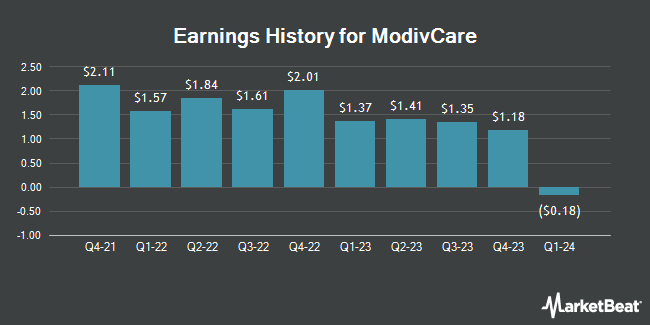

ModivCare (NASDAQ:MODV - Get Free Report) issued its quarterly earnings results on Thursday. The company reported $0.09 earnings per share (EPS) for the quarter, beating the consensus estimate of ($0.10) by $0.19, Zacks reports. The business had revenue of $702.80 million for the quarter, compared to analyst estimates of $703.30 million. ModivCare had a positive return on equity of 26.14% and a negative net margin of 6.57%.

ModivCare Stock Performance

NASDAQ:MODV traded down $0.23 during mid-day trading on Monday, hitting $2.52. The stock had a trading volume of 493,327 shares, compared to its average volume of 333,464. The company's 50 day simple moving average is $6.32 and its 200 day simple moving average is $13.66. The stock has a market cap of $36.02 million, a price-to-earnings ratio of -0.20, a PEG ratio of 3.46 and a beta of 0.59. The company has a debt-to-equity ratio of 103.63, a quick ratio of 0.80 and a current ratio of 0.80. ModivCare has a twelve month low of $2.33 and a twelve month high of $33.64.

Insider Buying and Selling

In other ModivCare news, major shareholder Q Global Capital Management, L bought 3,837 shares of the stock in a transaction dated Friday, January 10th. The shares were bought at an average cost of $12.61 per share, with a total value of $48,384.57. Following the completion of the acquisition, the insider now owns 1,970,935 shares of the company's stock, valued at $24,853,490.35. This trade represents a 0.20 % increase in their ownership of the stock. The purchase was disclosed in a document filed with the SEC, which is accessible through this link. Also, major shareholder Catalyst Fund Lp Ai acquired 187,500 shares of the firm's stock in a transaction that occurred on Monday, February 3rd. The stock was purchased at an average cost of $3.87 per share, for a total transaction of $725,625.00. Following the completion of the purchase, the insider now directly owns 2,130,000 shares of the company's stock, valued at $8,243,100. The trade was a 9.65 % increase in their ownership of the stock. The disclosure for this purchase can be found here. In the last three months, insiders have acquired 378,837 shares of company stock valued at $1,529,635. 1.20% of the stock is owned by insiders.

Wall Street Analysts Forecast Growth

A number of analysts have recently commented on MODV shares. Stephens lowered their price target on ModivCare from $7.00 to $3.50 and set an "equal weight" rating for the company in a research note on Monday. Barrington Research dropped their price objective on ModivCare from $10.00 to $6.00 and set an "outperform" rating on the stock in a research note on Friday. Finally, Lake Street Capital lowered their price target on ModivCare from $30.00 to $10.00 and set a "buy" rating for the company in a report on Monday, January 13th.

Read Our Latest Analysis on ModivCare

ModivCare Company Profile

(

Get Free Report)

ModivCare Inc, a technology-enabled healthcare services company, provides a suite of integrated supportive care solutions for public and private payors and their members. The company operates through four segments: Non-Emergency Medical Transportation (NEMT), Personal Care, Remote Patient Monitoring (RPM), and Corporate and Other.

Further Reading

Before you consider ModivCare, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ModivCare wasn't on the list.

While ModivCare currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.