BNP Paribas began coverage on shares of Molson Coors Beverage (NYSE:TAP - Free Report) in a research note released on Monday, MarketBeat.com reports. The firm issued a neutral rating and a $64.00 price target on the stock.

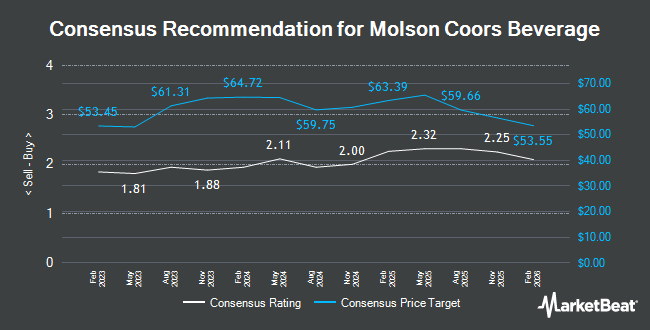

Several other equities research analysts also recently commented on TAP. TD Cowen reduced their target price on Molson Coors Beverage from $58.00 to $56.00 and set a "hold" rating for the company in a report on Tuesday, October 8th. Hsbc Global Res downgraded shares of Molson Coors Beverage from a "hold" rating to a "moderate sell" rating in a research report on Friday, November 8th. Barclays upped their price target on shares of Molson Coors Beverage from $49.00 to $51.00 and gave the company an "underweight" rating in a research report on Monday, November 11th. Deutsche Bank Aktiengesellschaft boosted their target price on shares of Molson Coors Beverage from $56.00 to $57.00 and gave the company a "hold" rating in a research note on Wednesday, August 7th. Finally, JPMorgan Chase & Co. raised their target price on Molson Coors Beverage from $57.00 to $60.00 and gave the stock a "neutral" rating in a research report on Friday, October 18th. Two analysts have rated the stock with a sell rating, ten have given a hold rating and three have issued a buy rating to the company's stock. According to data from MarketBeat, Molson Coors Beverage currently has an average rating of "Hold" and an average price target of $60.57.

Read Our Latest Research Report on Molson Coors Beverage

Molson Coors Beverage Price Performance

NYSE:TAP traded up $0.88 during mid-day trading on Monday, reaching $61.24. 967,353 shares of the stock were exchanged, compared to its average volume of 1,907,793. The company has a current ratio of 0.99, a quick ratio of 0.74 and a debt-to-equity ratio of 0.46. The business has a fifty day moving average price of $56.84 and a 200 day moving average price of $54.43. Molson Coors Beverage has a 1-year low of $49.19 and a 1-year high of $69.18. The firm has a market capitalization of $12.62 billion, a PE ratio of 13.79, a PEG ratio of 2.34 and a beta of 0.82.

Molson Coors Beverage (NYSE:TAP - Get Free Report) last released its earnings results on Thursday, November 7th. The company reported $1.80 EPS for the quarter, beating the consensus estimate of $1.67 by $0.13. The business had revenue of $3.04 billion during the quarter, compared to analyst estimates of $3.13 billion. Molson Coors Beverage had a net margin of 6.78% and a return on equity of 9.24%. The business's quarterly revenue was down 7.8% on a year-over-year basis. During the same period in the prior year, the business earned $1.92 earnings per share. Research analysts expect that Molson Coors Beverage will post 5.78 earnings per share for the current fiscal year.

Molson Coors Beverage Announces Dividend

The firm also recently disclosed a quarterly dividend, which will be paid on Friday, December 20th. Stockholders of record on Friday, December 6th will be given a $0.44 dividend. The ex-dividend date of this dividend is Friday, December 6th. This represents a $1.76 annualized dividend and a dividend yield of 2.87%. Molson Coors Beverage's dividend payout ratio is 39.64%.

Institutional Inflows and Outflows

Large investors have recently made changes to their positions in the stock. Family Firm Inc. bought a new position in shares of Molson Coors Beverage during the 2nd quarter worth approximately $26,000. Altshuler Shaham Ltd acquired a new position in Molson Coors Beverage in the second quarter valued at about $27,000. GPS Wealth Strategies Group LLC increased its holdings in shares of Molson Coors Beverage by 83.8% during the second quarter. GPS Wealth Strategies Group LLC now owns 645 shares of the company's stock worth $33,000 after buying an additional 294 shares in the last quarter. Ashton Thomas Securities LLC bought a new position in shares of Molson Coors Beverage in the third quarter valued at approximately $35,000. Finally, Gladius Capital Management LP acquired a new position in shares of Molson Coors Beverage in the 3rd quarter worth approximately $42,000. Institutional investors and hedge funds own 78.46% of the company's stock.

Molson Coors Beverage Company Profile

(

Get Free Report)

Molson Coors Beverage Company manufactures, markets, and sells beer and other malt beverage products under various brands in the Americas, Europe, the Middle East, Africa, and the Asia Pacific. The company offers flavored malt beverages including hard seltzers, craft, spirits and energy, and ready to drink beverages.

Recommended Stories

Before you consider Molson Coors Beverage, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Molson Coors Beverage wasn't on the list.

While Molson Coors Beverage currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.