Moment Partners LLC bought a new stake in shares of JPMorgan Chase & Co. (NYSE:JPM - Free Report) during the fourth quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The fund bought 7,794 shares of the financial services provider's stock, valued at approximately $1,868,000. JPMorgan Chase & Co. accounts for about 0.4% of Moment Partners LLC's portfolio, making the stock its 21st biggest holding.

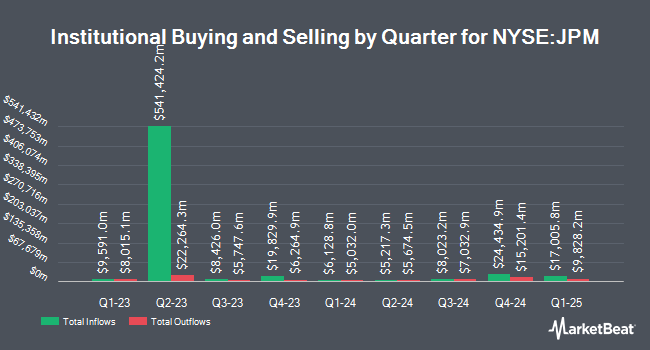

Several other institutional investors have also recently made changes to their positions in the stock. Geode Capital Management LLC increased its holdings in shares of JPMorgan Chase & Co. by 0.9% in the third quarter. Geode Capital Management LLC now owns 58,344,186 shares of the financial services provider's stock worth $12,258,346,000 after purchasing an additional 505,830 shares during the period. Charles Schwab Investment Management Inc. increased its position in shares of JPMorgan Chase & Co. by 0.4% in the fourth quarter. Charles Schwab Investment Management Inc. now owns 20,103,063 shares of the financial services provider's stock worth $4,818,905,000 after purchasing an additional 71,122 shares during the last quarter. Fisher Asset Management LLC raised its stake in JPMorgan Chase & Co. by 3.7% in the fourth quarter. Fisher Asset Management LLC now owns 17,401,436 shares of the financial services provider's stock valued at $4,171,298,000 after purchasing an additional 617,164 shares in the last quarter. Franklin Resources Inc. lifted its position in JPMorgan Chase & Co. by 7.2% during the third quarter. Franklin Resources Inc. now owns 15,073,193 shares of the financial services provider's stock valued at $3,338,955,000 after purchasing an additional 1,016,289 shares during the last quarter. Finally, Principal Financial Group Inc. grew its stake in JPMorgan Chase & Co. by 3.2% in the 3rd quarter. Principal Financial Group Inc. now owns 5,824,289 shares of the financial services provider's stock worth $1,228,110,000 after buying an additional 182,648 shares in the last quarter. Hedge funds and other institutional investors own 71.55% of the company's stock.

JPMorgan Chase & Co. Trading Down 0.7 %

Shares of JPM traded down $1.72 during mid-day trading on Tuesday, hitting $243.58. 8,048,355 shares of the company's stock traded hands, compared to its average volume of 9,363,549. The company has a quick ratio of 0.89, a current ratio of 0.88 and a debt-to-equity ratio of 1.24. The firm has a market capitalization of $681.06 billion, a P/E ratio of 12.34, a PEG ratio of 2.83 and a beta of 1.10. The business's 50-day moving average price is $256.88 and its 200-day moving average price is $241.33. JPMorgan Chase & Co. has a 1 year low of $179.20 and a 1 year high of $280.25.

JPMorgan Chase & Co. (NYSE:JPM - Get Free Report) last issued its quarterly earnings data on Wednesday, January 15th. The financial services provider reported $4.81 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $4.03 by $0.78. JPMorgan Chase & Co. had a net margin of 20.96% and a return on equity of 16.99%. The business had revenue of $42.77 billion for the quarter, compared to the consensus estimate of $41.90 billion. During the same period in the previous year, the firm earned $3.04 EPS. The company's quarterly revenue was up 10.9% compared to the same quarter last year. As a group, sell-side analysts forecast that JPMorgan Chase & Co. will post 18.1 EPS for the current fiscal year.

JPMorgan Chase & Co. Increases Dividend

The business also recently declared a quarterly dividend, which will be paid on Wednesday, April 30th. Investors of record on Friday, April 4th will be paid a $1.40 dividend. This is an increase from JPMorgan Chase & Co.'s previous quarterly dividend of $1.25. This represents a $5.60 dividend on an annualized basis and a yield of 2.30%. The ex-dividend date of this dividend is Friday, April 4th. JPMorgan Chase & Co.'s dividend payout ratio is presently 28.37%.

Insider Buying and Selling at JPMorgan Chase & Co.

In other JPMorgan Chase & Co. news, CEO Troy L. Rohrbaugh sold 37,500 shares of the firm's stock in a transaction on Thursday, February 20th. The stock was sold at an average price of $269.84, for a total transaction of $10,119,000.00. Following the completion of the transaction, the chief executive officer now owns 158,381 shares of the company's stock, valued at approximately $42,737,529.04. This trade represents a 19.14 % decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which can be accessed through this link. Also, COO Jennifer Piepszak sold 4,273 shares of the company's stock in a transaction dated Thursday, February 20th. The stock was sold at an average price of $269.85, for a total transaction of $1,153,069.05. Following the completion of the sale, the chief operating officer now directly owns 54,469 shares in the company, valued at $14,698,459.65. This represents a 7.27 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last three months, insiders have sold 76,848 shares of company stock valued at $19,987,908. 0.79% of the stock is currently owned by corporate insiders.

Wall Street Analyst Weigh In

A number of analysts have recently issued reports on JPM shares. Wolfe Research raised shares of JPMorgan Chase & Co. from a "peer perform" rating to an "outperform" rating and set a $269.00 price objective for the company in a report on Friday, January 3rd. Robert W. Baird raised JPMorgan Chase & Co. from an "underperform" rating to a "neutral" rating and lifted their price target for the stock from $215.00 to $220.00 in a research note on Friday, March 7th. Evercore ISI reduced their price objective on JPMorgan Chase & Co. from $273.00 to $265.00 and set an "outperform" rating on the stock in a research report on Tuesday. Piper Sandler boosted their target price on JPMorgan Chase & Co. from $240.00 to $275.00 and gave the stock an "overweight" rating in a research report on Tuesday, December 3rd. Finally, UBS Group upped their price objective on shares of JPMorgan Chase & Co. from $276.00 to $287.00 and gave the company a "buy" rating in a research note on Thursday, January 16th. Ten equities research analysts have rated the stock with a hold rating and ten have assigned a buy rating to the stock. According to data from MarketBeat.com, the company presently has a consensus rating of "Moderate Buy" and a consensus price target of $254.83.

Check Out Our Latest Stock Analysis on JPM

JPMorgan Chase & Co. Company Profile

(

Free Report)

JPMorgan Chase & Co is a financial holding company, which engages in the provision of financial and investment banking services. It focuses on investment banking, financial services for consumers and small businesses, commercial banking, financial transaction processing, and asset management. It operates through the following segments: Consumer and Community Banking (CCB), Commercial and Investment Bank (CIB), Asset and Wealth Management (AWM), and Corporate.

Further Reading

Before you consider JPMorgan Chase & Co., you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and JPMorgan Chase & Co. wasn't on the list.

While JPMorgan Chase & Co. currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for April 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report