Monarch Casino & Resort (NASDAQ:MCRI - Get Free Report) will likely be posting its quarterly earnings results after the market closes on Tuesday, April 22nd. Analysts expect Monarch Casino & Resort to post earnings of $1.04 per share and revenue of $122.70 million for the quarter.

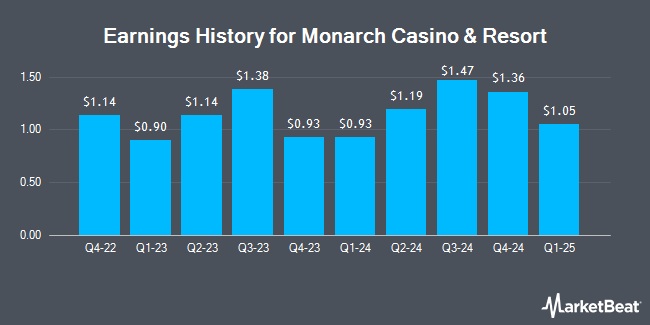

Monarch Casino & Resort (NASDAQ:MCRI - Get Free Report) last announced its quarterly earnings data on Tuesday, February 11th. The company reported $1.36 earnings per share for the quarter, beating analysts' consensus estimates of $1.13 by $0.23. Monarch Casino & Resort had a return on equity of 18.27% and a net margin of 18.01%. During the same period last year, the firm posted $1.03 EPS. On average, analysts expect Monarch Casino & Resort to post $5 EPS for the current fiscal year and $5 EPS for the next fiscal year.

Monarch Casino & Resort Stock Performance

NASDAQ:MCRI traded up $0.52 during trading hours on Friday, hitting $74.62. The company's stock had a trading volume of 73,546 shares, compared to its average volume of 118,508. Monarch Casino & Resort has a 52-week low of $64.50 and a 52-week high of $96.11. The business's 50-day moving average is $84.21 and its two-hundred day moving average is $82.18. The company has a market capitalization of $1.38 billion, a PE ratio of 15.07 and a beta of 1.57.

Analysts Set New Price Targets

MCRI has been the topic of several analyst reports. Stifel Nicolaus raised their price target on shares of Monarch Casino & Resort from $80.00 to $90.00 and gave the stock a "hold" rating in a research note on Wednesday, February 12th. Jefferies Financial Group increased their target price on shares of Monarch Casino & Resort from $73.00 to $88.00 and gave the stock a "hold" rating in a research report on Friday, January 3rd. Wells Fargo & Company upped their target price on Monarch Casino & Resort from $79.00 to $82.00 and gave the stock an "underweight" rating in a research report on Wednesday, February 12th. StockNews.com lowered Monarch Casino & Resort from a "strong-buy" rating to a "buy" rating in a research report on Wednesday, February 12th. Finally, Truist Financial raised Monarch Casino & Resort from a "hold" rating to a "buy" rating and increased their target price for the stock from $82.00 to $100.00 in a report on Tuesday, January 14th. One equities research analyst has rated the stock with a sell rating, three have assigned a hold rating and two have issued a buy rating to the stock. Based on data from MarketBeat, the stock currently has a consensus rating of "Hold" and a consensus target price of $87.20.

View Our Latest Stock Analysis on Monarch Casino & Resort

Monarch Casino & Resort Company Profile

(

Get Free Report)

Monarch Casino & Resort, Inc engages in the ownership and operation of the Atlantis Casino Resort Spa, a hotel and casino facility in Reno, Nevada, and the Monarch Black Hawk Casino in Black Hawk, Colorado. The company was founded in 1993 and is headquartered in Reno, NV.

Read More

Before you consider Monarch Casino & Resort, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Monarch Casino & Resort wasn't on the list.

While Monarch Casino & Resort currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.