Keefe, Bruyette & Woods upgraded shares of Moelis & Company (NYSE:MC - Free Report) from a market perform rating to an outperform rating in a research report released on Friday morning, MarketBeat.com reports. Keefe, Bruyette & Woods currently has $86.00 price objective on the asset manager's stock, up from their previous price objective of $71.00.

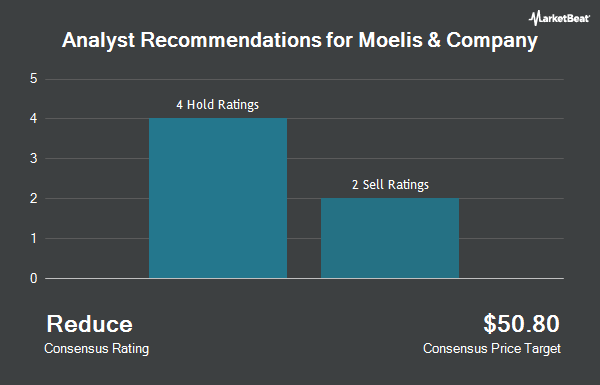

Other equities analysts also recently issued reports about the company. Wells Fargo & Company boosted their price objective on Moelis & Company from $70.00 to $78.00 and gave the stock an "equal weight" rating in a research report on Thursday, December 12th. Morgan Stanley upgraded shares of Moelis & Company from an "underweight" rating to an "overweight" rating and boosted their price target for the stock from $66.00 to $92.00 in a report on Monday, December 9th. Finally, UBS Group raised their price objective on shares of Moelis & Company from $54.00 to $60.00 and gave the company a "sell" rating in a report on Tuesday, October 8th. One analyst has rated the stock with a sell rating, five have given a hold rating and two have issued a buy rating to the company. According to MarketBeat, the company presently has an average rating of "Hold" and an average price target of $70.83.

Get Our Latest Stock Analysis on Moelis & Company

Moelis & Company Stock Up 2.9 %

Moelis & Company stock traded up $2.09 during mid-day trading on Friday, reaching $73.81. 1,253,101 shares of the company's stock were exchanged, compared to its average volume of 631,488. The company has a fifty day moving average of $72.97 and a 200-day moving average of $66.08. The company has a market cap of $5.53 billion, a P/E ratio of 139.26 and a beta of 1.37. Moelis & Company has a twelve month low of $46.24 and a twelve month high of $81.60.

Moelis & Company (NYSE:MC - Get Free Report) last announced its quarterly earnings data on Wednesday, October 23rd. The asset manager reported $0.22 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.20 by $0.02. Moelis & Company had a return on equity of 12.15% and a net margin of 4.22%. The business had revenue of $273.76 million for the quarter, compared to analysts' expectations of $273.58 million. During the same period last year, the firm earned ($0.15) earnings per share. The company's revenue for the quarter was up .6% compared to the same quarter last year. Equities research analysts expect that Moelis & Company will post 0.96 earnings per share for the current fiscal year.

Moelis & Company Announces Dividend

The company also recently disclosed a quarterly dividend, which was paid on Monday, December 2nd. Shareholders of record on Monday, November 4th were paid a $0.60 dividend. This represents a $2.40 dividend on an annualized basis and a yield of 3.25%. The ex-dividend date was Monday, November 4th. Moelis & Company's dividend payout ratio is currently 452.83%.

Hedge Funds Weigh In On Moelis & Company

A number of hedge funds and other institutional investors have recently made changes to their positions in the stock. Sei Investments Co. increased its stake in Moelis & Company by 18.2% in the 2nd quarter. Sei Investments Co. now owns 305,871 shares of the asset manager's stock valued at $17,392,000 after buying an additional 47,176 shares during the period. B. Metzler seel. Sohn & Co. Holding AG acquired a new position in shares of Moelis & Company during the third quarter worth about $3,433,000. XTX Topco Ltd raised its holdings in Moelis & Company by 274.4% during the second quarter. XTX Topco Ltd now owns 16,524 shares of the asset manager's stock worth $940,000 after purchasing an additional 12,110 shares in the last quarter. Natixis Advisors LLC raised its holdings in Moelis & Company by 13.7% during the third quarter. Natixis Advisors LLC now owns 804,860 shares of the asset manager's stock worth $55,141,000 after purchasing an additional 96,720 shares in the last quarter. Finally, Cerity Partners LLC lifted its position in Moelis & Company by 129.8% in the third quarter. Cerity Partners LLC now owns 13,845 shares of the asset manager's stock valued at $949,000 after purchasing an additional 7,819 shares during the period. Hedge funds and other institutional investors own 91.53% of the company's stock.

About Moelis & Company

(

Get Free Report)

Moelis & Company operates as an investment banking advisory firm. It offers advisory services in the areas of mergers and acquisitions, recapitalizations and restructurings, capital markets transactions, and other corporate finance matters, as well as strategic, capital structure, and private funds advisory.

See Also

Before you consider Moelis & Company, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Moelis & Company wasn't on the list.

While Moelis & Company currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.