Sterling Capital Management LLC boosted its position in monday.com Ltd. (NASDAQ:MNDY - Free Report) by 58.8% during the fourth quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The fund owned 17,050 shares of the company's stock after buying an additional 6,314 shares during the quarter. Sterling Capital Management LLC's holdings in monday.com were worth $4,014,000 at the end of the most recent reporting period.

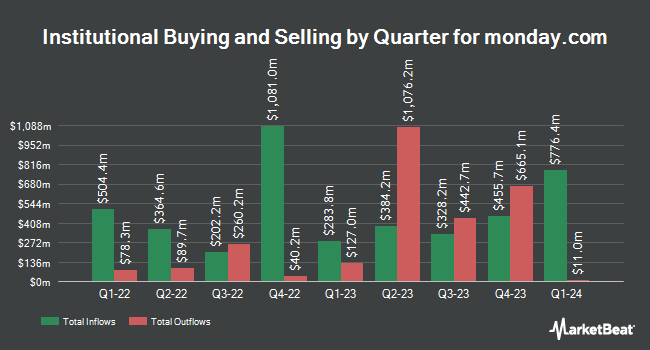

Several other institutional investors have also recently bought and sold shares of MNDY. Neuberger Berman Group LLC grew its holdings in shares of monday.com by 7,282.0% during the 4th quarter. Neuberger Berman Group LLC now owns 303,992 shares of the company's stock worth $71,572,000 after purchasing an additional 299,874 shares in the last quarter. Capital Fund Management S.A. raised its stake in shares of monday.com by 20.4% in the fourth quarter. Capital Fund Management S.A. now owns 32,528 shares of the company's stock valued at $7,658,000 after acquiring an additional 5,504 shares during the last quarter. CenterBook Partners LP acquired a new position in shares of monday.com in the 4th quarter worth approximately $1,945,000. APG Asset Management US Inc. acquired a new stake in monday.com during the 4th quarter valued at $278,000. Finally, Raymond James Financial Inc. bought a new position in monday.com in the 4th quarter valued at $27,010,000. Institutional investors own 73.70% of the company's stock.

monday.com Stock Down 1.6 %

Shares of NASDAQ MNDY traded down $4.06 during midday trading on Thursday, hitting $246.28. 551,631 shares of the company's stock were exchanged, compared to its average volume of 804,446. monday.com Ltd. has a 12 month low of $174.75 and a 12 month high of $342.64. The company's 50 day moving average price is $269.64 and its 200 day moving average price is $267.45. The firm has a market capitalization of $12.50 billion, a PE ratio of 410.47, a price-to-earnings-growth ratio of 16.53 and a beta of 1.34.

monday.com (NASDAQ:MNDY - Get Free Report) last announced its earnings results on Monday, February 10th. The company reported $0.50 EPS for the quarter, missing the consensus estimate of $0.78 by ($0.28). monday.com had a return on equity of 6.22% and a net margin of 3.33%. On average, equities research analysts anticipate that monday.com Ltd. will post 0.46 EPS for the current year.

Wall Street Analysts Forecast Growth

A number of brokerages have weighed in on MNDY. Piper Sandler boosted their target price on shares of monday.com from $345.00 to $385.00 and gave the stock an "overweight" rating in a research note on Monday, February 10th. The Goldman Sachs Group upped their target price on shares of monday.com from $350.00 to $400.00 and gave the company a "buy" rating in a research report on Tuesday, February 11th. Tigress Financial raised their price target on monday.com from $340.00 to $450.00 and gave the stock a "buy" rating in a research report on Friday, February 21st. Needham & Company LLC upped their price target on monday.com from $350.00 to $400.00 and gave the company a "buy" rating in a research note on Monday, February 10th. Finally, DA Davidson decreased their price objective on shares of monday.com from $350.00 to $290.00 and set a "buy" rating for the company in a report on Monday. Three research analysts have rated the stock with a hold rating and twenty-one have given a buy rating to the company's stock. Based on data from MarketBeat.com, monday.com currently has a consensus rating of "Moderate Buy" and an average target price of $349.91.

Get Our Latest Research Report on MNDY

monday.com Company Profile

(

Free Report)

monday.com Ltd., together with its subsidiaries, develops software applications in the United States, Europe, the Middle East, Africa, the United Kingdom, and internationally. The company provides Work OS, a cloud-based visual work operating system that consists of modular building blocks used and assembled to create software applications and work management tools.

See Also

Before you consider monday.com, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and monday.com wasn't on the list.

While monday.com currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.