Moderna (NASDAQ:MRNA - Get Free Report) had its target price dropped by stock analysts at Bank of America from $41.00 to $34.00 in a report released on Tuesday,Benzinga reports. The firm presently has an "underperform" rating on the stock. Bank of America's target price would suggest a potential upside of 3.06% from the stock's previous close.

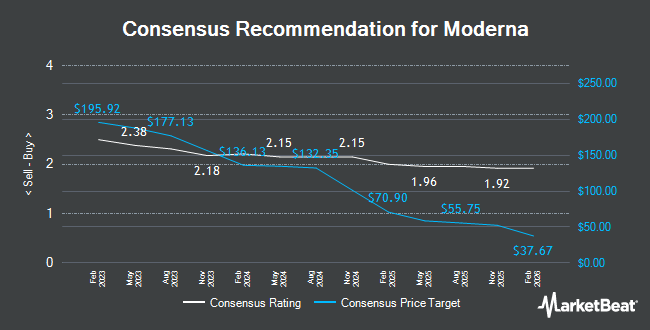

Other equities research analysts have also issued reports about the stock. Morgan Stanley dropped their price objective on shares of Moderna from $70.00 to $38.00 and set an "equal weight" rating on the stock in a report on Wednesday, January 15th. Wolfe Research initiated coverage on shares of Moderna in a report on Friday, November 15th. They issued an "underperform" rating and a $40.00 price target on the stock. Needham & Company LLC reaffirmed a "hold" rating on shares of Moderna in a report on Friday, November 8th. Hsbc Global Res raised shares of Moderna from a "hold" rating to a "strong-buy" rating in a report on Monday, November 18th. Finally, Sanford C. Bernstein initiated coverage on shares of Moderna in a report on Thursday, October 17th. They issued a "market perform" rating and a $55.00 price target on the stock. Four investment analysts have rated the stock with a sell rating, fourteen have issued a hold rating, four have assigned a buy rating and one has given a strong buy rating to the company. According to data from MarketBeat.com, Moderna currently has a consensus rating of "Hold" and a consensus price target of $66.89.

Get Our Latest Stock Analysis on MRNA

Moderna Stock Performance

Shares of MRNA traded up $1.07 during trading hours on Tuesday, reaching $32.99. 25,297,536 shares of the company traded hands, compared to its average volume of 12,567,232. The stock has a market capitalization of $12.70 billion, a P/E ratio of -5.67 and a beta of 1.59. The company has a quick ratio of 4.20, a current ratio of 4.39 and a debt-to-equity ratio of 0.05. Moderna has a 12-month low of $29.25 and a 12-month high of $170.47. The business has a fifty day moving average price of $38.86 and a 200-day moving average price of $54.70.

Insider Buying and Selling

In other Moderna news, insider Shannon Thyme Klinger sold 1,418 shares of the stock in a transaction dated Friday, November 29th. The shares were sold at an average price of $42.79, for a total value of $60,676.22. Following the completion of the sale, the insider now owns 19,717 shares in the company, valued at approximately $843,690.43. This represents a 6.71 % decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through the SEC website. Insiders sold a total of 2,664 shares of company stock worth $115,210 in the last 90 days. Insiders own 15.70% of the company's stock.

Institutional Trading of Moderna

A number of hedge funds have recently bought and sold shares of MRNA. Wilmington Savings Fund Society FSB grew its stake in shares of Moderna by 295.0% in the 4th quarter. Wilmington Savings Fund Society FSB now owns 786 shares of the company's stock valued at $33,000 after buying an additional 587 shares during the period. Compass Planning Associates Inc purchased a new stake in shares of Moderna in the 4th quarter valued at approximately $37,000. Venturi Wealth Management LLC grew its stake in shares of Moderna by 286.2% in the 4th quarter. Venturi Wealth Management LLC now owns 896 shares of the company's stock valued at $37,000 after buying an additional 664 shares during the period. Crowley Wealth Management Inc. purchased a new stake in shares of Moderna in the 4th quarter valued at approximately $41,000. Finally, Itau Unibanco Holding S.A. grew its stake in shares of Moderna by 51.2% in the 4th quarter. Itau Unibanco Holding S.A. now owns 1,013 shares of the company's stock valued at $42,000 after buying an additional 343 shares during the period. Institutional investors and hedge funds own 75.33% of the company's stock.

Moderna Company Profile

(

Get Free Report)

Moderna, Inc, a biotechnology company, discovers, develops, and commercializes messenger RNA therapeutics and vaccines for the treatment of infectious diseases, immuno-oncology, rare diseases, autoimmune, and cardiovascular diseases in the United States, Europe, and internationally. Its respiratory vaccines include COVID-19, influenza, and respiratory syncytial virus, spikevax, and hMPV/PIV3 vaccines; latent vaccines comprise cytomegalovirus, epstein-barr virus, herpes simplex virus, varicella zoster virus, and human immunodeficiency virus vaccines; public health vaccines consists of Zika, Nipah, Mpox vaccines; and infectious diseases vaccines, such as lyme and norovirus vaccines.

Featured Articles

Before you consider Moderna, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Moderna wasn't on the list.

While Moderna currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.