William Blair Investment Management LLC grew its stake in shares of Modine Manufacturing (NYSE:MOD - Free Report) by 7.7% during the 4th quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The fund owned 247,400 shares of the auto parts company's stock after purchasing an additional 17,599 shares during the quarter. William Blair Investment Management LLC owned about 0.47% of Modine Manufacturing worth $28,681,000 at the end of the most recent quarter.

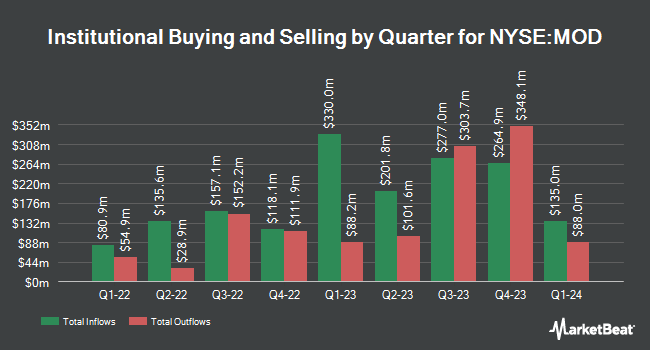

Other institutional investors have also recently made changes to their positions in the company. Skandinaviska Enskilda Banken AB publ increased its position in shares of Modine Manufacturing by 567.6% during the 4th quarter. Skandinaviska Enskilda Banken AB publ now owns 227 shares of the auto parts company's stock worth $27,000 after purchasing an additional 193 shares during the last quarter. Principal Securities Inc. increased its position in shares of Modine Manufacturing by 97.8% during the 4th quarter. Principal Securities Inc. now owns 544 shares of the auto parts company's stock worth $63,000 after purchasing an additional 269 shares during the last quarter. Private Trust Co. NA increased its position in shares of Modine Manufacturing by 650.5% during the 3rd quarter. Private Trust Co. NA now owns 773 shares of the auto parts company's stock worth $103,000 after purchasing an additional 670 shares during the last quarter. Nisa Investment Advisors LLC increased its position in shares of Modine Manufacturing by 6.5% during the 4th quarter. Nisa Investment Advisors LLC now owns 1,353 shares of the auto parts company's stock worth $157,000 after purchasing an additional 82 shares during the last quarter. Finally, KBC Group NV increased its position in shares of Modine Manufacturing by 47.8% during the 3rd quarter. KBC Group NV now owns 1,456 shares of the auto parts company's stock worth $193,000 after purchasing an additional 471 shares during the last quarter. Institutional investors and hedge funds own 95.23% of the company's stock.

Insider Buying and Selling

In other news, Director William A. Wulfsohn acquired 2,530 shares of the firm's stock in a transaction on Monday, March 3rd. The shares were purchased at an average cost of $79.43 per share, with a total value of $200,957.90. Following the acquisition, the director now directly owns 7,277 shares in the company, valued at $578,012.11. This represents a 53.30 % increase in their position. The purchase was disclosed in a document filed with the SEC, which is accessible through this link. 2.40% of the stock is owned by insiders.

Modine Manufacturing Stock Performance

Shares of MOD stock traded up $0.88 during trading on Friday, reaching $88.68. 1,275,952 shares of the company's stock were exchanged, compared to its average volume of 885,262. The company has a quick ratio of 1.18, a current ratio of 1.87 and a debt-to-equity ratio of 0.38. The stock has a market capitalization of $4.66 billion, a PE ratio of 29.76, a PEG ratio of 0.71 and a beta of 2.48. Modine Manufacturing has a twelve month low of $72.49 and a twelve month high of $146.84. The firm's fifty day moving average price is $98.13 and its 200-day moving average price is $115.86.

Modine Manufacturing (NYSE:MOD - Get Free Report) last posted its earnings results on Tuesday, February 4th. The auto parts company reported $0.92 earnings per share for the quarter, topping analysts' consensus estimates of $0.79 by $0.13. Modine Manufacturing had a return on equity of 24.25% and a net margin of 6.31%. As a group, sell-side analysts anticipate that Modine Manufacturing will post 3.88 EPS for the current year.

Modine Manufacturing declared that its Board of Directors has approved a share repurchase plan on Friday, March 7th that permits the company to repurchase $100.00 million in outstanding shares. This repurchase authorization permits the auto parts company to purchase up to 2.4% of its shares through open market purchases. Shares repurchase plans are generally an indication that the company's board of directors believes its stock is undervalued.

Wall Street Analyst Weigh In

Separately, DA Davidson reaffirmed a "buy" rating and set a $155.00 price target on shares of Modine Manufacturing in a research report on Monday, March 17th.

Get Our Latest Stock Report on MOD

Modine Manufacturing Company Profile

(

Free Report)

Modine Manufacturing Company provides thermal management products and solutions in the United States, Italy, Hungary, China, the United Kingdom, and internationally. It operates through Climate Solutions and Performance Technologies segments. The company offers heat transfer coils, including heat recovery and round tube plate fin coils; gas-fired, hydronic, electric and oilfired unit heaters; roof-mounted direct- and indirect-fired makeup air units; duct furnaces; infrared units; perimeter heating products; single packaged unit ventilators; modular chillers; air handler and condensing units; ceiling cassettes; evaporator unit coolers, remote condensers, fluid coolers, gas coolers, and dry and brine coolers; and motor and generator cooling coils, transformer oil coolers, radiators, dryers, and industrial heat exchangers.

See Also

Before you consider Modine Manufacturing, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Modine Manufacturing wasn't on the list.

While Modine Manufacturing currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.