MML Investors Services LLC raised its stake in Zscaler, Inc. (NASDAQ:ZS - Free Report) by 13.3% in the 3rd quarter, according to its most recent disclosure with the SEC. The fund owned 29,021 shares of the company's stock after purchasing an additional 3,418 shares during the quarter. MML Investors Services LLC's holdings in Zscaler were worth $4,961,000 at the end of the most recent quarter.

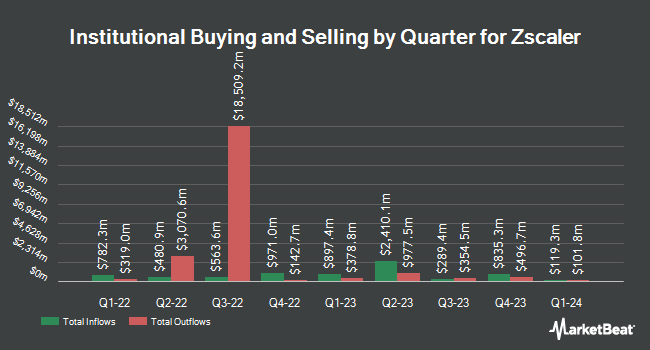

Other institutional investors have also recently made changes to their positions in the company. Champlain Investment Partners LLC raised its stake in Zscaler by 28.2% in the third quarter. Champlain Investment Partners LLC now owns 1,289,350 shares of the company's stock worth $220,401,000 after buying an additional 283,540 shares in the last quarter. Bank of New York Mellon Corp lifted its holdings in shares of Zscaler by 5.3% during the second quarter. Bank of New York Mellon Corp now owns 496,047 shares of the company's stock valued at $95,335,000 after purchasing an additional 25,181 shares in the last quarter. Westfield Capital Management Co. LP grew its stake in shares of Zscaler by 33.8% in the third quarter. Westfield Capital Management Co. LP now owns 399,516 shares of the company's stock worth $68,293,000 after acquiring an additional 100,814 shares during the period. Federated Hermes Inc. grew its position in Zscaler by 18.3% in the 2nd quarter. Federated Hermes Inc. now owns 394,698 shares of the company's stock worth $75,857,000 after purchasing an additional 61,037 shares during the period. Finally, Charles Schwab Investment Management Inc. grew its holdings in shares of Zscaler by 4.9% in the third quarter. Charles Schwab Investment Management Inc. now owns 355,070 shares of the company's stock worth $60,696,000 after acquiring an additional 16,634 shares during the period. Hedge funds and other institutional investors own 46.45% of the company's stock.

Zscaler Stock Down 3.8 %

Shares of ZS stock traded down $7.82 during mid-day trading on Friday, reaching $198.54. 1,885,946 shares of the company were exchanged, compared to its average volume of 2,050,768. Zscaler, Inc. has a fifty-two week low of $153.45 and a fifty-two week high of $259.61. The business's 50 day simple moving average is $196.36 and its 200 day simple moving average is $186.54.

Zscaler (NASDAQ:ZS - Get Free Report) last released its earnings results on Monday, December 2nd. The company reported $0.77 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.63 by $0.14. Zscaler had a negative return on equity of 0.75% and a negative net margin of 1.58%. The company had revenue of $628.00 million during the quarter, compared to analyst estimates of $605.51 million. During the same quarter in the prior year, the company earned ($0.18) earnings per share. The company's revenue for the quarter was up 26.4% on a year-over-year basis. On average, equities research analysts predict that Zscaler, Inc. will post -0.24 earnings per share for the current fiscal year.

Analyst Ratings Changes

A number of brokerages have recently issued reports on ZS. Scotiabank increased their price objective on shares of Zscaler from $195.00 to $205.00 and gave the stock a "sector outperform" rating in a research note on Tuesday, December 3rd. Rosenblatt Securities reiterated a "neutral" rating and set a $190.00 target price on shares of Zscaler in a research report on Wednesday, September 4th. Cantor Fitzgerald upgraded shares of Zscaler to a "hold" rating in a report on Monday, November 18th. UBS Group dropped their price objective on Zscaler from $270.00 to $250.00 and set a "buy" rating for the company in a report on Wednesday, September 4th. Finally, Oppenheimer increased their target price on Zscaler from $230.00 to $250.00 and gave the stock an "outperform" rating in a research note on Tuesday, December 3rd. Eleven equities research analysts have rated the stock with a hold rating and twenty-three have given a buy rating to the company's stock. According to data from MarketBeat.com, the stock presently has a consensus rating of "Moderate Buy" and a consensus target price of $224.84.

Check Out Our Latest Report on ZS

Insider Activity at Zscaler

In other news, CEO Jagtar Singh Chaudhry sold 2,852 shares of Zscaler stock in a transaction on Tuesday, September 17th. The shares were sold at an average price of $171.28, for a total transaction of $488,490.56. Following the transaction, the chief executive officer now directly owns 361,432 shares of the company's stock, valued at $61,906,072.96. This trade represents a 0.78 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is available through this hyperlink. Also, insider Robert Schlossman sold 1,435 shares of the firm's stock in a transaction that occurred on Wednesday, October 9th. The stock was sold at an average price of $181.70, for a total transaction of $260,739.50. Following the sale, the insider now owns 105,806 shares in the company, valued at $19,224,950.20. This trade represents a 1.34 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last 90 days, insiders sold 30,502 shares of company stock worth $5,256,651. Company insiders own 18.10% of the company's stock.

About Zscaler

(

Free Report)

Zscaler, Inc operates as a cloud security company worldwide. The company offers Zscaler Internet Access solution that provides users, workloads, IoT, and OT devices secure access to externally managed applications, including software-as-a-service (SaaS) applications and internet destinations; and Zscaler Private Access solution, which is designed to provide access to managed applications hosted internally in data centers, and private or public clouds.

Featured Articles

Before you consider Zscaler, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Zscaler wasn't on the list.

While Zscaler currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.