While Tetra Tech currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.