M&G PLC cut its position in Mobileye Global Inc. (NASDAQ:MBLY - Free Report) by 47.2% during the third quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The fund owned 713,283 shares of the company's stock after selling 637,662 shares during the quarter. M&G PLC owned approximately 0.09% of Mobileye Global worth $9,986,000 at the end of the most recent reporting period.

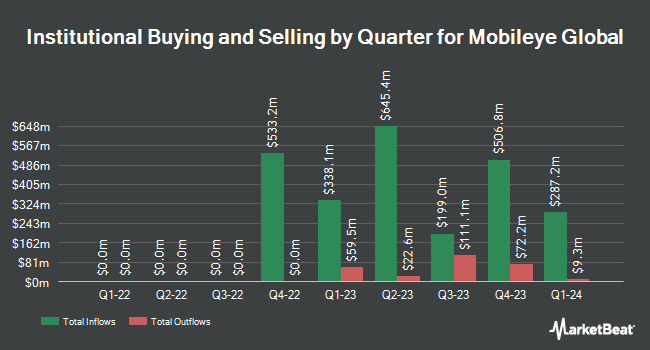

Other hedge funds and other institutional investors have also bought and sold shares of the company. Impax Asset Management Group plc acquired a new stake in shares of Mobileye Global in the third quarter worth $871,000. Arcadia Investment Management Corp MI increased its holdings in shares of Mobileye Global by 13.1% during the 3rd quarter. Arcadia Investment Management Corp MI now owns 139,656 shares of the company's stock worth $1,913,000 after purchasing an additional 16,190 shares during the period. Focus Financial Network Inc. raised its position in shares of Mobileye Global by 41.1% during the third quarter. Focus Financial Network Inc. now owns 12,314 shares of the company's stock valued at $169,000 after buying an additional 3,584 shares during the last quarter. Ayalon Insurance Comp Ltd. lifted its stake in shares of Mobileye Global by 24.2% in the third quarter. Ayalon Insurance Comp Ltd. now owns 85,057 shares of the company's stock valued at $1,165,000 after buying an additional 16,565 shares during the period. Finally, Avitas Wealth Management LLC bought a new stake in shares of Mobileye Global in the third quarter valued at about $137,000. 13.25% of the stock is currently owned by institutional investors and hedge funds.

Mobileye Global Price Performance

Shares of MBLY traded down $0.06 during mid-day trading on Friday, hitting $16.45. The stock had a trading volume of 6,262,303 shares, compared to its average volume of 6,647,938. The firm has a market cap of $13.34 billion, a P/E ratio of -4.51 and a beta of 0.07. Mobileye Global Inc. has a 52 week low of $10.48 and a 52 week high of $44.48. The business has a fifty day moving average price of $12.94 and a 200-day moving average price of $20.31.

Analyst Ratings Changes

MBLY has been the subject of several recent research reports. The Goldman Sachs Group cut their price target on Mobileye Global from $24.00 to $20.00 and set a "buy" rating for the company in a report on Tuesday, October 1st. Fox Advisors cut shares of Mobileye Global from an "overweight" rating to an "equal weight" rating in a research note on Thursday, August 1st. Mizuho cut Mobileye Global from an "outperform" rating to a "neutral" rating and dropped their target price for the stock from $30.00 to $13.00 in a report on Friday, October 11th. Morgan Stanley raised Mobileye Global from an "underweight" rating to an "equal weight" rating and decreased their price target for the company from $25.00 to $18.00 in a research note on Friday, August 2nd. Finally, Hsbc Global Res raised Mobileye Global to a "strong-buy" rating in a report on Monday, July 15th. Three research analysts have rated the stock with a sell rating, eleven have given a hold rating, ten have assigned a buy rating and one has assigned a strong buy rating to the stock. According to MarketBeat.com, Mobileye Global presently has a consensus rating of "Hold" and a consensus price target of $23.20.

Read Our Latest Stock Analysis on MBLY

Mobileye Global Company Profile

(

Free Report)

Mobileye Global Inc develops and deploys advanced driver assistance systems (ADAS) and autonomous driving technologies and solutions worldwide. The company operates through Mobileye and Other segments. It offers Driver Assist comprising ADAS and autonomous vehicle solutions that covers safety features, such as real-time detection of road users, geometry, semantics, and markings to provide safety alerts and emergency interventions; Cloud-Enhanced Driver Assist, a solution for drivers with interpretations of a scene in real-time; Mobileye SuperVision Lite, a navigation and assisted driving solution; and Mobileye SuperVision, an operational point-to-point assisted driving navigation solution on various road types and includes cloud-based enhancements, such as road experience management.

Featured Stories

Before you consider Mobileye Global, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Mobileye Global wasn't on the list.

While Mobileye Global currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.