US Bancorp DE trimmed its position in Mobileye Global Inc. (NASDAQ:MBLY - Free Report) by 68.1% during the third quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The fund owned 227,808 shares of the company's stock after selling 487,331 shares during the quarter. US Bancorp DE's holdings in Mobileye Global were worth $3,121,000 at the end of the most recent reporting period.

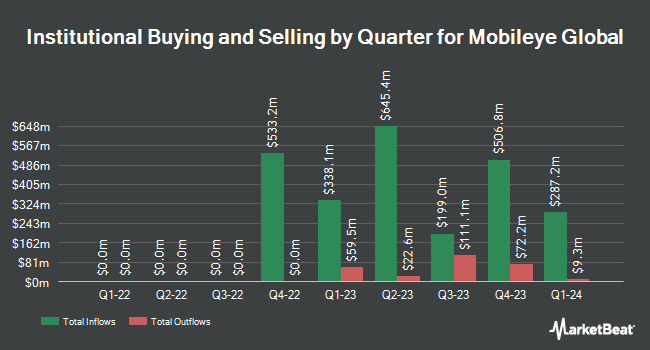

Several other institutional investors and hedge funds have also recently added to or reduced their stakes in MBLY. The Manufacturers Life Insurance Company boosted its stake in shares of Mobileye Global by 807.3% in the 2nd quarter. The Manufacturers Life Insurance Company now owns 9,073,601 shares of the company's stock valued at $254,832,000 after purchasing an additional 8,073,552 shares in the last quarter. Bank of New York Mellon Corp increased its holdings in Mobileye Global by 4.2% in the 2nd quarter. Bank of New York Mellon Corp now owns 2,347,269 shares of the company's stock worth $65,923,000 after purchasing an additional 94,946 shares in the last quarter. 1832 Asset Management L.P. grew its holdings in shares of Mobileye Global by 5,308.1% during the first quarter. 1832 Asset Management L.P. now owns 2,206,500 shares of the company's stock worth $70,939,000 after purchasing an additional 2,165,700 shares during the last quarter. Janus Henderson Group PLC acquired a new position in shares of Mobileye Global in the first quarter valued at approximately $69,638,000. Finally, Platinum Investment Management Ltd. raised its holdings in Mobileye Global by 47.8% in the 1st quarter. Platinum Investment Management Ltd. now owns 1,471,599 shares of the company's stock valued at $47,312,000 after buying an additional 475,829 shares during the last quarter. 13.25% of the stock is currently owned by institutional investors.

Mobileye Global Trading Up 1.4 %

Shares of MBLY traded up $0.21 on Wednesday, reaching $15.44. The company's stock had a trading volume of 9,315,810 shares, compared to its average volume of 4,987,813. The stock has a market capitalization of $12.49 billion, a PE ratio of -4.17 and a beta of 0.07. Mobileye Global Inc. has a twelve month low of $10.48 and a twelve month high of $44.48. The firm has a fifty day moving average of $12.81 and a 200-day moving average of $20.46.

Wall Street Analysts Forecast Growth

A number of equities research analysts have weighed in on the stock. Barclays reduced their target price on shares of Mobileye Global from $19.00 to $18.00 and set an "overweight" rating on the stock in a report on Monday. Canaccord Genuity Group reduced their target price on Mobileye Global from $27.00 to $25.00 and set a "buy" rating on the stock in a report on Friday, November 1st. Needham & Company LLC lowered their price target on shares of Mobileye Global from $25.00 to $20.00 and set a "buy" rating for the company in a report on Friday, November 1st. UBS Group cut shares of Mobileye Global from a "buy" rating to a "neutral" rating and decreased their price objective for the stock from $20.00 to $14.00 in a research report on Friday, October 4th. Finally, Mizuho cut shares of Mobileye Global from an "outperform" rating to a "neutral" rating and cut their price target for the company from $30.00 to $13.00 in a research report on Friday, October 11th. Three analysts have rated the stock with a sell rating, eleven have assigned a hold rating, ten have issued a buy rating and one has assigned a strong buy rating to the company's stock. According to MarketBeat.com, the company presently has a consensus rating of "Hold" and a consensus target price of $23.20.

View Our Latest Report on MBLY

Mobileye Global Company Profile

(

Free Report)

Mobileye Global Inc develops and deploys advanced driver assistance systems (ADAS) and autonomous driving technologies and solutions worldwide. The company operates through Mobileye and Other segments. It offers Driver Assist comprising ADAS and autonomous vehicle solutions that covers safety features, such as real-time detection of road users, geometry, semantics, and markings to provide safety alerts and emergency interventions; Cloud-Enhanced Driver Assist, a solution for drivers with interpretations of a scene in real-time; Mobileye SuperVision Lite, a navigation and assisted driving solution; and Mobileye SuperVision, an operational point-to-point assisted driving navigation solution on various road types and includes cloud-based enhancements, such as road experience management.

Featured Stories

Before you consider Mobileye Global, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Mobileye Global wasn't on the list.

While Mobileye Global currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.