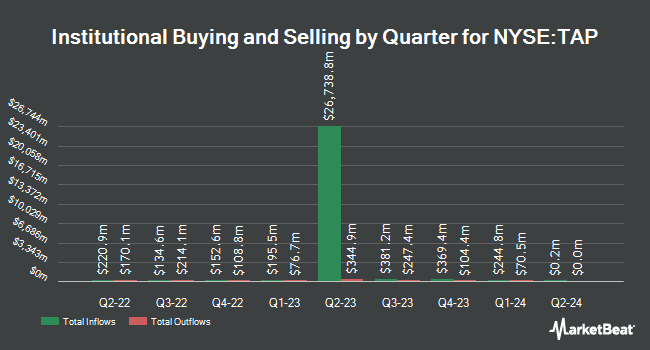

Bridgewater Associates LP decreased its stake in shares of Molson Coors Beverage (NYSE:TAP - Free Report) by 45.6% during the third quarter, according to its most recent filing with the Securities and Exchange Commission. The institutional investor owned 200,540 shares of the company's stock after selling 168,010 shares during the period. Bridgewater Associates LP owned approximately 0.10% of Molson Coors Beverage worth $11,535,000 as of its most recent SEC filing.

Several other hedge funds and other institutional investors also recently modified their holdings of the stock. Pacer Advisors Inc. boosted its position in Molson Coors Beverage by 66.5% during the 2nd quarter. Pacer Advisors Inc. now owns 5,397,223 shares of the company's stock valued at $274,341,000 after acquiring an additional 2,155,842 shares in the last quarter. Dimensional Fund Advisors LP boosted its position in shares of Molson Coors Beverage by 20.3% during the second quarter. Dimensional Fund Advisors LP now owns 2,579,811 shares of the company's stock valued at $131,130,000 after purchasing an additional 434,685 shares in the last quarter. River Road Asset Management LLC boosted its position in shares of Molson Coors Beverage by 1.8% during the third quarter. River Road Asset Management LLC now owns 1,677,241 shares of the company's stock valued at $96,475,000 after purchasing an additional 29,315 shares in the last quarter. Thompson Siegel & Walmsley LLC purchased a new stake in Molson Coors Beverage in the third quarter worth $48,202,000. Finally, Millennium Management LLC raised its holdings in Molson Coors Beverage by 541.4% in the second quarter. Millennium Management LLC now owns 765,150 shares of the company's stock worth $38,893,000 after purchasing an additional 645,847 shares in the last quarter. Hedge funds and other institutional investors own 78.46% of the company's stock.

Analyst Upgrades and Downgrades

A number of research analysts recently issued reports on TAP shares. BNP Paribas assumed coverage on shares of Molson Coors Beverage in a research report on Monday. They set a "neutral" rating and a $64.00 price target for the company. Barclays boosted their price target on Molson Coors Beverage from $49.00 to $51.00 and gave the stock an "underweight" rating in a research report on Monday, November 11th. Hsbc Global Res lowered Molson Coors Beverage from a "hold" rating to a "moderate sell" rating in a research report on Friday, November 8th. Deutsche Bank Aktiengesellschaft boosted their target price on Molson Coors Beverage from $56.00 to $57.00 and gave the stock a "hold" rating in a report on Wednesday, August 7th. Finally, JPMorgan Chase & Co. raised their price target on Molson Coors Beverage from $57.00 to $60.00 and gave the company a "neutral" rating in a report on Friday, October 18th. Two investment analysts have rated the stock with a sell rating, ten have given a hold rating and three have given a buy rating to the company's stock. According to data from MarketBeat.com, the company presently has an average rating of "Hold" and a consensus price target of $60.57.

Get Our Latest Research Report on Molson Coors Beverage

Molson Coors Beverage Stock Performance

Molson Coors Beverage stock traded up $0.81 during midday trading on Friday, reaching $62.06. 988,154 shares of the company traded hands, compared to its average volume of 1,910,897. The company has a debt-to-equity ratio of 0.46, a current ratio of 0.99 and a quick ratio of 0.74. Molson Coors Beverage has a 12 month low of $49.19 and a 12 month high of $69.18. The firm has a market capitalization of $12.78 billion, a price-to-earnings ratio of 13.80, a price-to-earnings-growth ratio of 2.37 and a beta of 0.82. The business has a 50 day moving average of $57.28 and a two-hundred day moving average of $54.55.

Molson Coors Beverage (NYSE:TAP - Get Free Report) last released its quarterly earnings results on Thursday, November 7th. The company reported $1.80 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $1.67 by $0.13. The firm had revenue of $3.04 billion for the quarter, compared to the consensus estimate of $3.13 billion. Molson Coors Beverage had a return on equity of 9.24% and a net margin of 6.78%. The company's revenue for the quarter was down 7.8% on a year-over-year basis. During the same period last year, the business posted $1.92 EPS. As a group, research analysts predict that Molson Coors Beverage will post 5.78 earnings per share for the current year.

Molson Coors Beverage Announces Dividend

The firm also recently declared a quarterly dividend, which will be paid on Friday, December 20th. Stockholders of record on Friday, December 6th will be given a dividend of $0.44 per share. This represents a $1.76 annualized dividend and a dividend yield of 2.84%. The ex-dividend date of this dividend is Friday, December 6th. Molson Coors Beverage's payout ratio is currently 39.64%.

About Molson Coors Beverage

(

Free Report)

Molson Coors Beverage Company manufactures, markets, and sells beer and other malt beverage products under various brands in the Americas, Europe, the Middle East, Africa, and the Asia Pacific. The company offers flavored malt beverages including hard seltzers, craft, spirits and energy, and ready to drink beverages.

Recommended Stories

Before you consider Molson Coors Beverage, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Molson Coors Beverage wasn't on the list.

While Molson Coors Beverage currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for December 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.