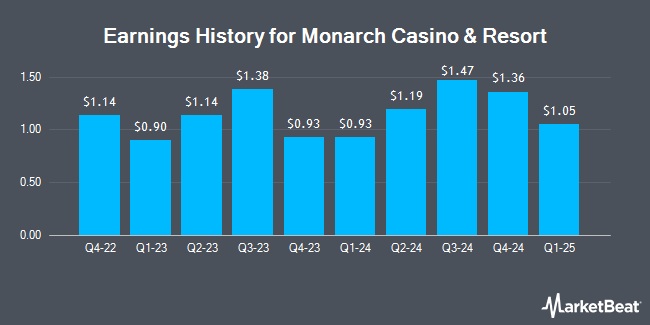

Monarch Casino & Resort (NASDAQ:MCRI - Get Free Report) announced its quarterly earnings results on Tuesday. The company reported $1.05 earnings per share for the quarter, topping analysts' consensus estimates of $1.04 by $0.01, Zacks reports. The company had revenue of $125.39 million during the quarter, compared to analysts' expectations of $122.70 million. Monarch Casino & Resort had a return on equity of 18.27% and a net margin of 18.01%.

Monarch Casino & Resort Price Performance

Shares of MCRI traded up $0.43 on Friday, reaching $77.49. 65,734 shares of the stock traded hands, compared to its average volume of 118,326. The stock's 50-day moving average price is $81.39 and its 200-day moving average price is $81.98. The firm has a market cap of $1.43 billion, a price-to-earnings ratio of 15.65 and a beta of 1.57. Monarch Casino & Resort has a 12 month low of $64.58 and a 12 month high of $96.11.

Monarch Casino & Resort Announces Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Sunday, June 15th. Shareholders of record on Sunday, June 1st will be given a $0.30 dividend. The ex-dividend date is Friday, May 30th. This represents a $1.20 dividend on an annualized basis and a dividend yield of 1.55%. Monarch Casino & Resort's dividend payout ratio is currently 24.24%.

Analysts Set New Price Targets

Several equities analysts have commented on the company. Wells Fargo & Company increased their price target on Monarch Casino & Resort from $79.00 to $82.00 and gave the company an "underweight" rating in a report on Wednesday, February 12th. Truist Financial lowered their target price on shares of Monarch Casino & Resort from $105.00 to $100.00 and set a "buy" rating on the stock in a research note on Wednesday. StockNews.com cut shares of Monarch Casino & Resort from a "strong-buy" rating to a "buy" rating in a report on Wednesday, February 12th. Macquarie reissued a "neutral" rating and set a $92.00 price objective on shares of Monarch Casino & Resort in a research report on Wednesday. Finally, Jefferies Financial Group lifted their price target on Monarch Casino & Resort from $73.00 to $88.00 and gave the stock a "hold" rating in a research report on Friday, January 3rd. One equities research analyst has rated the stock with a sell rating, three have given a hold rating and two have issued a buy rating to the company's stock. Based on data from MarketBeat.com, the stock currently has an average rating of "Hold" and a consensus price target of $88.60.

Check Out Our Latest Report on Monarch Casino & Resort

Monarch Casino & Resort Company Profile

(

Get Free Report)

Monarch Casino & Resort, Inc engages in the ownership and operation of the Atlantis Casino Resort Spa, a hotel and casino facility in Reno, Nevada, and the Monarch Black Hawk Casino in Black Hawk, Colorado. The company was founded in 1993 and is headquartered in Reno, NV.

Featured Stories

Before you consider Monarch Casino & Resort, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Monarch Casino & Resort wasn't on the list.

While Monarch Casino & Resort currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.