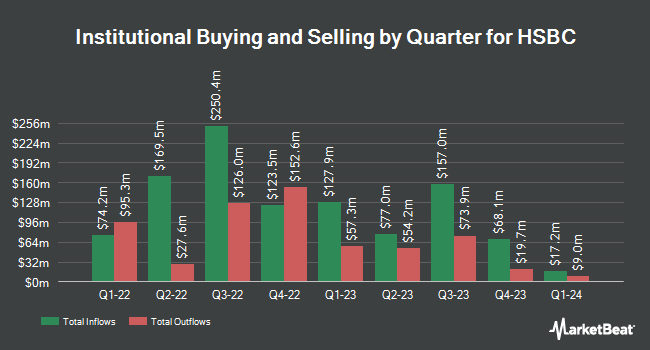

MML Investors Services LLC lowered its position in HSBC Holdings plc (NYSE:HSBC - Free Report) by 26.3% during the third quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The fund owned 47,677 shares of the financial services provider's stock after selling 17,034 shares during the period. MML Investors Services LLC's holdings in HSBC were worth $2,155,000 as of its most recent SEC filing.

Other large investors have also recently modified their holdings of the company. XTX Topco Ltd purchased a new stake in HSBC in the third quarter valued at about $1,956,000. Stifel Financial Corp increased its holdings in shares of HSBC by 40.0% during the third quarter. Stifel Financial Corp now owns 138,127 shares of the financial services provider's stock valued at $6,242,000 after acquiring an additional 39,465 shares in the last quarter. Integrated Wealth Concepts LLC increased its position in shares of HSBC by 1.9% in the 3rd quarter. Integrated Wealth Concepts LLC now owns 14,185 shares of the financial services provider's stock valued at $641,000 after acquiring an additional 265 shares during the period. HighTower Advisors LLC raised its stake in HSBC by 18.0% in the 3rd quarter. HighTower Advisors LLC now owns 157,846 shares of the financial services provider's stock worth $7,135,000 after acquiring an additional 24,080 shares during the last quarter. Finally, CreativeOne Wealth LLC purchased a new stake in HSBC during the 3rd quarter valued at about $217,000. Institutional investors own 1.48% of the company's stock.

HSBC Stock Performance

Shares of HSBC traded down $0.01 during trading hours on Tuesday, hitting $48.62. The stock had a trading volume of 973,828 shares, compared to its average volume of 1,629,732. The firm has a market capitalization of $175.17 billion, a price-to-earnings ratio of 8.04 and a beta of 0.56. The company has a debt-to-equity ratio of 0.52, a quick ratio of 0.96 and a current ratio of 0.96. The firm has a 50-day moving average price of $46.11 and a 200 day moving average price of $44.49. HSBC Holdings plc has a fifty-two week low of $36.93 and a fifty-two week high of $48.81.

HSBC Dividend Announcement

The business also recently announced a quarterly dividend, which will be paid on Thursday, December 19th. Stockholders of record on Friday, November 8th will be paid a dividend of $0.50 per share. The ex-dividend date is Friday, November 8th. This represents a $2.00 dividend on an annualized basis and a dividend yield of 4.11%. HSBC's dividend payout ratio is currently 32.73%.

HSBC Profile

(

Free Report)

HSBC Holdings plc provides banking and financial services worldwide. The company operates through Wealth and Personal Banking, Commercial Banking, and Global Banking and Markets segments. The Wealth and Personal Banking segment offers retail banking and wealth products, including current and savings accounts, mortgages and personal loans, credit and debit cards, and local and international payment services; and wealth management services comprising insurance and investment products, global asset management services, investment management, and private wealth solutions.

Recommended Stories

Before you consider HSBC, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and HSBC wasn't on the list.

While HSBC currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.