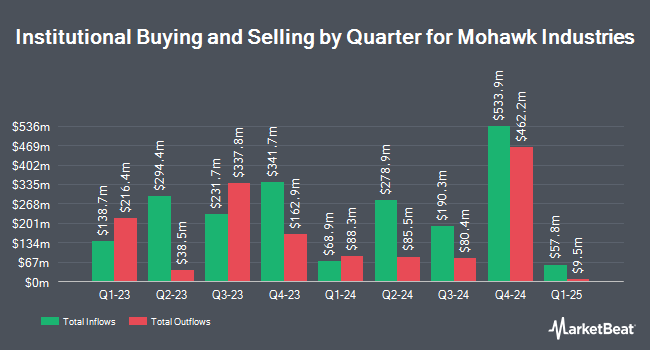

Bank of Montreal Can boosted its holdings in shares of Mohawk Industries, Inc. (NYSE:MHK - Free Report) by 64.6% during the 3rd quarter, according to its most recent filing with the Securities and Exchange Commission. The firm owned 139,867 shares of the company's stock after purchasing an additional 54,914 shares during the quarter. Bank of Montreal Can owned about 0.22% of Mohawk Industries worth $22,212,000 at the end of the most recent quarter.

Several other institutional investors and hedge funds have also recently modified their holdings of the stock. CANADA LIFE ASSURANCE Co boosted its position in shares of Mohawk Industries by 3.4% during the first quarter. CANADA LIFE ASSURANCE Co now owns 12,148 shares of the company's stock worth $1,590,000 after acquiring an additional 405 shares during the last quarter. Price T Rowe Associates Inc. MD boosted its holdings in shares of Mohawk Industries by 2.9% during the 1st quarter. Price T Rowe Associates Inc. MD now owns 73,755 shares of the company's stock valued at $9,654,000 after purchasing an additional 2,112 shares during the last quarter. Tidal Investments LLC grew its position in shares of Mohawk Industries by 28.1% during the first quarter. Tidal Investments LLC now owns 12,831 shares of the company's stock valued at $1,679,000 after purchasing an additional 2,816 shares in the last quarter. Swedbank AB bought a new stake in shares of Mohawk Industries in the first quarter worth about $2,340,000. Finally, GAMMA Investing LLC lifted its position in shares of Mohawk Industries by 21.5% in the second quarter. GAMMA Investing LLC now owns 2,196 shares of the company's stock worth $249,000 after buying an additional 389 shares in the last quarter. Institutional investors own 78.98% of the company's stock.

Mohawk Industries Trading Down 0.2 %

Shares of NYSE MHK traded down $0.27 during trading hours on Friday, reaching $138.83. The stock had a trading volume of 314,818 shares, compared to its average volume of 714,673. Mohawk Industries, Inc. has a 52-week low of $86.26 and a 52-week high of $164.29. The firm has a market cap of $8.76 billion, a price-to-earnings ratio of 15.72, a P/E/G ratio of 1.54 and a beta of 1.38. The business's fifty day moving average price is $147.82 and its two-hundred day moving average price is $137.85. The company has a current ratio of 2.03, a quick ratio of 1.09 and a debt-to-equity ratio of 0.22.

Wall Street Analysts Forecast Growth

A number of research analysts have recently commented on MHK shares. Royal Bank of Canada lowered their target price on Mohawk Industries from $140.00 to $134.00 and set a "sector perform" rating for the company in a research report on Monday, October 28th. Robert W. Baird upgraded shares of Mohawk Industries from a "neutral" rating to an "overweight" rating and boosted their target price for the stock from $160.00 to $196.00 in a report on Monday, October 21st. Baird R W raised shares of Mohawk Industries from a "hold" rating to a "strong-buy" rating in a report on Monday, October 21st. Truist Financial reduced their price objective on Mohawk Industries from $184.00 to $155.00 and set a "buy" rating on the stock in a research note on Monday, October 28th. Finally, Wells Fargo & Company raised Mohawk Industries from an "underweight" rating to an "equal weight" rating and raised their price objective for the company from $140.00 to $160.00 in a research note on Monday, October 7th. Five research analysts have rated the stock with a hold rating, seven have assigned a buy rating and two have issued a strong buy rating to the company. Based on data from MarketBeat.com, Mohawk Industries currently has an average rating of "Moderate Buy" and an average price target of $162.08.

Read Our Latest Analysis on MHK

Insider Buying and Selling at Mohawk Industries

In other news, insider Suzanne L. Helen sold 660 shares of the stock in a transaction that occurred on Monday, September 9th. The shares were sold at an average price of $151.46, for a total transaction of $99,963.60. Following the transaction, the insider now directly owns 118,709 shares in the company, valued at approximately $17,979,665.14. This trade represents a 0.55 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. 17.10% of the stock is currently owned by corporate insiders.

Mohawk Industries Company Profile

(

Free Report)

Mohawk Industries, Inc designs, manufactures, sources, distributes, and markets flooring products for residential and commercial remodeling, and new construction channels in the United States, Europe, Latin America, and internationally. It operates through three segments: Global Ceramic, Flooring North America, and Flooring Rest of the World.

Read More

Before you consider Mohawk Industries, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Mohawk Industries wasn't on the list.

While Mohawk Industries currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.