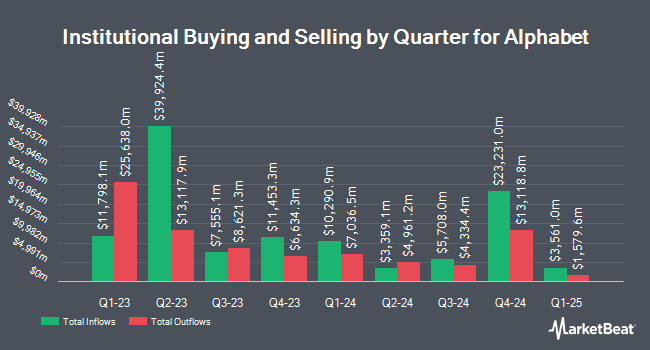

Modern Wealth Management LLC increased its holdings in shares of Alphabet Inc. (NASDAQ:GOOG - Free Report) by 367.3% in the fourth quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 76,752 shares of the information services provider's stock after purchasing an additional 60,327 shares during the period. Modern Wealth Management LLC's holdings in Alphabet were worth $14,445,000 as of its most recent SEC filing.

Other hedge funds and other institutional investors also recently bought and sold shares of the company. Weiss Asset Management LP purchased a new position in Alphabet in the 3rd quarter valued at $25,000. Fiduciary Advisors Inc. acquired a new stake in shares of Alphabet in the 4th quarter worth $27,000. Safe Harbor Fiduciary LLC purchased a new stake in shares of Alphabet in the third quarter valued at about $33,000. Mountain Hill Investment Partners Corp. acquired a new position in shares of Alphabet during the fourth quarter worth about $39,000. Finally, Noble Wealth Management PBC purchased a new position in Alphabet during the fourth quarter worth about $43,000. 27.26% of the stock is owned by hedge funds and other institutional investors.

Wall Street Analyst Weigh In

A number of brokerages have weighed in on GOOG. Wedbush reaffirmed an "outperform" rating and issued a $220.00 price objective on shares of Alphabet in a report on Thursday, January 30th. Citizens Jmp downgraded Alphabet from a "strong-buy" rating to a "hold" rating in a research note on Thursday, January 2nd. Benchmark reissued a "negative" rating on shares of Alphabet in a report on Wednesday, February 5th. Scotiabank upped their price target on shares of Alphabet from $212.00 to $240.00 and gave the stock a "sector outperform" rating in a research note on Friday, January 24th. Finally, Morgan Stanley reiterated an "overweight" rating on shares of Alphabet in a research note on Wednesday, February 5th. One analyst has rated the stock with a sell rating, six have assigned a hold rating, fourteen have assigned a buy rating and three have issued a strong buy rating to the company's stock. Based on data from MarketBeat.com, the stock currently has an average rating of "Moderate Buy" and an average price target of $209.13.

Check Out Our Latest Report on GOOG

Alphabet Trading Up 1.7 %

Shares of GOOG traded up $2.86 on Tuesday, hitting $172.79. 13,811,344 shares of the stock traded hands, compared to its average volume of 17,855,898. The firm has a market capitalization of $2.11 trillion, a P/E ratio of 21.46, a P/E/G ratio of 1.34 and a beta of 1.03. The company has a quick ratio of 1.84, a current ratio of 1.84 and a debt-to-equity ratio of 0.03. Alphabet Inc. has a 1 year low of $148.20 and a 1 year high of $208.70. The stock's 50 day moving average is $183.93 and its two-hundred day moving average is $178.30.

Alphabet (NASDAQ:GOOG - Get Free Report) last released its earnings results on Tuesday, February 4th. The information services provider reported $2.15 earnings per share for the quarter, topping the consensus estimate of $2.12 by $0.03. Alphabet had a return on equity of 32.49% and a net margin of 28.60%. As a group, sell-side analysts predict that Alphabet Inc. will post 8.89 earnings per share for the current year.

Alphabet Dividend Announcement

The business also recently announced a quarterly dividend, which was paid on Monday, March 17th. Investors of record on Monday, March 10th were given a $0.20 dividend. The ex-dividend date was Monday, March 10th. This represents a $0.80 annualized dividend and a dividend yield of 0.46%. Alphabet's dividend payout ratio is presently 9.94%.

Insider Activity at Alphabet

In other Alphabet news, Director John L. Hennessy sold 200 shares of Alphabet stock in a transaction on Thursday, March 13th. The shares were sold at an average price of $165.53, for a total value of $33,106.00. Following the transaction, the director now owns 7,813 shares in the company, valued at $1,293,285.89. This trade represents a 2.50 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available through this link. Also, CAO Amie Thuener O'toole sold 1,374 shares of Alphabet stock in a transaction on Monday, March 3rd. The shares were sold at an average price of $173.47, for a total value of $238,347.78. Following the completion of the transaction, the chief accounting officer now owns 15,024 shares in the company, valued at $2,606,213.28. The trade was a 8.38 % decrease in their position. The disclosure for this sale can be found here. Over the last three months, insiders sold 93,048 shares of company stock worth $17,374,274. 12.99% of the stock is owned by company insiders.

Alphabet Profile

(

Free Report)

Alphabet Inc offers various products and platforms in the United States, Europe, the Middle East, Africa, the Asia-Pacific, Canada, and Latin America. It operates through Google Services, Google Cloud, and Other Bets segments. The Google Services segment provides products and services, including ads, Android, Chrome, devices, Gmail, Google Drive, Google Maps, Google Photos, Google Play, Search, and YouTube.

See Also

Before you consider Alphabet, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Alphabet wasn't on the list.

While Alphabet currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.