Massachusetts Financial Services Co. MA lifted its holdings in Mohawk Industries, Inc. (NYSE:MHK - Free Report) by 33.7% during the 3rd quarter, according to its most recent disclosure with the SEC. The institutional investor owned 1,011,861 shares of the company's stock after acquiring an additional 254,779 shares during the period. Massachusetts Financial Services Co. MA owned approximately 1.60% of Mohawk Industries worth $162,586,000 as of its most recent filing with the SEC.

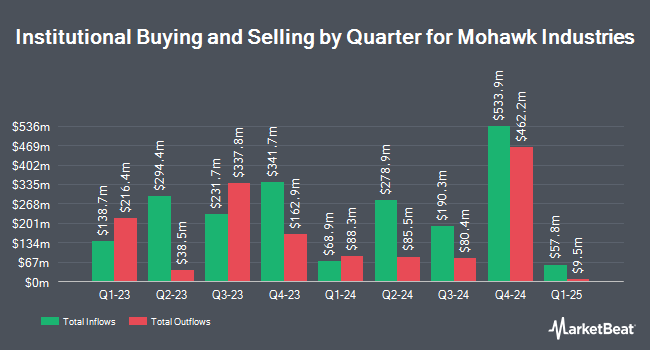

Several other hedge funds and other institutional investors have also bought and sold shares of the business. Dimensional Fund Advisors LP raised its position in shares of Mohawk Industries by 10.7% in the second quarter. Dimensional Fund Advisors LP now owns 3,036,545 shares of the company's stock valued at $344,903,000 after buying an additional 292,661 shares in the last quarter. Select Equity Group L.P. lifted its position in shares of Mohawk Industries by 8.5% during the 2nd quarter. Select Equity Group L.P. now owns 1,702,440 shares of the company's stock valued at $193,380,000 after acquiring an additional 132,879 shares during the period. Pacer Advisors Inc. grew its holdings in shares of Mohawk Industries by 42.9% during the 2nd quarter. Pacer Advisors Inc. now owns 1,200,360 shares of the company's stock worth $136,349,000 after purchasing an additional 360,628 shares in the last quarter. Brandes Investment Partners LP raised its stake in Mohawk Industries by 10.5% in the second quarter. Brandes Investment Partners LP now owns 1,015,640 shares of the company's stock valued at $115,057,000 after purchasing an additional 96,174 shares in the last quarter. Finally, American Century Companies Inc. lifted its position in Mohawk Industries by 4.5% during the second quarter. American Century Companies Inc. now owns 914,578 shares of the company's stock worth $103,887,000 after purchasing an additional 39,653 shares during the period. Institutional investors and hedge funds own 78.98% of the company's stock.

Mohawk Industries Trading Up 0.9 %

Shares of MHK traded up $1.28 during mid-day trading on Friday, reaching $138.77. 436,216 shares of the company were exchanged, compared to its average volume of 945,498. The business has a 50 day simple moving average of $149.44 and a two-hundred day simple moving average of $137.39. Mohawk Industries, Inc. has a 52 week low of $82.71 and a 52 week high of $164.29. The stock has a market capitalization of $8.76 billion, a PE ratio of 15.72, a PEG ratio of 1.52 and a beta of 1.38. The company has a debt-to-equity ratio of 0.22, a quick ratio of 1.09 and a current ratio of 2.03.

Wall Street Analysts Forecast Growth

MHK has been the subject of a number of recent analyst reports. Robert W. Baird raised shares of Mohawk Industries from a "neutral" rating to an "overweight" rating and upped their price target for the stock from $160.00 to $196.00 in a report on Monday, October 21st. Barclays lowered their target price on Mohawk Industries from $161.00 to $146.00 and set an "equal weight" rating for the company in a research note on Monday, October 28th. Loop Capital raised their price target on shares of Mohawk Industries from $145.00 to $185.00 and gave the company a "buy" rating in a research note on Monday, July 29th. Baird R W raised shares of Mohawk Industries from a "hold" rating to a "strong-buy" rating in a research note on Monday, October 21st. Finally, Truist Financial decreased their target price on shares of Mohawk Industries from $184.00 to $155.00 and set a "buy" rating on the stock in a research note on Monday, October 28th. Five equities research analysts have rated the stock with a hold rating, seven have assigned a buy rating and two have issued a strong buy rating to the company. According to data from MarketBeat, the company has a consensus rating of "Moderate Buy" and an average target price of $162.08.

Check Out Our Latest Stock Analysis on MHK

Insider Activity at Mohawk Industries

In other news, insider Suzanne L. Helen sold 660 shares of the firm's stock in a transaction that occurred on Monday, September 9th. The shares were sold at an average price of $151.46, for a total transaction of $99,963.60. Following the completion of the sale, the insider now owns 118,709 shares of the company's stock, valued at $17,979,665.14. This trade represents a 0.55 % decrease in their position. The sale was disclosed in a filing with the SEC, which is available through this link. 17.10% of the stock is owned by company insiders.

Mohawk Industries Profile

(

Free Report)

Mohawk Industries, Inc designs, manufactures, sources, distributes, and markets flooring products for residential and commercial remodeling, and new construction channels in the United States, Europe, Latin America, and internationally. It operates through three segments: Global Ceramic, Flooring North America, and Flooring Rest of the World.

Read More

Before you consider Mohawk Industries, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Mohawk Industries wasn't on the list.

While Mohawk Industries currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.