Victory Capital Management Inc. boosted its holdings in Modine Manufacturing (NYSE:MOD - Free Report) by 20.1% during the third quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The fund owned 157,200 shares of the auto parts company's stock after acquiring an additional 26,348 shares during the period. Victory Capital Management Inc. owned 0.30% of Modine Manufacturing worth $20,875,000 as of its most recent filing with the Securities and Exchange Commission.

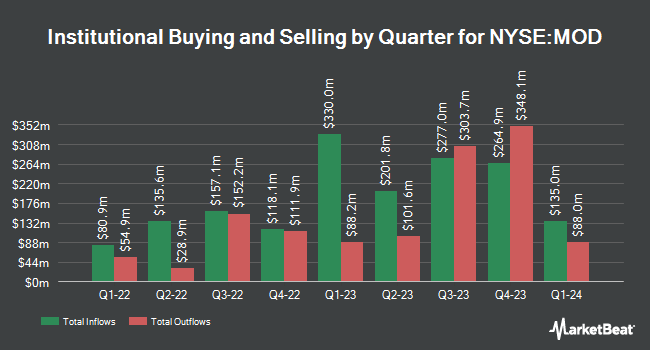

A number of other large investors have also recently added to or reduced their stakes in MOD. Vanguard Group Inc. lifted its position in shares of Modine Manufacturing by 27.3% in the first quarter. Vanguard Group Inc. now owns 3,909,016 shares of the auto parts company's stock valued at $372,099,000 after acquiring an additional 838,460 shares in the last quarter. Capital International Investors lifted its holdings in Modine Manufacturing by 40.6% in the 1st quarter. Capital International Investors now owns 1,425,845 shares of the auto parts company's stock valued at $135,726,000 after purchasing an additional 411,946 shares in the last quarter. Driehaus Capital Management LLC grew its holdings in shares of Modine Manufacturing by 32.8% during the second quarter. Driehaus Capital Management LLC now owns 1,101,932 shares of the auto parts company's stock worth $110,403,000 after buying an additional 272,174 shares in the last quarter. Emerald Advisers LLC acquired a new position in shares of Modine Manufacturing in the second quarter valued at approximately $26,064,000. Finally, Public Employees Retirement Association of Colorado boosted its position in Modine Manufacturing by 4,215.8% during the second quarter. Public Employees Retirement Association of Colorado now owns 260,547 shares of the auto parts company's stock worth $26,104,000 after acquiring an additional 254,510 shares during the last quarter. 95.23% of the stock is owned by institutional investors and hedge funds.

Wall Street Analyst Weigh In

Several research analysts have weighed in on MOD shares. Oppenheimer boosted their price target on Modine Manufacturing from $144.00 to $145.00 and gave the company an "outperform" rating in a report on Thursday, October 31st. DA Davidson increased their target price on Modine Manufacturing from $140.00 to $155.00 and gave the stock a "buy" rating in a research report on Tuesday, September 24th. B. Riley lifted their price target on Modine Manufacturing from $125.00 to $140.00 and gave the company a "buy" rating in a report on Thursday, August 1st. Finally, William Blair initiated coverage on shares of Modine Manufacturing in a research report on Monday, July 29th. They issued an "outperform" rating on the stock. One investment analyst has rated the stock with a hold rating and four have given a buy rating to the company. According to MarketBeat, Modine Manufacturing presently has a consensus rating of "Moderate Buy" and a consensus price target of $146.67.

Check Out Our Latest Analysis on MOD

Modine Manufacturing Trading Up 7.7 %

Shares of NYSE MOD traded up $9.76 during midday trading on Tuesday, hitting $136.06. The stock had a trading volume of 869,906 shares, compared to its average volume of 852,414. The company has a quick ratio of 1.09, a current ratio of 1.77 and a debt-to-equity ratio of 0.41. Modine Manufacturing has a 1-year low of $48.88 and a 1-year high of $141.72. The company has a market capitalization of $7.14 billion, a price-to-earnings ratio of 44.59, a PEG ratio of 0.95 and a beta of 2.25. The company has a fifty day moving average price of $125.56 and a 200 day moving average price of $111.35.

Modine Manufacturing (NYSE:MOD - Get Free Report) last announced its quarterly earnings results on Tuesday, October 29th. The auto parts company reported $0.97 earnings per share for the quarter, beating analysts' consensus estimates of $0.92 by $0.05. Modine Manufacturing had a net margin of 6.59% and a return on equity of 23.96%. The firm had revenue of $658.00 million for the quarter, compared to analysts' expectations of $646.86 million. During the same period in the previous year, the company posted $0.89 earnings per share. Modine Manufacturing's revenue was up 6.0% compared to the same quarter last year. On average, analysts predict that Modine Manufacturing will post 3.83 earnings per share for the current year.

Modine Manufacturing Profile

(

Free Report)

Modine Manufacturing Company provides thermal management products and solutions in the United States, Italy, Hungary, China, the United Kingdom, and internationally. It operates through Climate Solutions and Performance Technologies segments. The company offers heat transfer coils, including heat recovery and round tube plate fin coils; gas-fired, hydronic, electric and oilfired unit heaters; roof-mounted direct- and indirect-fired makeup air units; duct furnaces; infrared units; perimeter heating products; single packaged unit ventilators; modular chillers; air handler and condensing units; ceiling cassettes; evaporator unit coolers, remote condensers, fluid coolers, gas coolers, and dry and brine coolers; and motor and generator cooling coils, transformer oil coolers, radiators, dryers, and industrial heat exchangers.

Recommended Stories

Before you consider Modine Manufacturing, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Modine Manufacturing wasn't on the list.

While Modine Manufacturing currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.