MML Investors Services LLC trimmed its position in shares of Cloudflare, Inc. (NYSE:NET - Free Report) by 14.3% in the third quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The firm owned 28,472 shares of the company's stock after selling 4,766 shares during the period. MML Investors Services LLC's holdings in Cloudflare were worth $2,303,000 at the end of the most recent quarter.

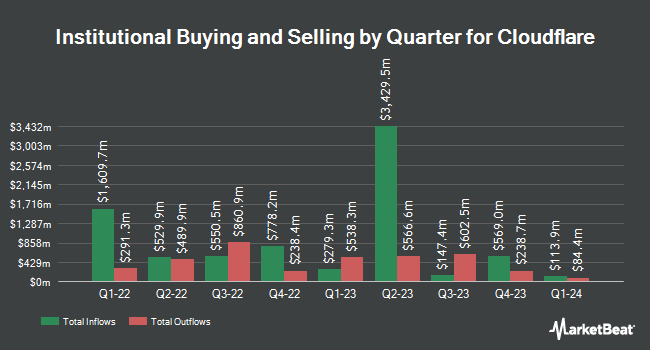

Several other institutional investors and hedge funds have also recently bought and sold shares of the company. Blue Trust Inc. grew its holdings in Cloudflare by 37,600.0% in the 2nd quarter. Blue Trust Inc. now owns 754 shares of the company's stock worth $62,000 after buying an additional 752 shares in the last quarter. Hennion & Walsh Asset Management Inc. bought a new position in shares of Cloudflare in the second quarter worth $320,000. Private Advisory Group LLC grew its stake in shares of Cloudflare by 18.7% in the second quarter. Private Advisory Group LLC now owns 32,680 shares of the company's stock worth $2,707,000 after purchasing an additional 5,137 shares in the last quarter. Advisory Resource Group increased its holdings in shares of Cloudflare by 57.6% during the second quarter. Advisory Resource Group now owns 12,416 shares of the company's stock valued at $1,028,000 after purchasing an additional 4,536 shares during the period. Finally, Baillie Gifford & Co. raised its stake in shares of Cloudflare by 8.5% during the second quarter. Baillie Gifford & Co. now owns 32,722,670 shares of the company's stock valued at $2,710,419,000 after purchasing an additional 2,575,396 shares in the last quarter. Institutional investors own 82.68% of the company's stock.

Cloudflare Stock Up 0.9 %

Shares of NET stock traded up $1.05 on Monday, reaching $114.65. 2,158,954 shares of the company's stock traded hands, compared to its average volume of 3,153,112. The business's 50 day moving average price is $96.78 and its two-hundred day moving average price is $85.43. The company has a market capitalization of $39.35 billion, a P/E ratio of -440.96 and a beta of 1.10. The company has a debt-to-equity ratio of 1.32, a quick ratio of 3.37 and a current ratio of 3.37. Cloudflare, Inc. has a 12-month low of $66.24 and a 12-month high of $116.00.

Cloudflare (NYSE:NET - Get Free Report) last released its earnings results on Thursday, November 7th. The company reported ($0.03) earnings per share for the quarter, meeting the consensus estimate of ($0.03). The company had revenue of $430.08 million for the quarter, compared to analysts' expectations of $423.65 million. Cloudflare had a negative return on equity of 7.18% and a negative net margin of 5.97%. On average, equities analysts forecast that Cloudflare, Inc. will post -0.1 earnings per share for the current year.

Wall Street Analyst Weigh In

A number of equities analysts recently issued reports on the stock. Scotiabank increased their target price on shares of Cloudflare from $85.00 to $87.00 and gave the company a "sector perform" rating in a research report on Friday, November 8th. UBS Group increased their price objective on shares of Cloudflare from $88.00 to $95.00 and gave the company a "neutral" rating in a report on Friday, November 8th. Mizuho boosted their target price on Cloudflare from $102.00 to $125.00 and gave the stock a "neutral" rating in a report on Friday. Piper Sandler increased their price target on Cloudflare from $83.00 to $92.00 and gave the company a "neutral" rating in a research note on Friday, November 8th. Finally, BNP Paribas began coverage on Cloudflare in a research report on Tuesday, October 8th. They set an "underperform" rating and a $65.00 price target on the stock. Four investment analysts have rated the stock with a sell rating, eleven have issued a hold rating and eleven have issued a buy rating to the company. According to MarketBeat, the stock has an average rating of "Hold" and a consensus price target of $95.20.

Get Our Latest Report on NET

Insiders Place Their Bets

In other Cloudflare news, COO Michelle Zatlyn sold 25,640 shares of the company's stock in a transaction dated Thursday, December 12th. The stock was sold at an average price of $113.16, for a total value of $2,901,422.40. Following the transaction, the chief operating officer now directly owns 172,959 shares of the company's stock, valued at $19,572,040.44. This represents a 12.91 % decrease in their position. The sale was disclosed in a document filed with the SEC, which is available at this hyperlink. Also, CFO Thomas J. Seifert sold 15,000 shares of Cloudflare stock in a transaction dated Wednesday, December 4th. The shares were sold at an average price of $109.90, for a total value of $1,648,500.00. Following the sale, the chief financial officer now owns 252,869 shares of the company's stock, valued at approximately $27,790,303.10. This represents a 5.60 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold a total of 524,824 shares of company stock worth $49,037,888 in the last quarter. 12.83% of the stock is currently owned by corporate insiders.

About Cloudflare

(

Free Report)

Cloudflare, Inc operates as a cloud services provider that delivers a range of services to businesses worldwide. The company provides an integrated cloud-based security solution to secure a range of combination of platforms, including public cloud, private cloud, on-premise, software-as-a-service applications, and IoT devices; and website and application security products comprising web application firewall, bot management, distributed denial of service, API gateways, SSL/TLS encryption, script management, security center, and rate limiting products.

See Also

Before you consider Cloudflare, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cloudflare wasn't on the list.

While Cloudflare currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.