Moloney Securities Asset Management LLC acquired a new stake in Simpson Manufacturing Co., Inc. (NYSE:SSD - Free Report) in the 3rd quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The institutional investor acquired 5,450 shares of the construction company's stock, valued at approximately $1,042,000.

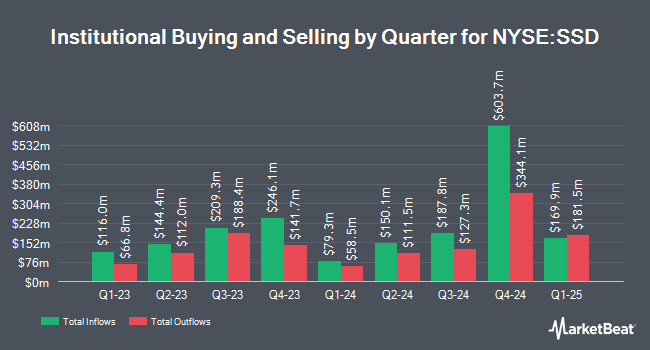

A number of other hedge funds also recently modified their holdings of the business. Vanguard Group Inc. lifted its holdings in shares of Simpson Manufacturing by 6.6% in the first quarter. Vanguard Group Inc. now owns 4,487,095 shares of the construction company's stock valued at $920,662,000 after purchasing an additional 278,283 shares in the last quarter. D. E. Shaw & Co. Inc. bought a new position in Simpson Manufacturing in the 2nd quarter worth about $35,884,000. The Manufacturers Life Insurance Company boosted its holdings in Simpson Manufacturing by 336.6% in the 2nd quarter. The Manufacturers Life Insurance Company now owns 224,517 shares of the construction company's stock valued at $37,838,000 after purchasing an additional 173,097 shares during the period. Nia Impact Advisors LLC bought a new stake in shares of Simpson Manufacturing during the 2nd quarter valued at about $15,010,000. Finally, Millennium Management LLC grew its stake in Simpson Manufacturing by 57.8% in the 2nd quarter. Millennium Management LLC now owns 201,685 shares of the construction company's stock worth $33,990,000 after buying an additional 73,872 shares in the last quarter. Institutional investors and hedge funds own 93.68% of the company's stock.

Simpson Manufacturing Price Performance

Shares of Simpson Manufacturing stock traded up $3.29 during trading hours on Wednesday, hitting $184.74. The company's stock had a trading volume of 649,629 shares, compared to its average volume of 284,664. The company has a debt-to-equity ratio of 0.24, a quick ratio of 1.99 and a current ratio of 3.53. The company has a market cap of $7.79 billion, a PE ratio of 23.88 and a beta of 1.32. The business has a 50 day moving average price of $184.49 and a two-hundred day moving average price of $177.71. Simpson Manufacturing Co., Inc. has a 12-month low of $140.62 and a 12-month high of $218.38.

Simpson Manufacturing (NYSE:SSD - Get Free Report) last released its earnings results on Monday, October 21st. The construction company reported $2.21 earnings per share for the quarter, missing analysts' consensus estimates of $2.40 by ($0.19). The business had revenue of $587.15 million during the quarter, compared to analysts' expectations of $589.00 million. Simpson Manufacturing had a return on equity of 18.29% and a net margin of 14.51%. The business's revenue for the quarter was up 1.2% on a year-over-year basis. During the same quarter in the previous year, the business earned $2.43 EPS. Analysts expect that Simpson Manufacturing Co., Inc. will post 7.55 earnings per share for the current fiscal year.

Simpson Manufacturing Announces Dividend

The company also recently announced a quarterly dividend, which will be paid on Thursday, January 23rd. Investors of record on Thursday, January 2nd will be paid a $0.28 dividend. This represents a $1.12 annualized dividend and a dividend yield of 0.61%. The ex-dividend date is Thursday, January 2nd. Simpson Manufacturing's dividend payout ratio is currently 14.80%.

Analyst Upgrades and Downgrades

Separately, Robert W. Baird increased their price objective on Simpson Manufacturing from $202.00 to $218.00 and gave the company an "outperform" rating in a research note on Monday, October 21st.

Check Out Our Latest Analysis on SSD

Insider Activity

In other news, Director James S. Andrasick sold 500 shares of Simpson Manufacturing stock in a transaction on Wednesday, August 28th. The stock was sold at an average price of $178.75, for a total transaction of $89,375.00. Following the transaction, the director now owns 866 shares in the company, valued at $154,797.50. The trade was a 0.00 % decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available at this hyperlink. In related news, Director James S. Andrasick sold 500 shares of Simpson Manufacturing stock in a transaction that occurred on Wednesday, August 28th. The shares were sold at an average price of $178.75, for a total value of $89,375.00. Following the completion of the transaction, the director now owns 866 shares in the company, valued at $154,797.50. The trade was a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available through this hyperlink. Also, CEO Michael Olosky sold 6,871 shares of the company's stock in a transaction that occurred on Monday, August 26th. The shares were sold at an average price of $187.41, for a total value of $1,287,694.11. Following the completion of the transaction, the chief executive officer now directly owns 19,534 shares of the company's stock, valued at $3,660,866.94. This trade represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold 9,871 shares of company stock worth $1,833,839 in the last ninety days. Company insiders own 0.42% of the company's stock.

About Simpson Manufacturing

(

Free Report)

Simpson Manufacturing Co, Inc, through its subsidiaries, designs, engineers, manufactures, and sells structural solutions for wood, concrete, and steel connections. The company offers wood construction products, including connectors, truss plates, fastening systems, fasteners and shearwalls, and pre-fabricated lateral systems for use in light-frame construction; and concrete construction products comprising adhesives, specialty chemicals, mechanical anchors, carbide drill bits, powder actuated tools, fiber-reinforced materials, and other repair products for use in concrete, masonry, and steel construction, as well as grouts, coatings, sealers, mortars, fiberglass and fiber-reinforced polymer systems, and asphalt products for use in concrete construction repair, and strengthening and protection products.

Recommended Stories

Before you consider Simpson Manufacturing, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Simpson Manufacturing wasn't on the list.

While Simpson Manufacturing currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report