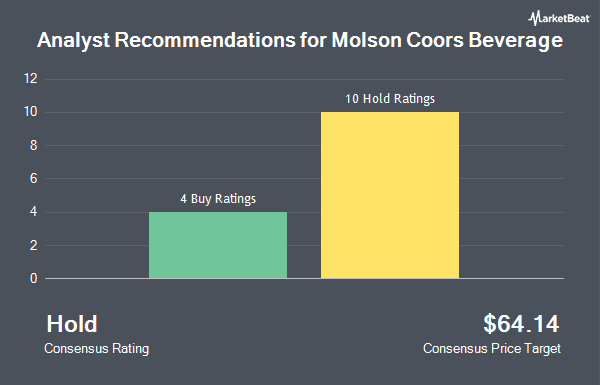

Molson Coors Beverage (NYSE:TAP - Get Free Report) has received a consensus recommendation of "Hold" from the thirteen analysts that are presently covering the stock, Marketbeat reports. Two investment analysts have rated the stock with a sell rating, eight have given a hold rating and three have given a buy rating to the company. The average 12-month price objective among brokerages that have issued a report on the stock in the last year is $60.31.

Several research analysts have recently commented on TAP shares. Piper Sandler boosted their target price on Molson Coors Beverage from $57.00 to $59.00 and gave the stock a "neutral" rating in a report on Wednesday, August 7th. JPMorgan Chase & Co. raised their target price on Molson Coors Beverage from $57.00 to $60.00 and gave the company a "neutral" rating in a research note on Friday, October 18th. Hsbc Global Res lowered shares of Molson Coors Beverage from a "hold" rating to a "moderate sell" rating in a report on Friday, November 8th. UBS Group boosted their target price on shares of Molson Coors Beverage from $55.00 to $58.00 and gave the stock a "neutral" rating in a research note on Wednesday, August 7th. Finally, Barclays increased their price target on shares of Molson Coors Beverage from $49.00 to $51.00 and gave the company an "underweight" rating in a research note on Monday, November 11th.

Read Our Latest Report on TAP

Molson Coors Beverage Stock Down 0.7 %

Shares of NYSE TAP traded down $0.42 during trading hours on Wednesday, hitting $60.38. The stock had a trading volume of 1,572,686 shares, compared to its average volume of 1,916,399. The firm's 50-day moving average price is $56.60 and its two-hundred day moving average price is $54.42. Molson Coors Beverage has a 52 week low of $49.19 and a 52 week high of $69.18. The company has a market capitalization of $12.44 billion, a P/E ratio of 13.60, a P/E/G ratio of 2.42 and a beta of 0.82. The company has a debt-to-equity ratio of 0.46, a quick ratio of 0.74 and a current ratio of 0.99.

Molson Coors Beverage (NYSE:TAP - Get Free Report) last released its earnings results on Thursday, November 7th. The company reported $1.80 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $1.67 by $0.13. The firm had revenue of $3.04 billion for the quarter, compared to analyst estimates of $3.13 billion. Molson Coors Beverage had a return on equity of 9.24% and a net margin of 6.78%. The company's revenue was down 7.8% on a year-over-year basis. During the same quarter last year, the firm posted $1.92 EPS. Analysts anticipate that Molson Coors Beverage will post 5.78 EPS for the current fiscal year.

Hedge Funds Weigh In On Molson Coors Beverage

Institutional investors and hedge funds have recently made changes to their positions in the company. Farther Finance Advisors LLC grew its stake in Molson Coors Beverage by 11.8% in the third quarter. Farther Finance Advisors LLC now owns 1,720 shares of the company's stock valued at $99,000 after acquiring an additional 182 shares during the period. Integrated Investment Consultants LLC boosted its holdings in shares of Molson Coors Beverage by 4.7% in the third quarter. Integrated Investment Consultants LLC now owns 4,154 shares of the company's stock valued at $239,000 after buying an additional 185 shares during the period. Perpetual Ltd increased its position in shares of Molson Coors Beverage by 1.0% during the third quarter. Perpetual Ltd now owns 20,543 shares of the company's stock worth $1,182,000 after acquiring an additional 197 shares in the last quarter. SkyView Investment Advisors LLC raised its holdings in shares of Molson Coors Beverage by 1.8% during the second quarter. SkyView Investment Advisors LLC now owns 15,102 shares of the company's stock worth $768,000 after acquiring an additional 274 shares during the period. Finally, Private Advisor Group LLC lifted its position in Molson Coors Beverage by 0.9% in the 3rd quarter. Private Advisor Group LLC now owns 32,080 shares of the company's stock valued at $1,845,000 after acquiring an additional 277 shares in the last quarter. Institutional investors and hedge funds own 78.46% of the company's stock.

Molson Coors Beverage Company Profile

(

Get Free ReportMolson Coors Beverage Company manufactures, markets, and sells beer and other malt beverage products under various brands in the Americas, Europe, the Middle East, Africa, and the Asia Pacific. The company offers flavored malt beverages including hard seltzers, craft, spirits and energy, and ready to drink beverages.

Further Reading

Before you consider Molson Coors Beverage, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Molson Coors Beverage wasn't on the list.

While Molson Coors Beverage currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.