Bank of America upgraded shares of Molson Coors Beverage (NYSE:TAP - Free Report) from a neutral rating to a buy rating in a research report sent to investors on Friday, MarketBeat reports. The firm currently has $70.00 target price on the stock, up from their prior target price of $57.00.

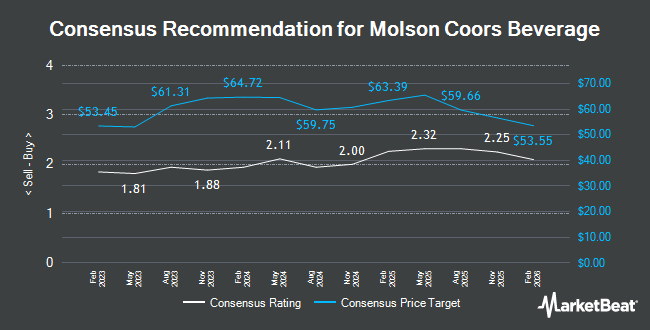

TAP has been the subject of a number of other reports. JPMorgan Chase & Co. upped their price objective on shares of Molson Coors Beverage from $57.00 to $60.00 and gave the stock a "neutral" rating in a report on Friday, October 18th. BNP Paribas started coverage on shares of Molson Coors Beverage in a report on Monday, November 25th. They issued a "neutral" rating and a $64.00 price objective for the company. Needham & Company LLC started coverage on shares of Molson Coors Beverage in a report on Friday. They issued a "buy" rating and a $72.00 price objective for the company. Barclays upped their price objective on shares of Molson Coors Beverage from $49.00 to $51.00 and gave the stock an "underweight" rating in a report on Monday, November 11th. Finally, Wells Fargo & Company upgraded shares of Molson Coors Beverage from an "underweight" rating to an "overweight" rating and upped their price objective for the stock from $52.00 to $74.00 in a report on Friday, November 8th. Two equities research analysts have rated the stock with a sell rating, eight have given a hold rating and five have issued a buy rating to the company. Based on data from MarketBeat.com, the company presently has an average rating of "Hold" and a consensus price target of $62.00.

Get Our Latest Stock Analysis on Molson Coors Beverage

Molson Coors Beverage Price Performance

Shares of NYSE TAP traded up $0.17 during trading on Friday, hitting $61.13. The company had a trading volume of 2,207,038 shares, compared to its average volume of 1,963,675. The company has a market cap of $12.59 billion, a P/E ratio of 13.77, a PEG ratio of 2.39 and a beta of 0.85. Molson Coors Beverage has a 52 week low of $49.19 and a 52 week high of $69.18. The business's 50-day moving average is $58.05 and its 200 day moving average is $54.73. The company has a debt-to-equity ratio of 0.46, a quick ratio of 0.74 and a current ratio of 0.99.

Molson Coors Beverage (NYSE:TAP - Get Free Report) last announced its earnings results on Thursday, November 7th. The company reported $1.80 earnings per share (EPS) for the quarter, beating the consensus estimate of $1.67 by $0.13. Molson Coors Beverage had a net margin of 6.78% and a return on equity of 9.24%. The company had revenue of $3.04 billion for the quarter, compared to the consensus estimate of $3.13 billion. During the same period in the previous year, the business earned $1.92 EPS. The company's revenue was down 7.8% on a year-over-year basis. Equities research analysts predict that Molson Coors Beverage will post 5.78 earnings per share for the current fiscal year.

Molson Coors Beverage Dividend Announcement

The firm also recently declared a quarterly dividend, which will be paid on Friday, December 20th. Investors of record on Friday, December 6th will be given a $0.44 dividend. This represents a $1.76 annualized dividend and a yield of 2.88%. The ex-dividend date is Friday, December 6th. Molson Coors Beverage's dividend payout ratio (DPR) is presently 39.64%.

Institutional Inflows and Outflows

Several hedge funds have recently added to or reduced their stakes in TAP. Pacer Advisors Inc. raised its position in Molson Coors Beverage by 66.5% in the second quarter. Pacer Advisors Inc. now owns 5,397,223 shares of the company's stock worth $274,341,000 after purchasing an additional 2,155,842 shares in the last quarter. Thompson Siegel & Walmsley LLC acquired a new stake in shares of Molson Coors Beverage during the third quarter worth approximately $48,202,000. State Street Corp increased its holdings in shares of Molson Coors Beverage by 8.4% during the third quarter. State Street Corp now owns 8,792,196 shares of the company's stock worth $505,727,000 after buying an additional 681,757 shares in the last quarter. Millennium Management LLC increased its holdings in shares of Molson Coors Beverage by 541.4% during the second quarter. Millennium Management LLC now owns 765,150 shares of the company's stock worth $38,893,000 after buying an additional 645,847 shares in the last quarter. Finally, Dimensional Fund Advisors LP increased its holdings in shares of Molson Coors Beverage by 20.3% during the second quarter. Dimensional Fund Advisors LP now owns 2,579,811 shares of the company's stock worth $131,130,000 after buying an additional 434,685 shares in the last quarter. Institutional investors and hedge funds own 78.46% of the company's stock.

Molson Coors Beverage Company Profile

(

Get Free Report)

Molson Coors Beverage Company manufactures, markets, and sells beer and other malt beverage products under various brands in the Americas, Europe, the Middle East, Africa, and the Asia Pacific. The company offers flavored malt beverages including hard seltzers, craft, spirits and energy, and ready to drink beverages.

See Also

Before you consider Molson Coors Beverage, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Molson Coors Beverage wasn't on the list.

While Molson Coors Beverage currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.